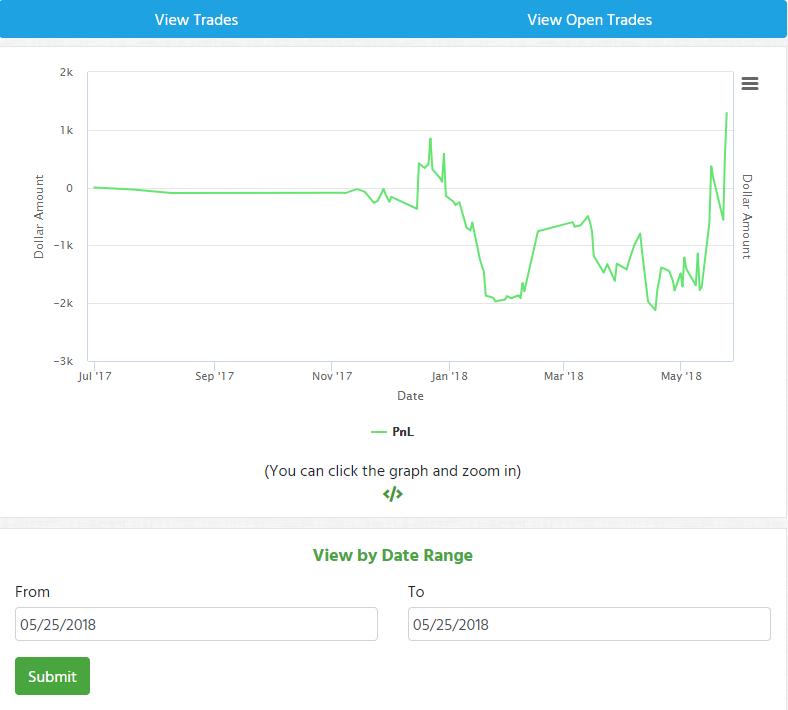

Yesterday was the day of my 100th trade and the day I dug myself out of the hole on my profit chart. For the most part, I have been consistent in with locking in 20% and not getting greedy. I did have a hiccup though and over traded on Tuesday. I had my biggest loss to date, but definitely taught me/reminded me of a good lesson: walk away when you have profits and dont get greedy.

Tuesday 22rd:

$SNES: I got in towards closing hours on Monday at around 1.16 since it was closing near HOD on the first green day. I took a small position mainly because I dont like taking large positions overnight even if the setup looks good. With a smaller position, I dont worry as much during AH or premarket. I let it run or give it room to dip. I ended up selling at 1.71 for a 47% win ($996).

$CDTI: I got into this trade because I wanted to trade and got greedy on the day. I took a full account size position and went green to red with that trade specifically and on the day. I told myself it was a bad idea before I got into the trade, but I did it anyways. I thought that maybe pushing my size up a bit would help me with confidence, but it turned out it just killed my confidence haha. Lessons were learned. 17% loss ($1700)

Wednesday 23th:

$AVGR: I saw this gap up during premarket hours. Watched it hold a pretty good support near its high. Waited for the market open and watched it spike up very quickly. Sold quickly right before it began to trickle down going to green to red on the day. 19% gain ($1020)

Thursday 24th:

$AVGR: Held overnight thinking it would have a gap up. Didnt gap up. took a small loss of $181.

$SBOT: First or second green day. Spiked during premarket hours and then had a morning spike into the open. Ran up to 3.60ish, but I got out at 3.25 with a 20% gain. $1010.

Overall I am still happy with my trading for the past week. I had a few mistakes, but recognized the stupid mindset I was in. Im still a noob, but am getting more and more confident with these premarket gap ups and morning spikes. Overnight holds are kind of a 50/50 play, but thats why I take a small size. They either gap up or just trickle down into market open. It's been about a year since I joined the challenge and Im happy with my process. Ive been taking notes of several traders and have found Dux's DVD section on premarket breakouts to be my favorite. Everyone has their own trading style and Im happy Im finally figuring mine out. Thank you all for reading and I hope yall end this week green.

Good job of going green on your profit chart!

@RockRobster thanks!

Join now or log in to leave a comment