Week of May 18-22. I gained $770 this week, average about $150 per day. I had 3 green days, 1 red day with big loss due to the offering, 2 tickers in a day, and 1 no trading (one trading only). I did not trade on Friday 22, my internet was not working well and my TOS platform was lagged. I took day off, I was sad, but it is better than losing.

Big lesson: when company plays dirty, they can do whatever it takes and make the stock holder loss big time. Premarket when the institutional share holders can drive the price down so fast, or when during market hours, when the company decided to do offering. I experienced both of them. 2 tickers with the biggest lost I had ever experience right before my eyes and nothing I could do about it, loss more than 30%.

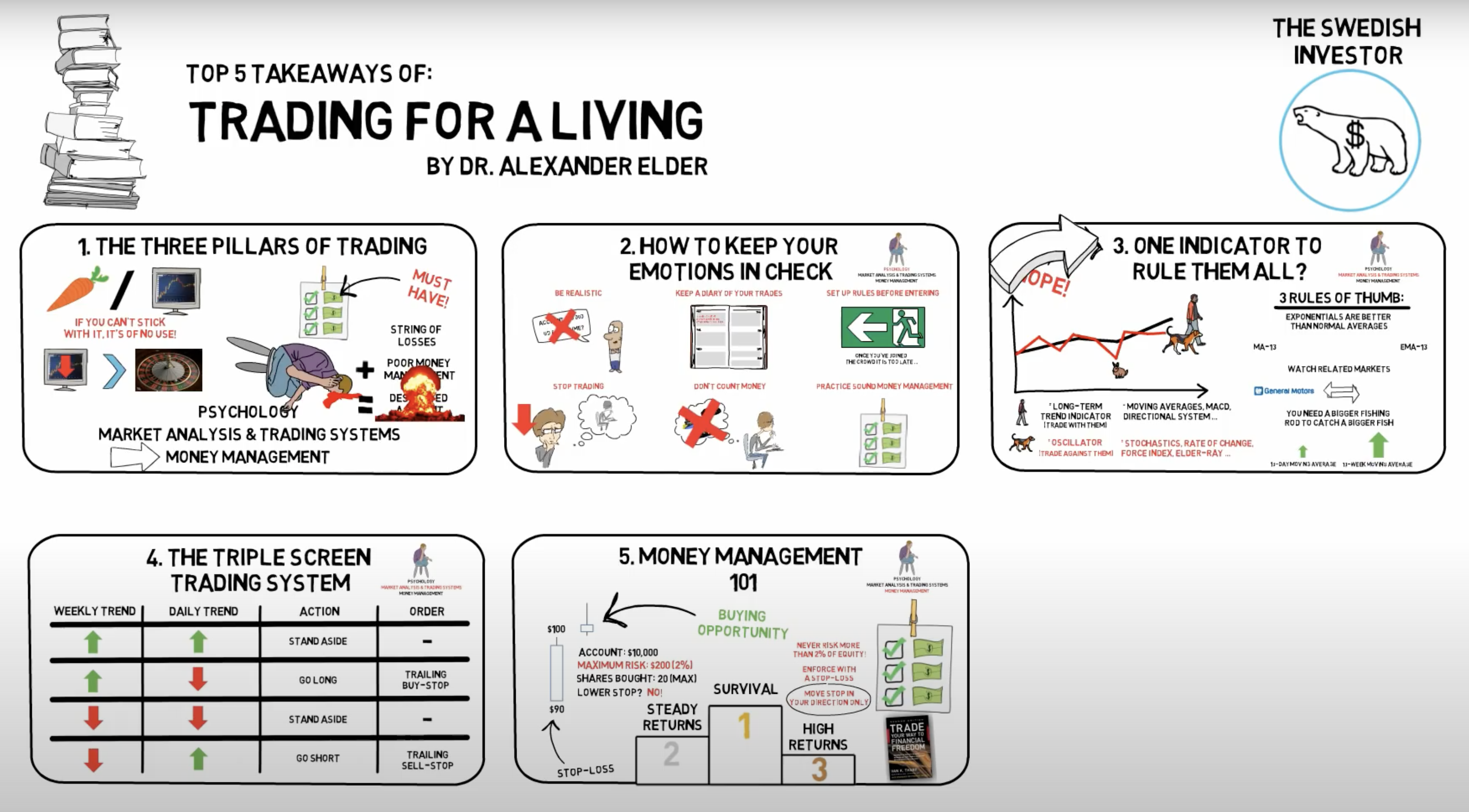

I study more and more. I learn more about psychology, I read book of psychology by Alexander Elder, went to YouTube and got the summary from Swedish trading. I put it together for you to read. It pays to learn a bit everyday.

TRADING FOR A LIVING by Alexander Elder

- Learning from the past, review your past trading, and have a good plan for future.

- Most traders are only pay attention on price actions, not aware of time. Long term price cycles happens (pattern repeats). 2 years before presidential elections tend to be bullish, 6 months after presidential election tends to be bearish.

- Most traders only pays attention on short term prices, not looking a the big picture — Look to the left.

- Know the news and the economic moves when you are trading. You need to know the time/trend instead of just jumping on trade while everyone jump in (don't be a sheep).

- Contrary indicator behavior, use technical indicator to more precise entry. Trading against the crowd, when the crowd became very bullish, be prepare to sell, when the crowd became very bearish, be prepare to buy.

- if 80% long and 20% short, that means the short has 4 times more money than the long and vice versa. Because the market consensus always steady.

- The three pillars of trading

- Psychology

- Market analysis and trading systems

- Money management

-

Psychology

Analyzing your self is more important than analyzing market.

- Keep the diary of your trades (write why you are in that ticker, attach the print screen of what the situation look like), Learning from your past mistakes is essential so you won't repeat them again in the future.

- Set up rules before entering how you are going to exit.

- Stop trading. take the step back when losing and analyze your trading before you start again getting in the crowd. Over trading = loss and blow up your account.

-

Market analysis and trading systems.

When analyzing markets and observing a price chart of a security that you want to trade. Indicator of different kinds will help you in your examination.

-

One indicator to rule them all — Man walking the dog, man walk in kinda straight line act as the long term indicator (trend), while dog acting as as oscillator, up and down, the dog because of the leash, will always following the man even though it tries to walk away from the man.

-

3 rules of thumb:

- exponentials are better than normal averages (MA 13 and EMA 13, EMA 13 is better because attach more weight to the more recent days)

- watch related markets (if GE up and Ford up too, market is more reliable and stronger)

- you need bigger fishing rod to catch bigger fish — Signals in longer time frames generally lead to greater price movements. Weekly chart beat dailies, which beat hourlies. Start out with a few indicators, both trend-following ones and oscillators, and learn to interpret them correctly, and more as you get more comfortable. Eg. 13 week Moving average is better than 13 daily moving average.

-

The triple screen trading system (the trend is your friend, buy low sell high, let your profits run), BUT why sell if the trend is up? How high is high?

-

Issue — indicators sometimes contradict each other. Moving average and MACD up but can be down on different time frame, depending on which time frame is used. Trend may be up on daily chart, but down hourly.

-

Market Tide

Enter only in the same direction as this indicator. E.g. MACD: up and down, enter only in the same direction of the MACD weekly system, if it is red, go short, if green go long. Follow in the same arrow of the indicator

-

Market Wave

The screen identifies waves that go against the tide. You want to time your entry well, even when going with the trend, otherwise, you will risk being stepped out by your stop quickly.

Use and oscillator i.e. 2 day EMA of the force index to identify a good opportunity. You are looking for lows in your oscillator for buying opportunities, and highs for shorting opportunities.

Think of Man walking his dog.

-

Intraday Breakout

It is a technique of entering, and when buying, it is called trailing buy stop, and when shorting it is called trailing sell stop. For buying, when screen 1 and 2 allows for it, place a buy order one tick above the high of the previous day. Buy only if today's price goes to that point, or higher. Place a stop at the low of the previous day.

-

-

- Money Management

- Survival

- Steady Returns

- High returns

Stick to these simple rules:

- Never risk more than 2% of your equity in a single trade (include the commissions and fees)

- Set up stop loss, physically or mentally

- Move the stop loss in the direction of your trade, NEVER against it. So if you are long, only move stop loss upwards, and if you are short, you may only move it downwards

- Play with number of shares based on your risk, not the nominal amount: for instance if you are trading on the account of $10k, the risk is 2% which is $200, you only can trade 20 shares. If the stock goes down to $95, are you allowed to lower your stop to $85? No, NEVER.

Survival always comes first. If you don't practice sound money management, you are a gambler, not a trader.

Summary: Click on pic to see undistorted picture.

Thanks man, that is a very good synopsis, i have listened to it twice on youtube audio book, but its like the bible, i can't believe it is real but it is, MARK made me rich but poorer the next day, not following years of experience, thanks man, again, good synopsis on the material

@Perez351 I am glad it helps you :) I thought I am going to start making summaries of things I read, a little bit of knowledge each day. Thanks again. Good luck with you.

Great one! Love this book! By far top 5~!

Great summary, I have to go look for the book. I can see how the summary helps make sure you understand. Keep up the great work!!

Join now or log in to leave a comment