Day one after my big loss. I wanted to write about some followup thoughts I had today, and just some other things I noticed during the trading day.

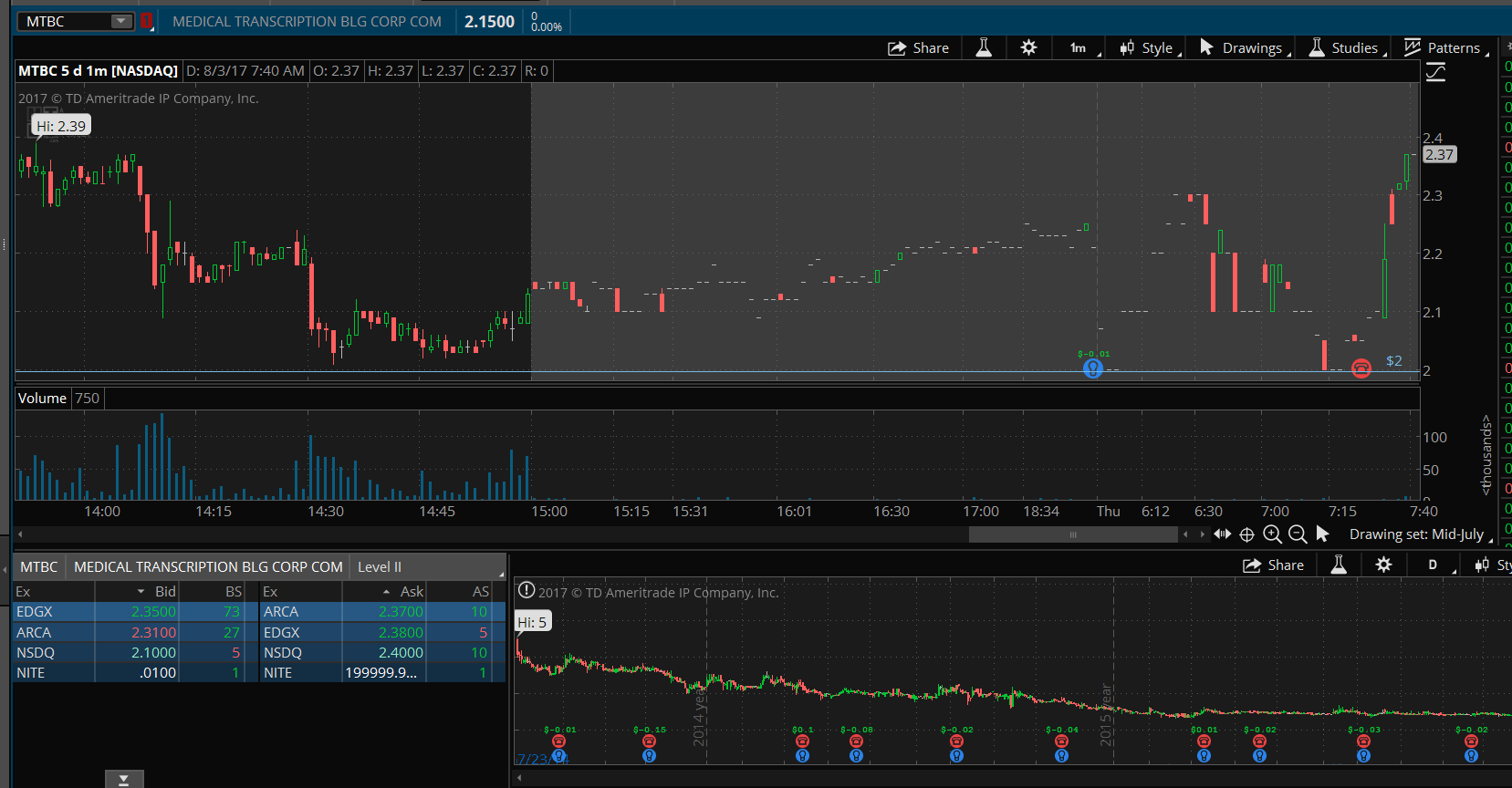

First, $MTBC, since it's the new star. I watched pre-market today, and I must say I had to bite my tongue and sat on my hands the entire time. Specifically, because of this:

If you're unaware of the details of my loss, I had bought 3k at $2.35, so it felt like salt on open wounds, but it's ok, I had a valuable learning experience, and I can recover well enough, but still, I grumbled.

Anyways, I decided not to take any pre-market trades for a few reasons as I explained yesterday as my motivations.

First, the monetary setback is minor, it doesn't affect anything except my pride. I don't need to take dumb trades trying to get back what I lost, even though I really, really wanted to. It's just human nature. However, as Tim talks about in his content, emotional trading leads you down the path of ruin, or thereabouts, and that's not what I want.

Second, the play I was attempting was over, and while I was considering a new take on it the day of earnings, it was cutting it too close, and taking a dumb trade that resulted in a loss would look and feel a lot worse than my trade yesterday, which I'll get back to next.

Third, there was no way I was going to try to trade into the open. I know too much about this stock, having watched it last earnings as well as to how things can go. Considering what happened the day before, I really did not see upside being possible anymore, even though the stock was back to the levels where I bought right before the big crash.

So, I sat back and watched. Here's what happened:

Ouch.

Basically, the sell-off lasted until noon EST, with a few minor spikes on big dips, but if you know anything about the basics of dip buying, this was not a dip buying day. In fact, once the stock topped out again at $2.35 and begun to sell off, even with the good earnings release (as expected), this stock should have been on your no-trade, earnings loser list.

I saw a lot of people trying to trade this and taking dumb (long) trades later in the day thinking it could come back, and some of them made money, others probably lost, but one of the key points of emphasis Tim makes, as well as made during the day was that you should not buy these earnings losers.

In fact, let me link the quote because it's so important to understand, but people who have not studied at all, are oblivious to this simple thing (https://profit.ly/content/commentary/175732):

| People ask why is MTBC dropping it had good earnings? It's not your job to question what the market says good vs. bad earnings are, it's your job to stop being biased and making assumptions and REACT to the reaction of the market to any news event |

It's really simple, and it saves noobies from making so many mistakes, but if they didn't take the time to study and learn the basics from the DVDs, then they wouldn't know that.

Now, I don't follow Tim's teachings strictly to the letter, because I want to learn how to think for myself based on what is being taught and actually understand it rather than just not doing something because someone says so, but this lesson was really obvious to me once I realized it having watched last earnings around May and being in TimAlerts.

Basically, I took no trades on $MTBC for the day because it was an earnings loser, and no amount of possible money I could have made trying to scrape 5c-10c moves could ever justify the results.

I don't regret my trade yesterday one bit still. It was a new day today, I had some time to sleep on it, and I woke up and felt like I made the right choice with the trade, I don't want to take anything back on it, and I just happened to be on the wrong side of things. Watching $MTBC today, I think I realized what my ultimate mistake was, which I'll go over my theory on that soon.

Now in hindsight, especially after watching the events of today unfold in some other stocks, which I'll cover later in this blog post, I now see I was mistaken about the trade timing, and not just because I bought literally a few minutes before it crashed.

I was viewing power hour as the final stretch where more buying comes in, and the final moves are being made which I thought ultimately would push the stock a lot higher than it currently was, with little risk of downside. This was wrong for 2 main reasons.

The first was that the current run the stock was on, was pure speculation going into earnings, the actual event hadn't happened yet. Basically, I was in the mindset the deal was sealed already when in fact, it was nothing but speculation at the time. Looking back now, this was a bigger mistake in my thinking then I first realized, but I would not have realized it if not for watching some different stocks today. I'm not sure why I was in that mindset at the time, other than just being a noobie and focusing so much on everything else, I just didn't connect that one specific detail to everything else.

The second was that the price action I saw, and the amount of seller walls being broken through all day, which I attributed as pure strength, even though I mentioned it looked and felt artificial, was not what I thought it really was. I didn't realize this mistake until I watched the level 2 on $MTBC today all the way down.

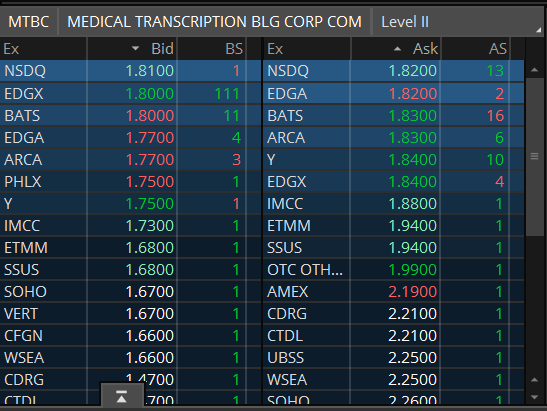

I'm going to post some wall-of-buyers images from level 2 (sorry, no timestamps) of when $MTBC was selling off hard. As I watched it, I was thinking about Tim's lesson on using wall of buyers to find the bottom, but then realized the context was also really important. The stock was a no-trade for me anyways, but this goes to show why you have to be aware of the big picture and not just pay attention to one thing or another.

I had a few more, but the point is, if you were looking at this out of context, you would think, wow, there's a lot of buying support at these levels, I should be able to buy at the ASK, have a nice support cushion under me, then sell into strength when the stock goes back up.

However, context matters. At this point in time, $MTBC was a falling knife, so as Tim says, if you try to catch that, you're going to end up bloody, and sure enough, look back at the daily chart to see how far it did sell off to.

Watching multiple walls of sellers get sold into all the way down, and seeing them pop back up time and time again, made me realize my ultimate mistake yesterday. These buyers were most likely people buying to cover. However, consider the following scenario on the way down (and this won't be 100% correct due to SSR, but bear with me).

People shorted at $2.35. They buy to cover at the bid on the way down, say in any of those screenshots. However, rather than retail traders selling into the bid, you have new shorts shorting into the bid. Without SSR, you could have this perceptual mass selloff of shorts driving the price down all within themselves. However, SSR should have kicked in just above $2.04 if my math is right, but that bar was from $2.12 - $1.86. I just double checked NASDAQ and I was right: $MTBC SSR kicked in at 8/3/2017 9:40:43 AM.

Now, that got me thinking about yesterday. I assumed I was buying into a 60k+ short seller who was guessing the top, the stock was still showing strength at the time, no real weakness to be seen, and as I said before, I've bought that pattern already and hit. I thought it was a SS because it came out of nowhere, as I had been watching level 2 full book all day, and knew where the pending orders were because I based my trade off that as well.

The order did move around a few times trying to get filled, rather than being dumped into the bid, which is why I thought it was a short trying to get filled at the top to create a ceiling, but didn't want to trigger a panic sell by dumping into the bid and only filling a small amount. It got completely filled, and after that, I thought we'd be on our way to the moon.

However, a few minutes later, something triggered a bunch of selling. I don't know what but it wasn't another massive ask, because I would have bailed right away. I want to go back and check time and sales as well as a visual representation of the trades that went through, because all of a sudden, the stock was selling off hard, to which I thought was seemingly out of nowhere.

This got me thinking, what if all day long, someone (and I just say someone as an entity and not specifically a person) was accumulating the stock, building up a large position, and in doing so, kept it from ever breaking down, since it was a pretty much uptrend all day long. However, they were "rolling" their accumulation, so as the stock continued to go up and attract more buyers, they sold their earlier positions, then kept that cycle up until a critical mass was reached. At that time, the stock was hitting new HOD scanners, new people were buying and volume was just going up more and more.

I thought solid support was being built up the entire way because of the lack of weakness shown all day long, but as it turns out, there was no support at all. Well technically, there was support all the way back to $2.00 for the day, but even then, that crumbled today pretty easily, all the way back to $1.45 with some breaks for people buying to cover and whatnot.

Anyways, they were unloading all their shares at $2.30+ as long as possible, then they could have even sold all the way back down towards $2 if they wanted to, but I don't think they did. Today's open had a big seller back at $2.35 again, and that ate a ton of volume before the stock rolled over. Normally I would have thought maybe offering related or exercise, but I didn't see anything, unless I missed it, that would point that out. Float is still low (5.5m) and outstanding hasn't changed (11m).

I don't know, but the point of thinking of this theory was that I didn't account for buyer exhaustion. I mentioned how I saw wall of seller after all of seller get demolished all day long. Even if some of that was artificial, you have a day long of buying and uptrend, which I knew and saw clearly, but I thought more people would want to dive in after powerhour because the stock was still going up, holding strong, and anyone watching just saw the massive ask get taken out, clearing the path for a breakout towards $2.40.

As I acknowledged earlier, I now realized I over-valued the catalyst, without even thinking twice about it. I was so fixated on how strong the reaction was all day long going into the earnings, I didn't really stop and think that this speculation has no real basis, and that the closer we got to end of day, the more likely a disaster could be imminent.

I know that now, not just from my $MTBC loss, but rather watching $AUPH today.

Right around the time the $SPY started to tank out of nowhere, this happened, and I was watching the stock at the time thinking about trade ideas, so that's how I captured it.

That's a nasty spill. There was a bounce afterwards, but I didn't attempt to play it for a few reasons. First, earnings was the next day, pre-market. I did not know if this was some news leak and someone selling off, or maybe it was related to the $SPY panic sell, or perhaps someone just wanted to get out from their position because of how much the stock has been falling.

In any case, the downside risk was unknown, all my price alerts for this stock have been cleared already due to the weakness, so there was no way I was going to risk trying to buy the bottom of the bounce (which I could have in terms of trade preparation at the time) not knowing what was going on.

Now, I was thinking about another pre-earnings play, but I figured I was too late because the stock was already down on the day, and just going lower. I watched level 2 carefully, and sellers were moving down more and more as the day went on. I was still biased to the prospect of trying to take an earnings play on the stock, which is why I was looking, but I realized I was too late. The move to be had was 1 day before, and selling into the day before earnings - not buying.

It was at this time I realized my true mistake with the $MTBC trade. I was executing an out of context trade. Everything I felt about why I thought it was going to be an amazing trade was not wrong per-se, but it was wrong in this particular context. The catalyst was purely speculative, I was entering the trade at the end of the day, and I mistook the amazing stock run as legitimate strength when it really wasn't based on anything. Rather than buying when I did, that was the time to be selling from having held earlier in the day or even the day before.

In addition, earlier today I was watching $WKHS as usual, because it has earnings next week, and I want to play that stock again for an earnings runup, and I will bet big again. However, I was thinking about "how early is too early" and "how late is too late", because that was the main mechanical point as to why I failed both my $MTBC trades.

Now, I didn't want to buy $WKHS because of how many on the book sellers there were around $3. Now, heavy volume wipes these away pretty easily, but once again, no news until earnings is actually out, so just speculation runup to power through it.

I witnessed this today too, which should illustrate the dangers of being too early:

Someone dumped a ton of shares into the bid, and it wasn't a short. It wasn't a seller I had been watching on the book either, because I had saved earlier images of level 2 to compare, and it was roughly the same.

Now, the price action and result wasn't that bad. Stock closed at $2.85 with some more selling, but it's still within the bounds of my chart, so I'll be keeping watch on it into next week. Point is though, patience is key, and while it might seem like a good time to get a position in early, you're really risking missing out on a better entry that would allow you to have a failed trade and still sell at a decent profit as I did in my last failed $WKHS overnights.

All in all, it was a very educational day for me. I felt like I learned a lot, and realize where my mistakes were on my big loss yesterday, whereas I just wasn't seeing it before. It wasn't until I saw it again, under different circumstances that got me thinking about things.

I also want to mention I chickened out of my first $MTBC trade because I saw that wall of sellers, but it was a tiny wall, and in hindsight, I should have been buying into that as well, because if you go back and check my level 2 wall of seller posts I linked in yesterday's blog post, $ESES had a freaking 1534 ASK, $AVEO had a 1K+ ASK, and $FCEL was about 500. The final volume of the bar I bought on was an over 600 total ASK.

I had no reason to be afraid of an ASK I could have taken out myself had I really wanted to bet on future success of the stock and my plan. I'll make sure to be more mindful of this in the future, as I tend to think fewer people are trading and generating volume than really are. That's totally on me though, and just not having the right perspective at the time I did the trade, probably because I'm a noobie.

So to wrap things up, here's something to laugh with me at, as you can't make this stuff up.

If that's not noobie talent, I don't know what is! Thanks for reading.

Thanks for sharing

Too good for your own benefit! Thats why I was excited for you on your first trade, I saw it was the exact start of the move. Great info here to study and ponder, thanks for sharing!

Join now or log in to leave a comment