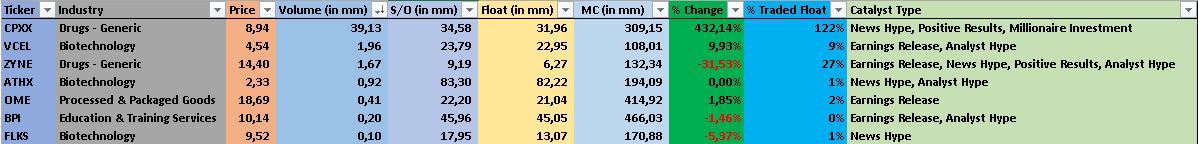

Biotechnology and Drug - Generic Sectors are showing quite the squeezing action for this week, and spy holding over the 200 level now, shows it could still have more upside at least towards 205 core level and where it could start to face resistance, but with ECB rates cut off, Hedge funds with squeezing action cutting short off, still bullish sentiment for the short term and showing now on these sectors specifically, big range and runs with huge volume. Phase 3 trials or hot news right now, any positive results on these sectors with those news are managing interesting parabolic runs. Markets opened gapping down and close solid Green for tomorrow. Watching $CPXX as there is an AH stake on this stock and i believe it will spike even more tomorrow, interesting shorting action there.

I orginized the above table by volume, highest to lowest, all information from finviz.com. I filter and group catalysts as to share public information but no recomendation to buy or sell any of these stocks. Price action dictates and plan your trades accordingly, dont over trade nor use bigger positions if uncertain. Patience is key for entry and let winners run for as much as conviction allows you taking partials along the way.

www.finviz.com - Free scanner

@slopezsu - tweeter

Safe trading!

Join now or log in to leave a comment