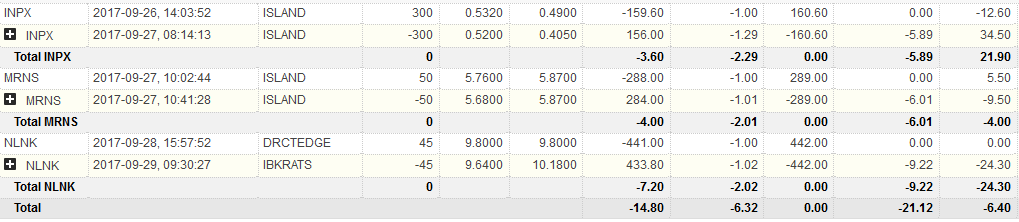

Bought this recent runner, that was down 50% from the highs. The entry was not ideal, as I bought at EOD. Should've got in around 9.50-60, because in difference from last time it squeezed, it now hade a base around the 9's. I was targeting a gap up, and wanted to get out if it gapped down. I should've thought bigger picture on this stock, because of the float-volume ratio, so should've targeted a swing trade. Lesson: Think bigger picture, and base trade ideas(risk) around major support levels.

Broker:Interactive Brokers

| Date | Price | |

|---|---|---|

| Entry | 9/28/2017 | 9.80 |

| Exit | 9/29/2017 | 9.64 |

- Total Views419

- Position Size45

- Percentage-1.63%

Copy and paste the following into your page or blog. If using WordPress, you must paste this in the HTML tab only: