Good day to all,

Focusing on the Oil and Gas industry, getting overextended. All the industry is on the edge of Oil going over resistance level and making the spy sentimen all bullish, but the extension, resistance level approaching on USO, and all the hype around the spy holding 200's level, we might sight a couple of breathing moments and pullbacks from the market before consolidating. As of sentiment going on, exepcting the downside for the market and all these plays pointed out here are giving overextension to play to the short side. Will watch USO and SPY as my side bias at all times which can avoid any strong spikes and mixing up my cost price avg on trades.

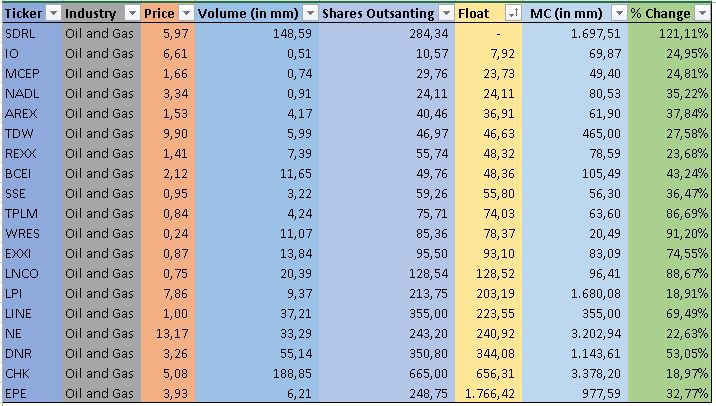

I orginized the above table by float, lowest to highest, all information from finviz.com. A lot of sympathy plays, the oil industry has brought skyrocketing stocks on Friday with squeezing price action and the highest percent changers on average dont carry significant news to explain the behavior expect for a handfull which are driving the rest around, so its to notice 5 of them have over a billion in market cap, one is very close to this market cap, showing 6 stocks with significant volume, significant market cap and spiking in tremendous volatility, so much cash being injected in the market giving volume and adding liquidity in this sector pushing prices from small caps and under around big range chanes.

www.finviz.com - Free scanner

@slopezsu - tweeter

Safe trading!

nice

Join now or log in to leave a comment