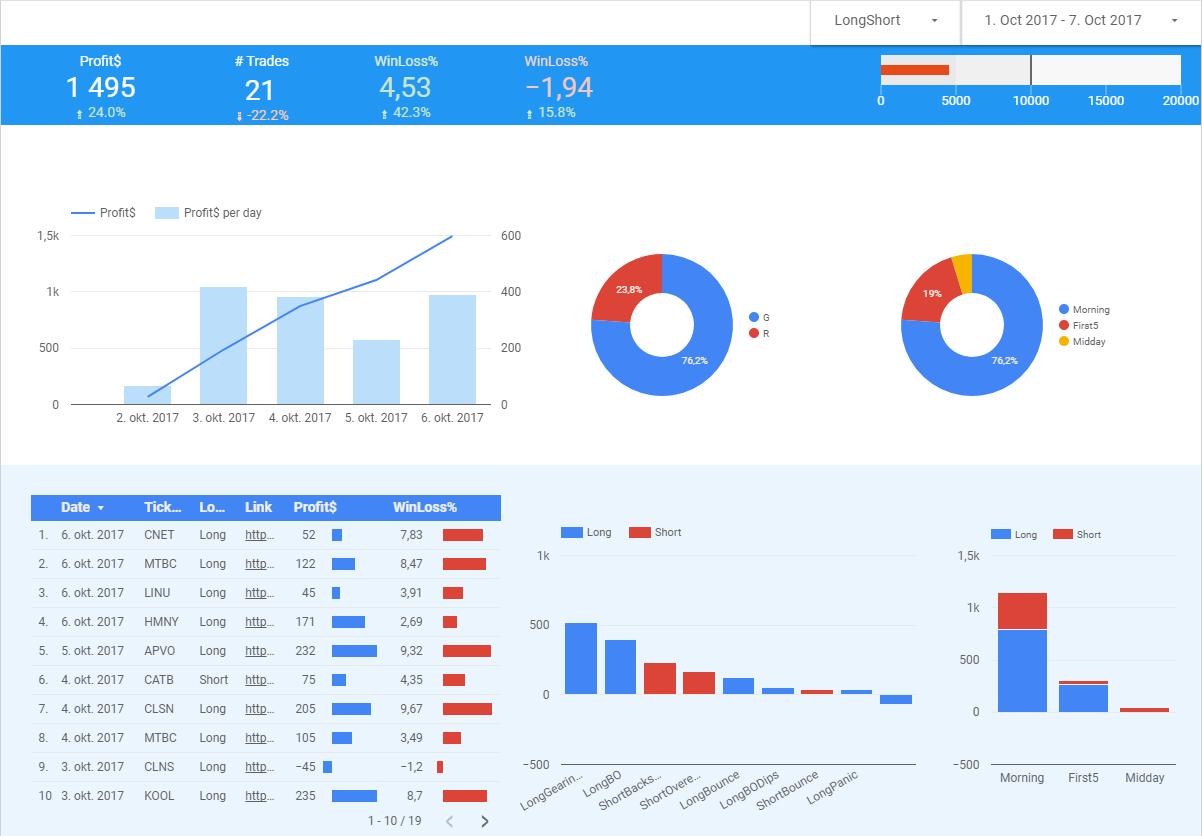

*Profits of 1 495 dollars, closing in on 5 000 dollars in total

*Started the week with a lot of overtrading and bad dicipline - a continuation from last week, but managed to turn that around, and took 22 % fewer trades

*Had better % wins, probably caused by choosing trades more carefully, letting it setup on the intraday as well as daily chart. I was also probably better prepared and let the trade come to me. E.g. MTBC yesterday, had fallen a lot from its highs on the daily, and seem to bottom out. It kind of traded in a range, and I was looking for it to break above that range for a bounce. Then some news hit and it reacted well, so I took a position when it broke the range, and it got a nice pop

*Better at leaving trades alone although they have huge range. Try hard not to trade them if they don't offer good r/r. At the same time, the losses this week seems like it was caused by chasing and overtrading

*Best trades:

VICL short - first I chased so I covered it right away. Then I waited for a measured pop up to resistance. Took partial profits early, then tried to leave the rest, but didn't have the patience to let it fade below 3..

CLSN long - seemed to have found the bottom and started gearing after falling far from its highs. Doesn't seem like much, but had 1 dollar range.

*APVO long - morning breakout. Wanted this to consolidate close to upper range from PM before breaking out, and got a cup. Bought on the breakout of range with volume, sold too early, originally I had my second half at 3.7, but I always bring it down. Was choppy though

MTBC long - as described above. Here I didn't bring my second portion down to take profits, so got a little less out of it. Got a little greedy, hit resistance at .5, and bounces seems to not follow up as well as at the beginning of the pattern

*Most annoying trade

MTBC long - bought the moring spike after some consolidation and then break to new highs, but got scored for some reason and covered right away. Might have something to do with lack of focus and overtrading, it takes up brain capital so you also screw up the good opportunities

Biggest miss:

CYTX long - had this on my watchlist, but overlooked it before the marked opened, and forgot to include it on my TWS watchlist. Wanted this to ideally pull a little before breaking out, combining factors like r/g, .5-break, U-shape/gearing, breakout above range. It had a lot of space to move into, and I was thinking it could go to 1 dollar.

Sorry, here's a link to the spreadsheet where you can edit the spreadsheet: https://docs.google.com/spreadsheets/d/1LEDtcjJjUC1xBk4JzliVlWbJtoPuGbzyHj6ranZReF8/edit?usp=sharing

How do you input data into the Studio setup? Also, do you input the data into the trading log by yourself or is it automatically done? I noticed that LongGearing got you the most gains, but what does it mean/

In Data Studio you have to connect to a data source, like databases, Google Analysis, Excel, or Googe Spreadsheet that I use. When opening a new Data Studio project, that's the first step. If you use the template, you go to resources and "administrate data source". It will do the import for you. I add the data myself, but have categories/drop downs to choose long/short, and there are calculations, so only really need to add ticker, # shares, in and out price. Long gearing is just this gearing/ab

Long gearing 1 is just abcd type gearing action/triangle/wedge in the morning, and 2 and 3 the midday and afternoon. They go by different names - the no2 is basically what Dux is talking about here: https://www.youtube.com/watch?v=_js7yhvPdWA

Join now or log in to leave a comment