SPY has tested 205 to retrace just under it and still showing bullish signs. FOMC decisions have afected positively the market ans still showing signs of green which looking foward to using hot catalysts working right now which could bring great upside, and for swing traders, positive fundamental news could be lasting. This week will have a taste for 205 level for the spy, which could define market trend in the short term. IBB closed green for the day just over 250 level and looks to have found support around 204 and with this market expectation and Biotechs and pharmaceuticals having interesting extension price action, will still be watching closely a couple of stocks from last week and see how monday brings price action. The rally has been lasting, wouldnt be surprise if we start to pullback this week, so careful on long swing positions on the wrong sectors or with no fundamental catalyst to hold value.

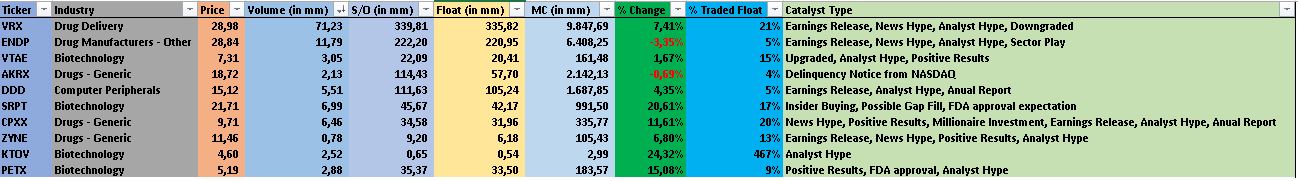

I orginized the above table by volume, highest to lowest, all information from finviz.com. I filter and group catalysts as to share public information but no recomendation to buy or sell any of these stocks. Price action dictates and plan your trades accordingly, dont over trade nor use bigger positions if uncertain. Patience is key for entry and let winners run for as much as conviction allows you, taking partials along the way.

www.finviz.com - Free scanner

@slopezsu - tweeter

Safe trading!

here in my watch list.....

Join now or log in to leave a comment