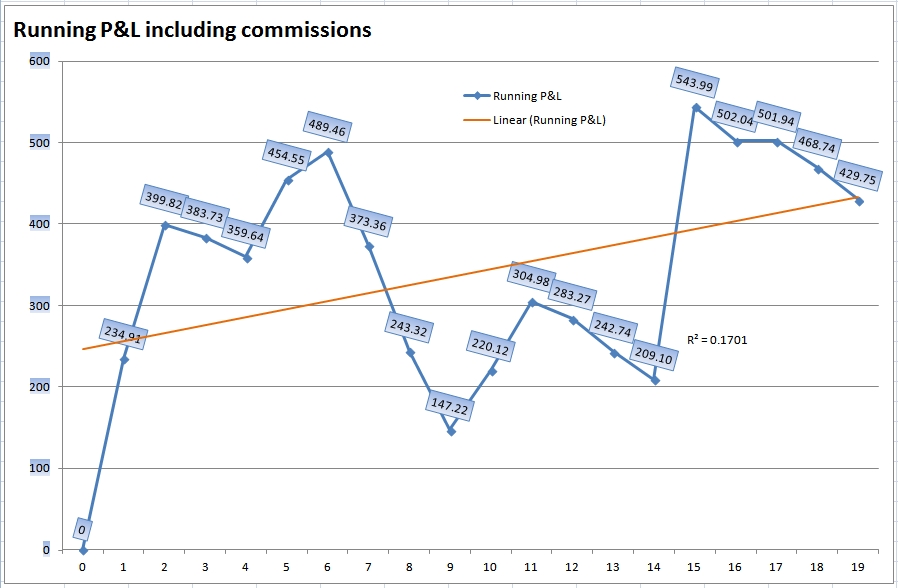

I'm up $429.75 since I started trading, including commissions, pre-tax. I initially funded my account with only $600, so I'm up 71.6% on the initial $600.

Since I only had $600 to start with I traded some earnings plays using options to quickly double-up my cash (or lose most of it). Most of the earnings options plays paid off, so I started trying to day & swing trade penny stocks. Ironically, I have lost money on every single "penny stock" (below $5) that I've traded. Fortunately, the losses have been small in the 30 to 40 dollar range. Interestingly, I often have small unrealized gains while I'm in the penny stock positions but I don't take profits because they're not big enough for me.

It seems what I have to do in order to profit from the pennys is to dramatically increase my size and then take profits much quicker when they appear. With penny stocks it seems that you're unrealized gains can disappear rapidly if you don't take them.

This week, I plan on depositing $2,500 into my account to increase my buying power. The live value of my account right now is $1,002, so the $2.5k deposit should bring it to about $3,500.

Great job by the way. Also how do you fund your account are you currently working a side job

Bon, I am currently working full-time from 5pm to 3:30am four days per week. My work schedule doesn't interfere at all with market trading hours.

Join now or log in to leave a comment