It's the last weekend before August starts, so I wanted to do another reflection blog post.

My video progress is as follows:

- How To Make Millions - 6/13 parts

- Pennystocking - 4/4 parts

- PennyStocking Part Deux - 4/4 parts

- TIMidicators - 2/6 parts

- Spikeability - 3/3 parts

- Pennystocking Framework - 4/5 parts

Making pretty good progress, and I'm loving the content and learning a lot, but I still have a lot of work to do. I've been keeping up with Tim's latest video lessons, but I've only watched a handful of the archived content since starting. I hope to subscribe to Silver in the near future after working my way through the other DVDs I've not bought yet.

I've only been active for 3 months, and I can already see the huge difference between when I started and where I'm at now. May/June was me trying to feel my way back into trading without paying attention to Tim's content because I wasn't sold on it yet. Going into July, I started to realize why I needed Tim's teachings, and have since been working on changing my path to hopefully be the one that leads me to future success.

Looking back on when I last traded in 2009, it's amazing I ended that year breakeven with all the trading I did. Knowing what I know now, and now knowing what I didn't know then, I managed to survive somehow. The only rule I didn't break back then, was trading with reckless size, even though I had the money to. I was using a cash account, and had no idea what margin was, much less short selling, candlestick charts, or why to not believe in the companies I was trading, although I was actually trading based from CNBC/Mad Money most of the time, so "value" stocks (lol) and not pennystocks.

I suppose that's where I managed to gain the bias of wanting to trade in the share sizes I currently do. I know the style of trading I was doing was just trial and error, so not sure why I adopted the practices I did other than from a practicality standpoint. I was willing to throw around several thousands at a time, but never too much in a reckless manner. I was literally buying something, then waiting for it to go up before selling. The only research I did was in the biotechs I traded, and most of my info came from Seeking Alpha and Yahoo message boards (try not to laugh too hard!).

One of my biggest losses was from $BDSI (which I'm still bitter about), which I fell prey to a pumper (as he was actually mentioned in one of Tim's videos, funny enough) on Seeking Alpha and thought I would "invest" in the company. I found myself agreeing what was being written about, listened to the company's CCs, and on the FDA approval of Onsolis, thought I'd have some nice profits by year end. Nope. I ended the year breakeven after taking those big losses, so I just abandoned my ideas of trying to trade and invest in the stock market for the foreseeable future.

I think that's what served as my base mentality for my trading activity in May/June. I got by decent enough on my own, and thought I could still do the same. Except this time, maybe I can learn the stuff I was ignorant of when I did it before (like candlestick charts). I can't say I learned from my past though, because I wasn't ever in the mindset I had done anything wrong. That led me to a number of mistakes from May-June, all which are recoverable from, but one is a pending pain train. I actually did have a number of success, but before this month, I wouldn't have been able to explain the trades or why I ended up on the right side of things.

After I started watching Tim's content and taking it seriously because it really is legit, and he is the real deal, I started to see just how fortunate I have been with the random trading I was doing. From what I've seen on profit.ly and the chat room, most don't fare so well. I've come to actually live a lot of the lessons being taught, and now that I've experienced most of them myself, I feel like I'm finally in a position to understand Tim's teachings and work towards applying to my trading.

As I finished the second disc of Timdicators last night, there was a segment lx21 had done at the spur of the moment that really stuck with me. The premise was pretty straight forward: are you in a position to achieve success? The questions asked were: are you married (no), do you have kids (no), do you have a mortgage (no). I think those can also be summed up to cover more as: "do you have any obligations that are going to have priority over your journey towards success"?

For me, the answer is no, which is why I've been able to find my own success outside of the trading world doing what I do. Not Tim level success in terms of money, but just general success of working your way towards self-sufficiency doing what you love. lx21 also talked about understanding why you're trading, and how much money you should be trading with. I've never once had that question or even thought about it, and still don't. I'm not sure why that is, as it always felt obvious to me, but I do understand the concept of "if you have to ask certain questions, you're just not ready for something yet". That was something I learned outside of the trading world as well.

Furthermore, the question of if you need the money or not from trading. I see a lot of people who do, and it's scary thinking about that. I know firsthand, from non-trading experiences, how things change when you look to do something because you need the money vs looking to do something for any other reason. You have a different mindset, you can't focus on what you really need to focus on, and as a result, I think your odds of success are significantly lower when you put yourself in that position.

I think about the story Tim tells about not getting hired when he ran his hedge fund because of his flawless record, and it wasn't until he had his big loss that he understood. I hear similar sentiments from other traders giving presentations, you need that one big loss to really open your eyes, and unfortunately, it seems like everyone needs to make that mistake themselves to truly learn the lesson to make it real.

My mistake was in May was with $HMNY. That's the trade that has really opened my eyes now because I was trading with almost no rules, didn't understand what I was really doing, and no matter if it eventually becomes a profitable or a breakeven trade, it'll always be that terrible noobie mistake from now on now that my eyes are open. It's truly ironic I took that trade and lost the way I did, because I second guessed myself in the worst possible way, then buried my head in the sand and just ignored it.

I don't regret it though, because everyone needs that type of mistake to learn from, and I understand that now. I've come to accept how dumb of a trade it was in the first place, and understand why I lost big on it, and why I deserved it. With that said though, my golden rule that I would never, ever break is to not trade with money you can't afford to lose, so even if it goes to $0 and I lost 100% of my money, that's not going to matter. That's not to say I want to lose all my money, but if I did, it'd have no impact on my life (no, I'm not rich). It's a steaming pile of poop stock, but it's now my steaming pile of poop stock.

It's not going to take me out of the game. I've accepted it, am learning from it, moving on from it, and that's what matters most moving forward. It's because of that, that I use this pending loss as motivation for my future success. You have to have rules, and you have to stick to them no matter what. Time and time again you hear the same story from different people of what happens when they break their rules. It's so easy to sit back and say that won't ever be me, and think you're immune to it until it finally happens. Quite often, it results from becoming too comfortable or having too much success and just forgetting how vigilant you have to remain with trading. In my case, it was because I had no idea that I had no idea what I was doing.

When looking back at all my losses through May/June (which I've done some blogging about already, but just to recap), almost all of them were a result from not having taken the time to listen to Tim, plain and simple. I saw $VGZ as an early investment for a month later. I saw $GSAT as an investment for a buyout play due to a hot sector at the time. $SPI and $CYTR were me just trying to experiment with trading mechanics I hadn't even learned yet. $CHGG was treated as a non-trade based on a Tim alert. $MSLI was my first trade and loss that was a whole bunch of noobie mistakes. $AMD was an experimental play I had no idea about what I was trying to do.

$RAD was about the only solid early loss that I can't complain about, because it just didn't work out at the time, but it's the type of trade I'd not hesitate to take again. I ended up protecting myself from additional unnecessary loss and it had good R/R, and I didn't hold and hope even though if I had, it'd been profitable later on. Had I had enough confidence in sticking to a plan, I would have made over $1K.

Losses from $ADMP were offset by gains, as that was my first attempt at day trading, and I learned the style of trading of random scalping was not for me. My only recent losses are from $AVEO, which are also offset by gains, but they were solid losses on very specific plays that I can justify, so no real complaints there. I was a bit late on those plays, but I pretty much only took commission losses.

What doesn't show up, are my pending losses for $HMNY, which is the hole I'm currently digging myself out from, but it's manageable, and I'm confident studying Tim can help fill that hole. A very expensive learning lesson, but as I mentioned before, very necessary for me if I hope to ever achieve real success.

Looking at profits, which I think we need to be just as critical of as losses, most of them don't mean anything now. My $XGTI profits were from a TimAlert and it was just lucky trading on my part as I didn't understand what I was attempting to do at the time. My $WKHS profits are about the only thing I'm actually proud of, but even then, those were profits from a failed trade (which speaks volumes of why you need to listen to Tim's teachings). Everything else is just a bunch of whatever honestly now, but all are still useful learning lessons reflecting back.

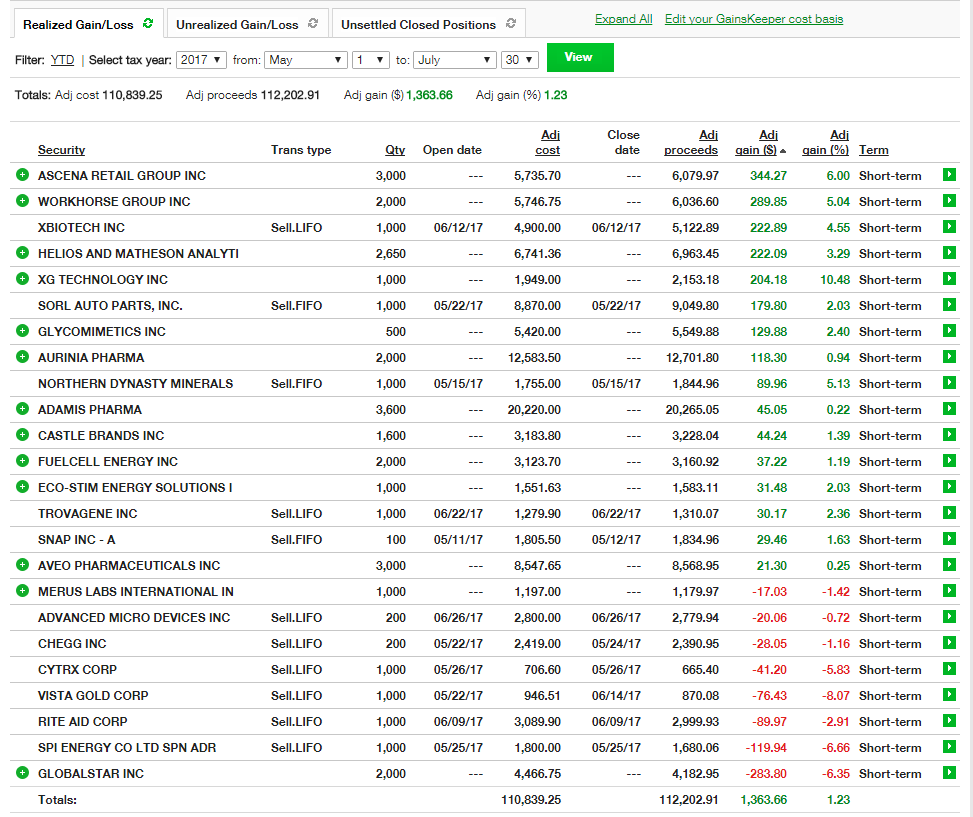

Aggregate profit/loss snapshot from TDA. I have been posting all my trades on profit.ly since I started, but the slight difference comes from free trade commissions that weren't actually 100% free when I posted my May/June trades before $ADMP, so a little over a $1's worth before I ran out of time on them. No big deal though, I've always been one for honesty.

I don't use the verified trade system though. I feel entering trades by hand, and writing the commentary makes you really think about them, and if you can't be bothered to do that work, then you're probably trading too much. I'm sure there's quite a few people posting bogus trades or living in denial of their failures and not showing or talking about them, but they're just hurting themselves. You shouldn't care about other people's gains and losses though, nor follow people that just appear to be successful who aren't putting out educational content time to time.

I'm not a fan of the whole red/green day/week/month business. I feel it's just focusing on immediate profits and losses, and that's missing the big picture. I've already written about how I don't think your trades can really show your true progress at first, because more skills are reflected in trades vs the progress associated with what you learn. It's hard to gauge your true progression though, unless you reflect upon yourself often, and start looking at others to really verify if you're getting it or not.

I blogged about before how I gauge my progression. I read and watch almost all content posted on profit.ly when I can (don't have the time to respond to it all though), and I see a lot of people putting forth a lot of good effort in contributing content to the community. Watchlists, trade reviews, blog posts, videos, and so on. It's really amazing seeing these experiences shared with others and learning from them. I have also built up and stuck to a consistent routine of watching daily progress videos from Warrior Trading, and I enjoy watching Martin Shkreli's weekly video series. Not going to dive into those two things in this post though, but point is, I'm in full content absorption mode.

I find it's helping a lot. What's helped me the most though, is using ToS and maintaining annotated charts, as you'll see a lot of my posts contain screenshots of them. I've eliminated so much guess work and have been building up more confidence in planning trades once I started doing that. It all started with $AVEO as I blogged about a few weeks ago about changing the way I approach trading. Ever since, I've been looking at the day's hottest plays, draw my charts, then wait and see how things play out.

I can't stress how much of a difference studying the charts across days and having a real-time cheat sheet in front of you as you consider a trade makes. It's not an exact science, so I don't treat it as such, but I feel my odds of success are going to go way up if I stick to investing time in learning the charts before jumping into a trade. In some cases, I'll skip trying to play the exact chart if the price action was right ($FCEL and $ESES) for example, but other than that, if I don't have what I feel is an accurate chart, I just don't take a trade.

Case in point, $ZN on Friday. It had a pretty nice recovery due to the SSR being active and the fact it had so many down days in a row, but my chart was not that complete at the levels it was trading at from Thursday, so I didn't take any trades. I wrote about how I missed my Thursday trade based on my chart, but I did not miss anything on Friday, even though there was potential for very large successful trades early on and holding. There was just too much room for risk based on my chart, and a few of the nice uptrending areas fell at inopportune trading times (such as during lunch hours). All in all, I felt most of the day was simply untradable, so I don't dwell on it for a second or think I should have approached it differently.

Anyways, this is getting a bit long now, so I'll wrap up. My main focus for August is to study more Tim content, and start understanding how to find Tim quality plays and profit off them, because I can see the essence of his strategy from my $WKHS trades - failed trades but still a 5% return, all because I had a good entry, stuck to my plan, and took profits when the opportunity presented itself, then got out when it seemed the plan was not going to work anymore while still being ahead. You really can't ask for more than that on your failures, so that's what I want to strive towards when I'm wrong about a trade in the future.

Tim makes baseball comparisons to his trades and hitting singles, but I'd say my line of thinking is more akin to American football, and focusing on 1-4 yard gains each play. That will barely help long term progression, but once you can consistently do that, you can start to expanding towards larger gains, and then work towards putting it together to score, and then focus on winning the game, hypothetically speaking.

Unlike sports though, we can take no action and wait for the best opportunities, and try as many times as we want as long as we keep ourselves in the game by not moving backwards too far, and that's what Tim teaches so well, and why we really need to focus on those lessons and apply it to our trading, regardless of what you actually trade.

Great Job

Great stuff, keep it up!

Keep this up and posting your progress, your ability to articulate your process is very helpful to me and I resonate well with your logic and reasoning. Thanks for sharing this!

This is really wonderful, thank you for sharing!

Join now or log in to leave a comment