Tough week for the markets.

In this blog post I'm going to talk about the trade I started Monday and ended up cutting losses today on. It really sucks to give back all my gains from this month, but I feel like I learned some valuable lessons, have a better idea of how to shape the trading strategy I want to use going into next year, and while it's a bad loss value wise, I still only gave back profits generated from the strategy, so I'm 'ok' with this loss right now because it was the result of sticking to my plan and strategy as best I could at the time, but I did make some key mistakes.

Basically, I don't consider this type of loss the same as any of my other large losses. I've blogged about some of my big losses already, but I feel like this is just a progress loss, and I can recover from it, and it wasn't because I made some massive mistake like I did with $VSTM, $I, $UVXY, $OSTK, $MTBC, etc... 1 good trade with size on this ticker, and the $1.2K loss is recoverable, so I'm not really worried about the short term set back.

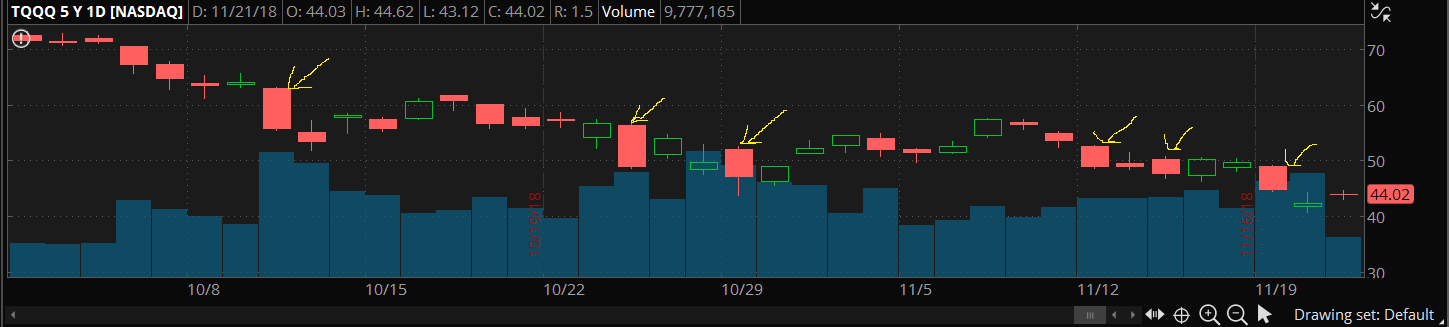

Anyways, first, I'll talk about what I'm trying to accomplish. I want to buy weakness on red days that have made a certain type of "big move" down. For example, these are the days that I'd like to execute my strategy across 1-3 days ideally. So yes, there's a lot of waiting and I'm not actually looking to trade that often with this, but there's been 6 days that pretty much match the setup I want to play since the start of the Oct. correction.

My strategy well defined would be to wait until such a large red day develops, then look to start a position near the close. Ideally, I have been playing with 100 share buys, and I try to space them out across $1 increments so I don't get too high of an average too fast. However, it's not perfect or well developed yet. Sometimes, the rate of price change exceeds my plan, so I'm still trying to work on how to best handle that. Over the next few days, I'd be looking to take a $1 move from my average, but ideally try to give it time for more.

In most of the cases shown, if you bought the close, you had an opportunity to make $1 within the next few days. That's the overall theme behind what I'm trying to develop a strategy for, buying a dip and taking the $1 or less if that's all that is given, giving me some safety because it's not a toxic penny stock, and unless we were in a bear market, it has a high chance to bounce (although this premise is no longer true, but earlier it was).

Now where I've struggled with this, is buying the dip too early. I've seen big red days setup, then recover, so maybe it's a bit of FOMO that I have to work on if I want to consistently execute this strategy more profitably, but trading isn't easy so I'm sure everyone can relate how things are easier said than done. That's also why I take these trades and try to keep building up experience and emotion control, because I won't get better sitting on the sidelines.

[TQQQ]

There's no single mistake I made on this trade, other than just being wrong, but that's trading, so I'll go over the things that contributed to this being a losing trade, because I executed my strategy, but was also executing another trade idea at the same time based on the chart.

- The reason for starting a trade was because I had watched TQQQ form a nice channel from 11/12 - 11/16 (last week). I had played 11/12 - 11/14 and even though it was profitable, I realized I had not really executed the way I wanted to. However, markets were holding out and the channel looked solid going into Monday, so I decided I'd play this Monday again, and execute my strategy into the channel bottom, and look to sell into a possible bounce later in the week.

I should note I had some remorse about that trade, because I didn't take early profits Tuesday, and then it dipped, but I was able to escape Wednesday on bad price action near the tops before it came down again. It was at that point I realized I did not want to have an average above $49, so as I watched on the sidelines, I kept in mind where I wanted to start an entry from (under $49).

- The reason I started an entry at $48.50 on Monday morning, was because I told myself I had two choices:

1. commit to a trade where I have an average under $49 like I wanted and look to sell into a move back up into $50+ on the channel

2. give up on the trade I am looking for, and don't trade until next week. Had I seen major weakness, I'd not have executed my strategy and would have had no trade at all just because of the circumstances

I went with #1, because I want to get better at this stuff, and I need the hands on experience and emotions associated with trading since it's been a rough year for me and things won't magically get better if I sit on the sidelines and do nothing. As a result, I committed to $48.50 as my first entry because I felt like there was a good opportunity to execute my strategy based on the channel formed, and my plan was to buy down as part of my strategy even if it dips, so it's fine.

This turned out to be a big mistake, because Monday was a big red day that I'd normally would have wanted to buy the close of (but even then, that would have poised a problem I'll talk about later). Going into Tuesday, markets gapped down large and there was an insane dump where $TQQQ touched $40.70 before bouncing. I missed my entries around that level, but at the time I was down nearly $4k on paper, so I wanted to leave some of my account for day trading buying power worse comes to worse.

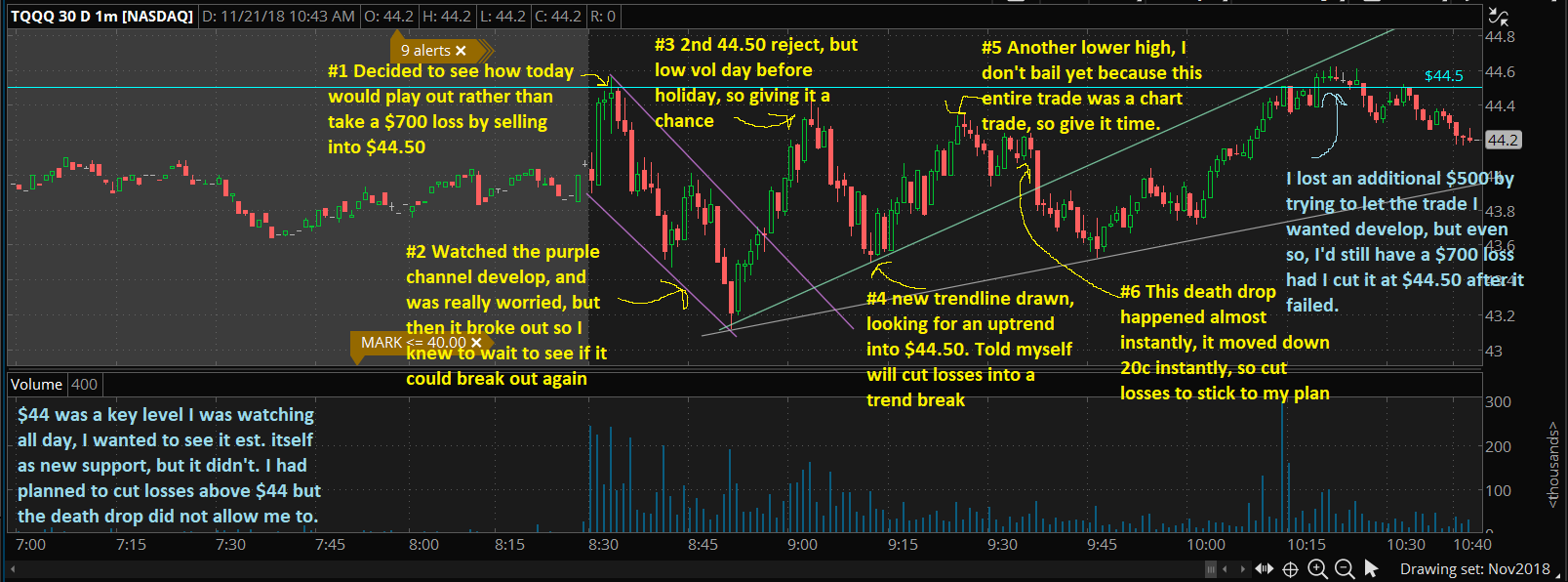

The end result was going into today, I had an average of about $45.50 w/ 700 shares, and Thursday is a holiday and Friday is a half day, so the chance of any big moves seems thin, and Friday some economy data is out I believe, so markets might react to that with low vol more drastically. I could have taken a smaller loss of ~$700, but I gave the chart a chance today because there's no difference losing $700 vs the $1200 I did because the trade didn't work out. I can't like and say I wish the loss was smaller, but if the stock ran today back towards $46, I'd have a winning position, so it'd be a different story.

Here's this mornings chart and what I was thinking. I was really worried on #2, but I decided to let the chart develop, because I was already making the decision to let the chart develop by not trying to get out for less of a loss on the morning spike.

I just want to emphasis why I feel 'ok' with this loss, because the trade I was taking, I wasn't thinking about taking less of a loss until the move I was looking for failed to materialize, and I was too heavy in the trade to go into a half day and then weekend (which is another consideration of my 2 choices of taking the Monday trade in the first place or not)

As much as I'd like to start a new position around $44 now, it's too much of a gamble seeing the past few days, because if we really are in a new bear market and things start to really tank, I cannot execute this strategy the way I thought I could during the "correction" phase. As a result, I have to wait until Monday most likely now, and just dwell on the $1.2K loss until then.

In hindsight, the trade was to wait until Tuesday morning, but even then, I don't have a viable strategy to play a day like that. Typically, I want to wait at least 15m before taking my first morning trade, and def don't buy premarket to start my first position. I would have seen the topping action, and then the nasty dip and a new low, and I would have just waited to see how the day turned out. I wouldn't have chased it on the way up (which is why my strategy is to buy on the way down on red days in the first place) so there was just not opportunity to start a new position the rest of the day and going into AH.

Clean channel break, big gap down, new low, I was not going to YOLO a $42 entry, so that's why I say had I not committed to my Monday trade, I'd just not have any trades afterwards. Even if I got in $44.50 Monday near the close, the high of today was $44.62, and Tuesday I would have woken up to a gap down of nearly $4 on that morning dip, so aggressively adding down under those circumstances would have felt like suicide, so at best maybe I stop out for once and take a small loss, but that's thinking in hindsight, so the results could have been much worse.

That's why I'm 'ok' with this loss even though it's a large loss, the logic and reasoning I used to take the trade in the first place was relying on the stock not breaking the channel and ending up dropping nearly $9, but it did, so I was just on the wrong side of the trade. There's a lot of macro-market things to consider as well, so as I try to get better and improve at this stuff, I have to put all these experiences together to come up with a better way to consistently make money.

All in all, an unfortunate step back again profit wise, but some good experiences and considerations to make for the future. Coming off the Oct highs, tech has really sold off, and a lot of people are now down over 1-2 years worth of profits, so the nature of the trade I'm trying to go for might not just work out, but it's something I've started seeing and trying to get comfortable with, so I'll give it a chance and see how trading goes going into an uncertain 2019.

There's always going to be opportunity, and larger priced stocks require more risk tolerance, so I'm still feeling my way around, but I'm not discouraged with my progress and lessons learned so far from $TQQQ.

Moving forward, what I need to work on is really executing my strategy when it best fits and the conditions aren't deteriorating like they were Monday. Trading around Holidays is always iffy, but I decided to take the chance and now another expensive lesson, however, I don't regret the trade, which is really important for me. I was regretting not selling 11/13 on the morning spike, and then had to eat the opportunity cost into the next day, but I don't regret buying for the reasons I did Monday and then executing my strategy, giving it a chance today, and then cutting losses when I felt like I had to protect my account.

I need to find a better way to average down or wait for the downside to end before starting to add more, as that's something I've been struggling with because of opportunity cost. If I get only 1 entry and the stock bounces back to where I first bought and dies again, that feels really bad, but I also can't just buy and sell for a fast loss as I'm not trading that type of stock; I need to give it time to move like I want it to. Anyways, lots to work on and think about, I'll manage, even though I'd rather be going into tomorrow green, but that's trading.

If we weren't possibly in a bear market, I'd just hold and continue to give the trade time, but right now things are really scary and if stuff hits the fan, I don't want to destroy my account, so I'll wait for the next setup and look to play the bounces and get back on my feet.

Thanks for reading, Happy Thanksgiving!

Hi. I know how to help you. Here is a link to https://essayusa.com . I work with them a lot and they really always help me very well. In general, if you need help in this area, contact them.

Join now or log in to leave a comment