I'm going to explain my thoughts, reasoning, and why I took this trade. It was a loser for me, and a bit frustrating, as I missed the move I was thinking would happen because things just didn't work out the way I thought they would when they would.

I want to ask if this is a winning setup/trade or not, and what type of plan should I be using to have green trades, since I thought it was text book, but I couldn't have a winning trade on it.

---

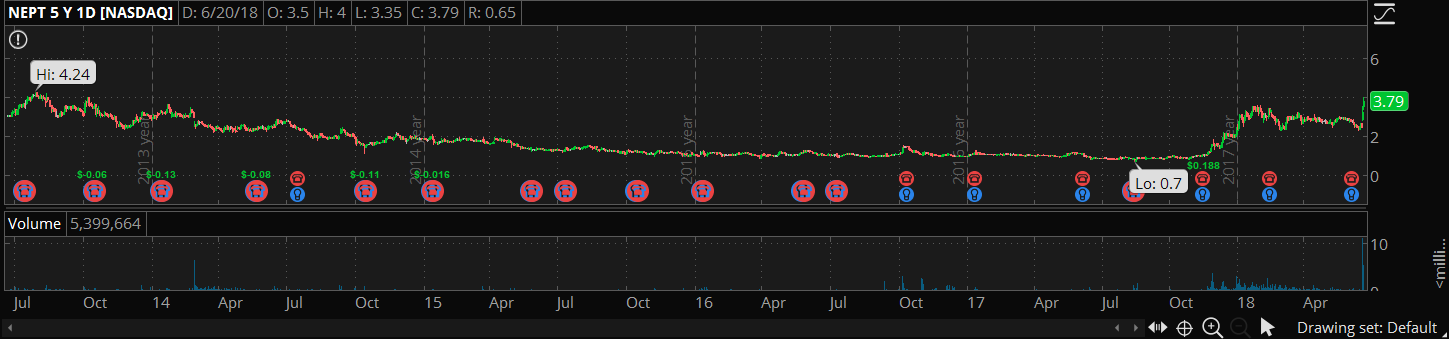

$NEPT was on my watchlist for a potential 2nd green day gap and go. I didn't have a winning trade yesterday because I just didn't have a winning plan that would have worked out, something I've been trying to get better at, but I'm just not good at it. It has a 54m float (around $VSTM) and it's in the perfect price range for me to trade.

Key levels on watch today were (with charts):

- $3.54 - HoD yesterday

- $3.58 - PM high today

- $3.61 - Resistance from 2014

My plan was simple, wait for a convincing push above yearly resistance and the HoD yesterday and PM high today, with volume, and get in on the next candle if it shows strength to the upside. I wanted to be sure it's actually going to move up and not just get slammed back down, so I got in when I thought the coast was clear. basically, I want to wait around 10c above at minimal to let momentum prove itself, as I've seen 7 - 8c spikes then huge dumps.

There was no way I was buying under $3.60s and hoping it pushed up into multi-year resistance and ran, so the morning dip that held and the move up was just not worth buying to me since it could be a second day gap and crap with a ways down.

I got in at $3.70 on what I thought was very convincing strength. Basically, anyone shorting yesterday and holding is screwed, long time yearly resistance broke and the price was just enough away to signal momentum is building up to carry it further, and since it's a NHOD, as well as a new 52-week high, above yearly resistance back from 2014. Short float is less than 3% or so, so not major.

I literally just lost $3700 on VSTM on the same exact setup, wrong bias though and terrible plan, so I thought for sure I was approaching this trade the right way, having just seen this type of play go Monday.

After I bought, the stock lost momentum, it started to look like it was going to fade, so I just got out. The reason why I shorted $VSTM was because of having seen this play in the past reject hard and dump, so I did not want to be long at the top and baghold or take a larger than expected loss.

Literally 2 minutes later, a nasty 18c drop happened, that I would have had to cut losses into regardless, so there was no way I would have had a position for the move that I wanted to make. The dip was into the yearly resistance level, but my risk was more along the lines of $3.65, as I can't control losses if there's a dump under the yearly resistances - I'd be holding and hoping it acted as support.

So, I cut losses, watched it dip hard into that key level, held, but I couldn't justify getting back in because it could just reject and die again so I waited to see what it did. It moved back up and ran to $4 into massive resistance, where I definitely would have had to dump into $3.99 to take profits if I had a position, and wait it out. The $4 resistance was very obvious, and I've seen that type of price action before to know not to buy it, and if I were holding a position, sell asap, so I have some experience that was useful to not chasing and buying the literal top.

---

I understand that you can't hit all your trades, or have all winners, and things don't always work the way you want, and you can be right and have unlucky timing, etc.. etc...

However, I'm frustrated because I can't find the right risk, timing, plans to use for any of these plays that after the fact, look like obvious winners, meeting criteria that I've read about. I went with half size, because my perception of things is obviously flawed as I'm pretty much losing all the time and not really making the most of any opportunity, so I wanted to be sure I could limit my losses if I was just flat out wrong again.

My question is, "was there anything I could have done differently to have a winning trade on this, or was it just a case of bad luck things went the way they went?"

Monday, I took on way too much risk feeling like I don't take on enough risk at times, and more times than not, I have such limited risk, I only hit tiny winners or smaller losers unless I've put myself into position where I can't protect myself from a larger loss (which is why I've come to stop trading pre-market for the most part).

I'm really trying to understand risk and putting myself in position where I can protect myself better. Risking off former resistance seems great on paper, but if it's a fakeout and it dumps hard under it and acts and resistance again, you're taking significantly more risk and that just doesn't seem like safe trading given some of the dumb mistakes I've made.

As a result, I risked 5c under my buy at a level that made sense, but didn't ignore my intuition this time and got out when things didn't do what I thought they would, and missed the dump (which ever since getting caught in that $MTBC dump last year, I've been doing pretty well avoiding them when I'm long) and that dump seemed to be the bottom, but I just never saw the next opportunity to get back in, and didn't want to chase above my original entry hoping to have a winning trade, so I missed it.

Sure, I could have been willing to take 20c risk and it would have worked, but I lost big on Monday because I was willing to keep taking larger risk, and I just can't think that way.There's always the question of what's the reward? Natural whole dollar resistance so $4 had a good chance, so that was 30c upside potential unless things really went supernova. It just didn't seem smart, but it was a multi-year breakout, with volume, at a time that looked really good to have an entry. It held the key levels, but the nasty dip would have scared me out anyways.

How do you consistently win in these cases? Buying early seems like gambling, getting in around major key levels has an uncontrollable risk associated to it depending on which way it goes. I felt like I did everything right and just lost, which is 'ok', but there's no way to really know that unless people give their advice on the matter.

I don't think the best trade is no trade and see how it closes today, because 3rd green days are hard to maintain, and you'll only want to take that trade if it closes above the multi-year resistance, so that's another type of trade I'll be looking for today.

Thanks for any feedback!

$NEPT Was a little play I was looking at the other day but decided not to go with it. I was watching it late afternoon on 18th right as it was comming out of its wedge , 3:35 would have been my entry. But would not have held it for more than a day. I'm not any good at a stair step pattern. Yes this is a play , I stay away from tickers that are 1-4 a share . Everyone's diffrent..

3.70 is a good entry if your plan was to hold for a day or two.. I'm sure I was still watching it

Join now or log in to leave a comment