It's been a while since I've last blogged, almost 8 months now. I had been thinking about doing a blog post sooner, but I was just grinding along, trying to find my way in the market still. A 1/2 years worth of progress was just lost yesterday though, so I felt it was time to post an update and everything I did wrong again so people can hopefully learn from my continued mistakes and try to avoid making the same ones.

I've still not really found my trading niche yet. I have a love/hate relationship with pennystocks. I love their potential, but I hate their quality and how easy it is to lose big with them if you're not constantly working to protect yourself. You're easily punished for every little mistake or judgement lapse, and it's hard to work up consistency and keeping your profits long term unless you find a way to discipline yourself and stick to the rules.

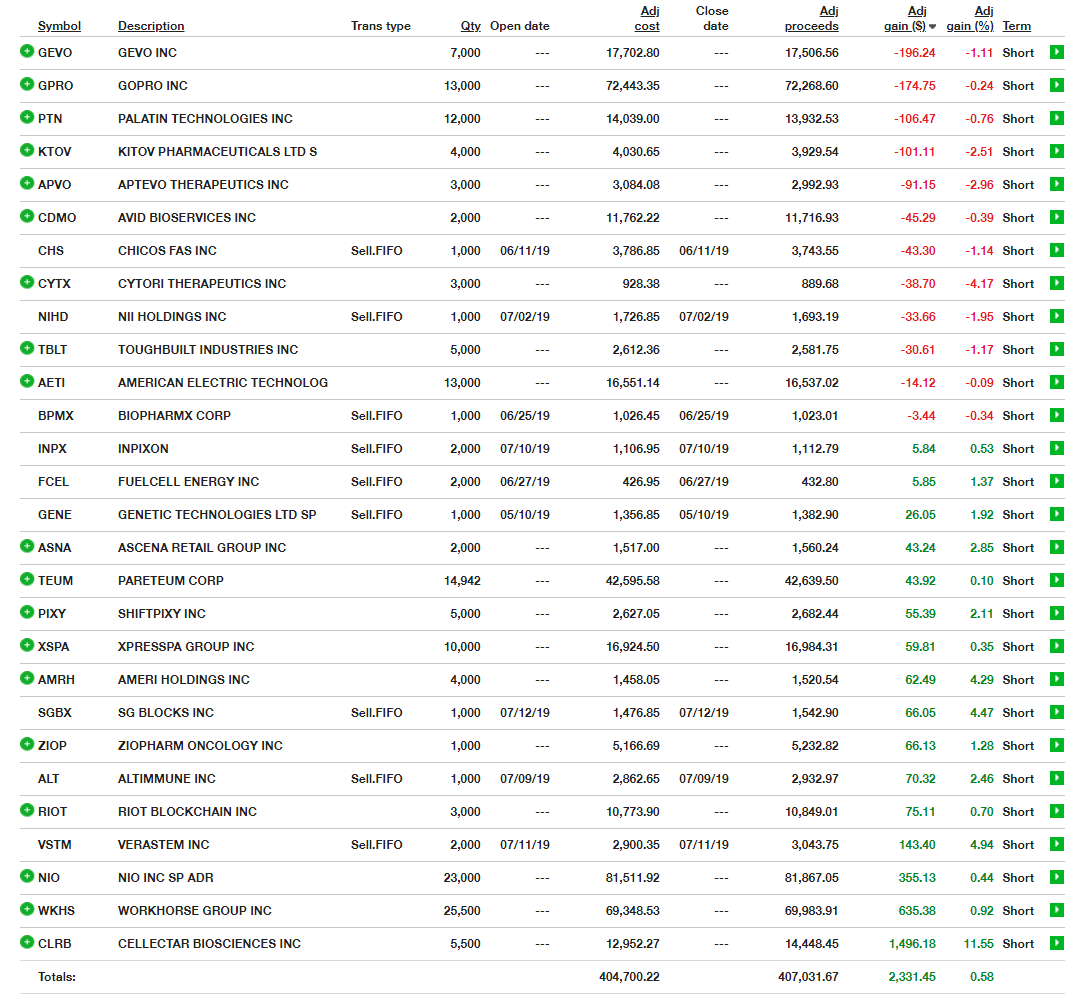

Going into yesterday, I was doing decently profit wise, here's a summary:

Lately, I've been over-trading and been scalping more or less because I feel like if I can just capture a $100 a day, I'll be steadily working towards my goal, but then days like today I'm reminded of the problem with that. All the gains wiped out by 1 really bad trade that I normally wouldn't take because it would break so many of my rules, but I just wasn't thinking about rules yesterday and instead just thinking about making money on a trade (as opposed to thinking about not losing money on a trade).

I'm not going to make excuses, since it's the same story past 2 years now since I started. I feel like my experience has certainly helped, and I've been trying to change my thought process, but it's just not going well. I need to fundamentally change the way my mind works, and that's a really hard thing to do.

Unfortunately, I didn't quit while I was ahead, and made a massive mistake yesterday. I'll summarize what I did wrong, as no new lesson was learned; I just had a mental lapse from having been trading in an unhealthy manner the past few months. I was starting to feel it, but I couldn't stop myself and it finally caught up to me.

My big loss on the day was $CLDC. To get started, let's take a look at the chart.

Now, if you're an experienced trader and have learned the lesson I'm about to share, you'll know right away what the #1 red flag is about this chart if you look before the day of the news. See it? That's a 30 day chart, that fits into the entire screen, because that's how low the daily average volume is.

Mistake #1 - taking a trade on a super low volume stock that is having massive volume for the first time in a while. Normally, I'd see this and steer clear away, because I know when you have a sudden influx of liquidity to an illiquid stock, bad things tend to happen. However, I totally missed that aspect of the trade yesterday. I have no excuses for this, I use ToS because of the charting, but it's no good if I don't pay attention to it.

Mistake #2 - I entered the trade pre-market on the pullback, really liking the volume and the price action. Normally, I've been avoiding pre-market trades almost all year because they're hard and trying to jump in too early leaves you at the mercy of the spread, which can lead to really bad risk management. This ticker was on a scan, along with $CAPR, and I decided for some reason that I liked the quality of this trade so much I had to get in without any thoughts of risk. I honestly can't explain it, other than just having a complete mental lapse and making a really bad mistake.

Mistake #3 - Adding to a loser position on the way down, and then not thinking about cutting losses quickly as soon as the trade looked like it was over. This mistake really hurts because it's a reversion to past bad habits that I had been working on attempting to correct. So far this year, I've not had any issues with cutting losses quickly and have bee proactively working towards keeping my losses small, as you can see in the first image above. I've had a few unfortunate bad luck cases where I lost more than intended, but those things happen.

Mistake #4 - Not doing basic DD, reading SEC docs, or searching for more info about the trade I was going to take in respect to the size I was also willing to take. Once again, I've been doing this all year just fine, but for some reason I didn't do it on this trade because I saw the volume, saw the chart, and thought I could trade it as-is and come out on top. Had I read more on StockTwits feed, I would have seen that apparently this was a chat room pump, but I wasn't aware of it until it was too late. Even then, I had a chance to get out for a 1k loss but decided to hunker down and ride out the storm, which once again was a relapse.

Mistake #5 - Not trying hard enough to cut losses into the close during a short cover spike. Since I was out of position, I had so much size that I could not sell into the bid because there was virtually no bid support and only ask offers getting bought, but I should have been trying to set sell orders on the ask as fast as possible to get out and reduce the damage. I knew I should not hold overnight, but there was simply not enough bid to get out and I knew how trapped I was and how I'd have to accept the outcome.

I think those cover the main points. I once again had a complete mental breakdown trading, and paid the price again. Total damage done was about a $2500 loss with commissions (12k shares). Having lost big in the past if you check my profile, I'm not as devastated about this loss from a financial standpoint, but it's more the relapse into bad behaviors and letting myself work so hard for so long just to wipe it all out yet again.

The most frustrating thing is that I know better, I've learned these lessons over the past few years and have made these mistakes before, and I usually work so hard to try to avoid making them, but one bad day is all it takes where your mind isn't in the right place, and you throw all your progress away.

I'm not feeling as bad as I would have if I lost 50% or $6k on this trade had the pre-market bid support disappeared and the stock dumped hard. I saw that potential this morning and decided I had to escape no matter what my exit was above that, even if I miss out on possibly taking less of a loss today should the share price hold up. I just couldn't take that large of a risk again knowing how bad I messed up again.

My biggest challenge moving forward is getting myself onto a path of consistency and profitability. It's been a long hard 2 years, and I foresee many more if I can even last that long. I want to be a successful trader, and have fun making money in the stock market and doing research and feeling that joy when you work hard for a trade that works out exactly as you plan, but I also know the reality of this stuff and I might just not ever get good enough to do it.

I can't say taking a break would help me recover, as I've tried that in the past many times, and it didn't, but I do need to figure out what to do going forward. I'm not looking for sympathy or anything, as I make my own decisions and have to live with them and have no one to blame but myself, but I do want to share my thoughts and experiences with others in hopes they can serve as a reminder about the reality of trading and how sometimes your best just isn't enough.

Anyways, thanks for reading, I just wanted to share this because I really do enjoy trading and learning, and trying to become better, but it's really hard and this stuff can take an untold toll on you. For now, I need to pull myself together, re-evaluate and refocus, and try to dig myself out of this hole I'm back in.

I really like to bet on sports and I think that you can make good money in this way. By the way, now the bookmaker where I place bets has a lot of profitable bonuses. You can view https://parimatch.com.cy/en/boxing and place a profitable bet if you want to make your first sports bet.

When it comes to betting, bonuses and promotions can make a huge difference, especially if you're just starting out or looking to maximize your winnings. I've realized over time that taking advantage of good offers really helps stretch your betting budget and increases your chances of landing bigger payouts. It's all about finding the right platforms that give consistent value https://ggbet.world/en/news/bonuses If you're into exploring more options for bonuses and want to boost your betting exp

Join now or log in to leave a comment