These are non-Tim related trades, as I want to distinguish trades that fit into my Millionaire plan using Tim's teachings, and other trades that I use to build up trading experiences and look for other types of strategies I can get good at.

Today turned out to be a pretty boring trading day. I stayed up watching more of the How To Make Millions video last night, so I had no real plans to be around for the morning as I had no planned trades. I was still watching $WKHS, but decided there's no way I can justify more trades on it until closer to earnings or at least some new relevant PR. I'm watching a bunch of other stocks, but all are coming off their initial catalyst, so they are starting to fade back into the abyss of irrelevance.

This afternoon, $FCEL was halted pending some news: FuelCell Energy (FCEL) Awarded 39.8WM in Fuel Cell Projects by Long Island Power Authority

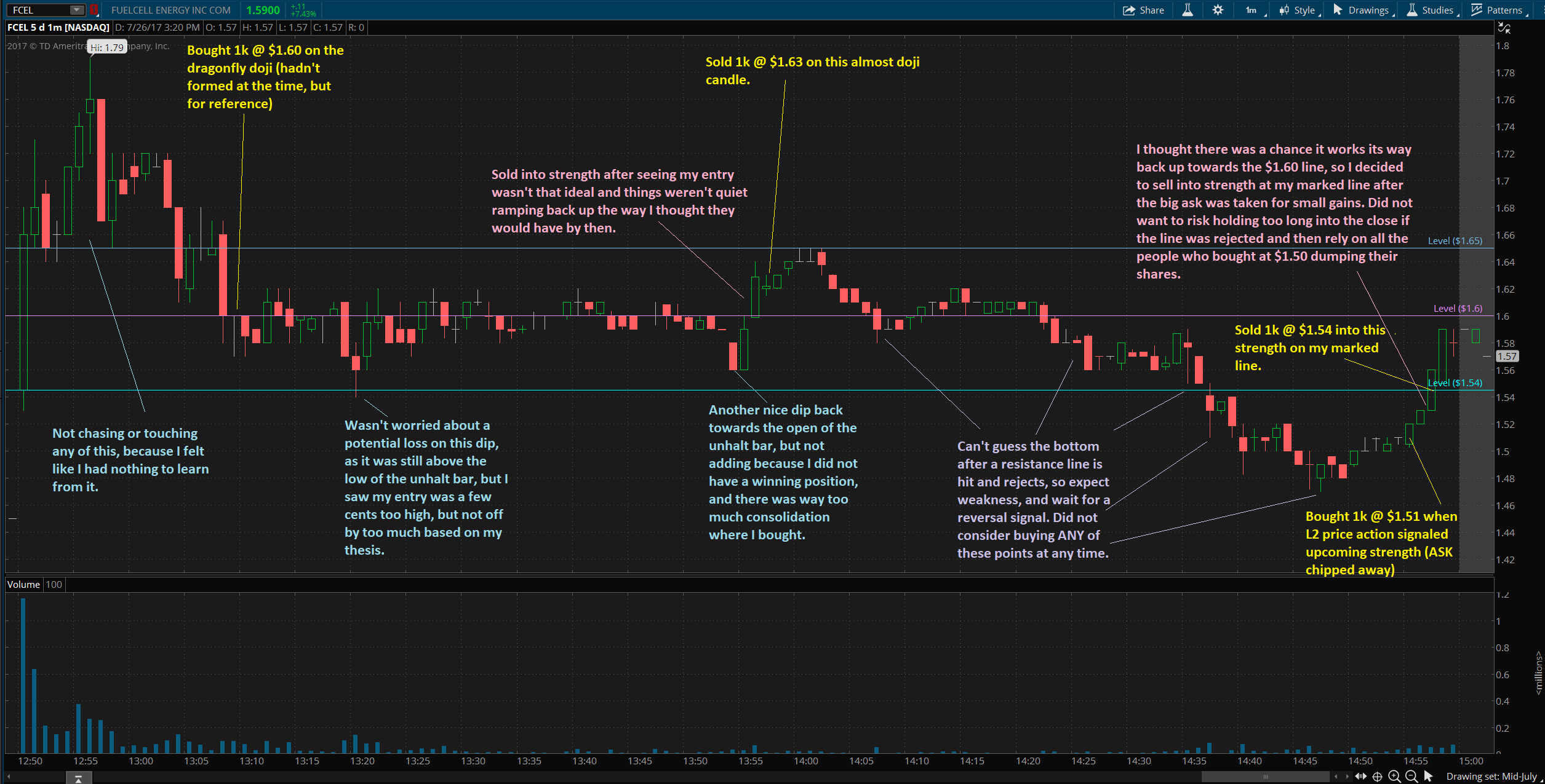

It seemed like a potential contract win, so I decided to watch how it played out. Now, I choose not to chase or play the initial unhalt action, because I felt like the potential money to be made was irrelevant, and I'd rather take a trade that I planned out and had a reason for to grow as a trader. So, that's what I did.

Before I post the annotated chart of my trades, I want to go over something important for these types of trades. First, if you have a 4-digit or below account, don't try to emulate this stuff, terrible R/R and chances are, you'll waste a day trade. Second, understand where risk comes from.

When considering today's trades, I looked at:

- Recent price action (how far it was from the open, previous day close, etc...)

- Recent volume (pretty low on average, but yesterday was 1.13m)

- Liquidity (volume is coming from a few big spikes time to time, rather than sustained trading)

- Yearly trend (Since mid-May, been on a nice slow grind upwards, so really liked that. Terrible for trading, but good for longer term stuff)

- Last big gap (4/27 -> 4/28, to which it's now filling that gap, good sign)

- SEC docs (Few worrying things there in term of dilution)

- Quality of the catalyst (meh, boring day all around so I felt the reaction might be a bit exaggerated since everyone wants to trade)

For me, I was pretty comfortable letting the chart play out, and planned a trade to take based on what I thought were the most influential factors. I didn't just buy because it was up, or jump in because I felt like I needed to trade, but rather I thought there would be some good opportunity to test my thesis on how things would play out.

My initial thesis was that $1.60 was going to be an important level, as it was the doji (neutral) from 4/27 before the big gap down. Imagine today's candle wasn't on the yearly, what do you see? I saw a slow bullish trend up, a gap fill about to complete, and basically a bullish sentiment firmly rooted since mid-May.

Because of that, I decided I liked an entry of $1.60 at the time I bought because of math. Stock opened at $1.50, so I'm buying 10c above the open. The stock was trading at $1.45 before the halt, so I'm buying at a 15c premium before the contract was alerted. Price downside, I just didn't see much. However, I was worried about liquidity.

The initial unhalt bar had almost as much volume as the entire day yesterday. My main risk concern was that while this stock isn't super low volume or illiquid, the new liquidity of day traders jumping in will provide the action necessary for them to sell, not because the stock is up a little bit on news, but rather there's a huge influx of buyers.

If a lot of buyers want to get out around $1.45-$1.50, but couldn't just because of low volume, then they certainly will sell into anything above on high volume. I think we did see a lot of that actually, but the results were in-line with my planning, so I wasn't way off.

My timing of the buy was off the weakness following the runup. Generally, I don't like buying into weakness, but I felt it was predictable weakness. A bunch of people just chased up the stock, now they are fleeing because it's not going any further. I felt with such limited price downside, I would buy now, but if I waited longer and things weren't looking the way I envisioned, then I simply wouldn't buy at all.

Had the weakness been from a resistance rejection after strength, then I would not buy, as my trade chart shows. I never, ever want to buy weakness following a resistance rejection, because you never know the bottom, and it's worth risking missing the next move in order to not give away money to the market being too eager.

In this case, I decided I'd rather take the risk of the plan not working out, than just try to time a profitable move. Once again, I'm not trying to trade for profits, I'm trying to learn to trade better and find things that I am good at, so I'm willing to experiment.

I held through a lot of sideways consolidation. Major resistance was around the $1.61-$1.62 area, so as that kept developing, I decided I would get out as soon as it broke. A few dips back towards the low of the unhalt bar, and the general channel action that developed showed me that I bought a few cents too high, but since things were still within my plan, I showed patience.

As soon as strength presented itself, I sold into it for a small gain. I was not going to risk trying to sell into the next top, then see a rejection and more downside given that I had confirmed my entry was off a bit. A bit more patience and I could have bought around $1.55 and sold at $1.63 for a larger (but still irrelevant) gain, so I was not going to risk it.

After $1.65 presented itself as the new resistance, and rejected, I knew it was time to sit back and wait. No way I am buying any weakness without letting the bottom form. The bottom did eventually form, near the close at $1.50. Level 2 showed the following:

Now, as I have previous trades around playing this price action ($ESES, $AVEO), I will not buy early into a wall of selling like this. However, I will patiently wait to see if it's able to be broken, because I'll buy into it as soon as it's finished, and confidently use that resistance as new support.

That's exactly what happened again. The ASK started getting chipped away, then over a few minutes, it was down to double digits, so I bought. I was certain some strength was coming, but I did not know how much, so I just decided to sell into any strength into my next trendline up.

Once again, I sell into strength into my lines not to maximize profit, but because I have no idea if they will fake breakout, then reject hard, and I will not want to be holding after a resistance rejection. I got out for small profits a second time, and decided that was it.

Overall, two successful small trades. Not great risk/reward, but then again, I developed a plan, stuck to my plan, and executed and used this as another learning lessons to help grow my experiences. I can't really ask for more, so that's why I'm blogging about it.

I decided I did not want to do an overnight play, because of this: https://www.sec.gov/Archives/edgar/data/886128/000119312517152053/d385366d424b5.htm

$1.28 has come and gone so plenty of opportunity for those to get exercised and held to be sold into any spikes. $1.60 was already approaching, and was breached today, so I expect any further upside to be marred by those and the previous warrants. In other words, I do not want to take the risk of buying into dilution moving forward.

At the time of writing, Finviz has the data as:

So, we'll have to see how that plays out. There might be a good trading opportunity tomorrow, but I'm not committed on it yet.

Annotated Trade Chart:

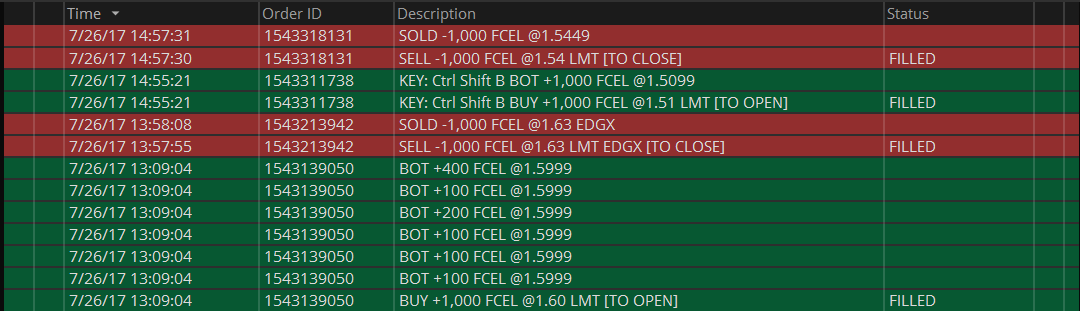

TDA log of the transactions:

Thanks for the follow brother

Welcome

Join now or log in to leave a comment