Markets are generating more uncertainty as markets ended day literal flat. The SPY opened gapping up, but retraced completely closing red from open, but flat since Thursday. QQQ made an equivalent move as the SPY and tracing the IBB as Biotechs have been running on positive press releases, this ETF closed red on day which dumped 1.3%. IBB is now extended 6.2% from a short-sale entry at 269. U.S. crude futures settled down 0.2% to $39.39 a barrel. Will continue to watch premarket movers for solid catalyst and volume to scalp spikes and looking for shorts on gap down with solid catalyst and overextended price action. Trade safe as this week.

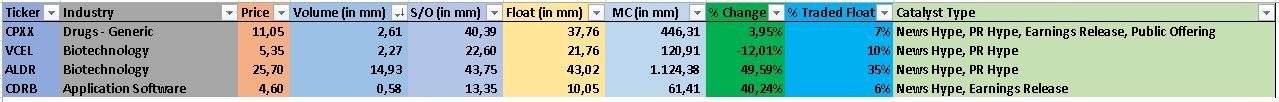

I orginized the above table by volume, highest to lowest, all information from finviz.com. I filter and group catalysts as to share public information but no recomendation to buy or sell any of these stocks. Price action dictates and plan your trades accordingly, dont over trade nor use bigger positions if uncertain. Patience is key for entry and let winners run for as much as conviction allows you, taking partials along the way.

www.finviz.com - Free scanner

@slopezsu - tweeter

Safe trading!

Join now or log in to leave a comment