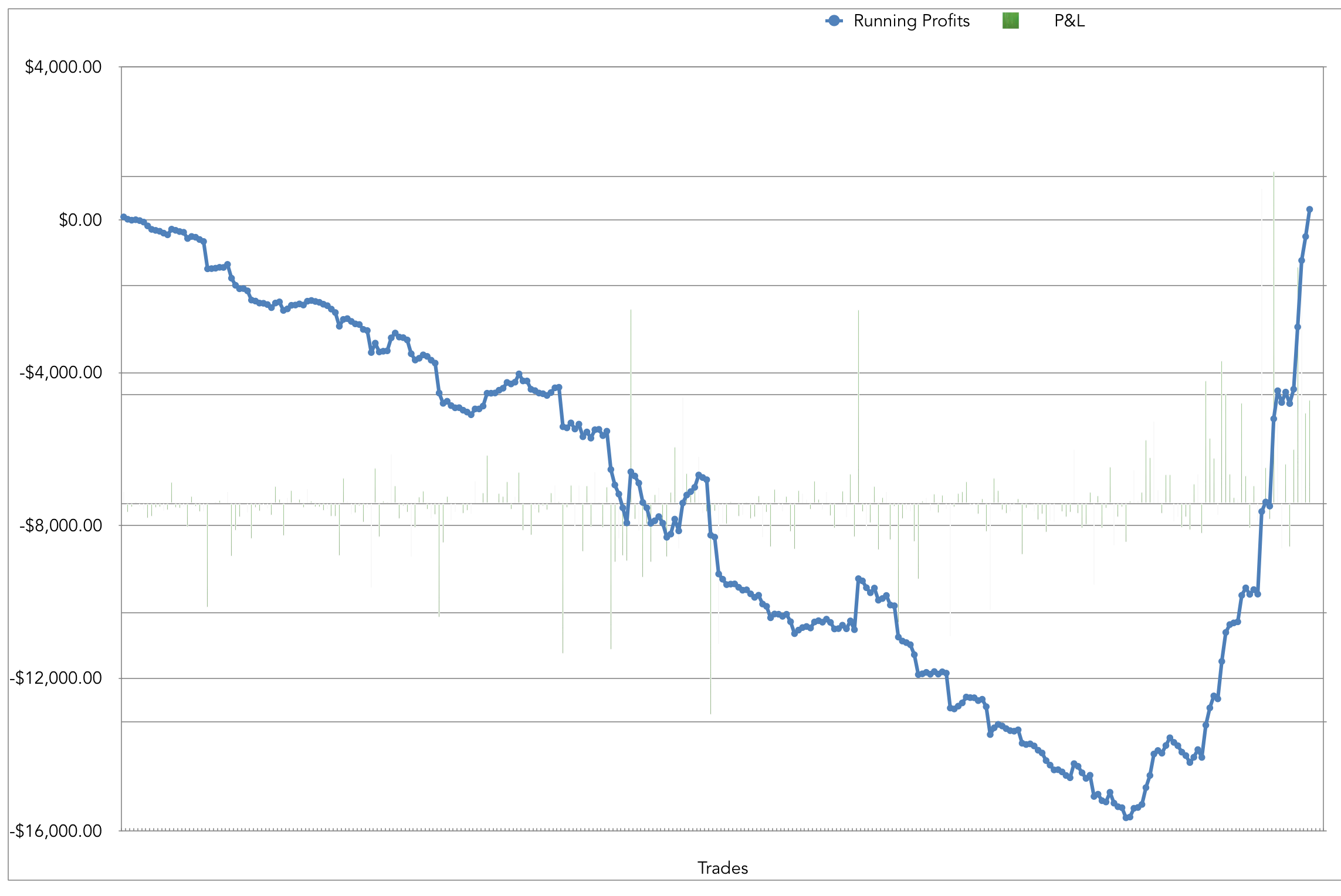

What an incredible end to the year. I made over $4,700 on the last day of the year, making me profitable overall, up $276 or about 1.15% profit on my starting account size. Now 1.15% may sound minuscule, and it is, but you really need to see my profit graph to understand how huge it actually is. Starting in May with about $24k I joined PennyStocking Silver and jumped right into trading. Soon after I joined Millionaire Masters, then the Challenge near the end of June. I had no doubts that I would learn to do this profitably and although I started with small size of around $250 - $500 positions, as soon as I thought I had it figured out I increased my size. This led to me losing a lot more than I should have as I didn't have it figured out yet and I would take some massive losses over $1k. By November 14th I had lost $15,652 and was left with $7935 in my trading account, but had also figured out that playing multiday breakouts was where my edge lay. As soon as I focused solely on this one pattern, my trades instantly turned around.

Since November 15th, starting with that $7935 account, I have profited $15,928 which is a 200% account growth, in six weeks!

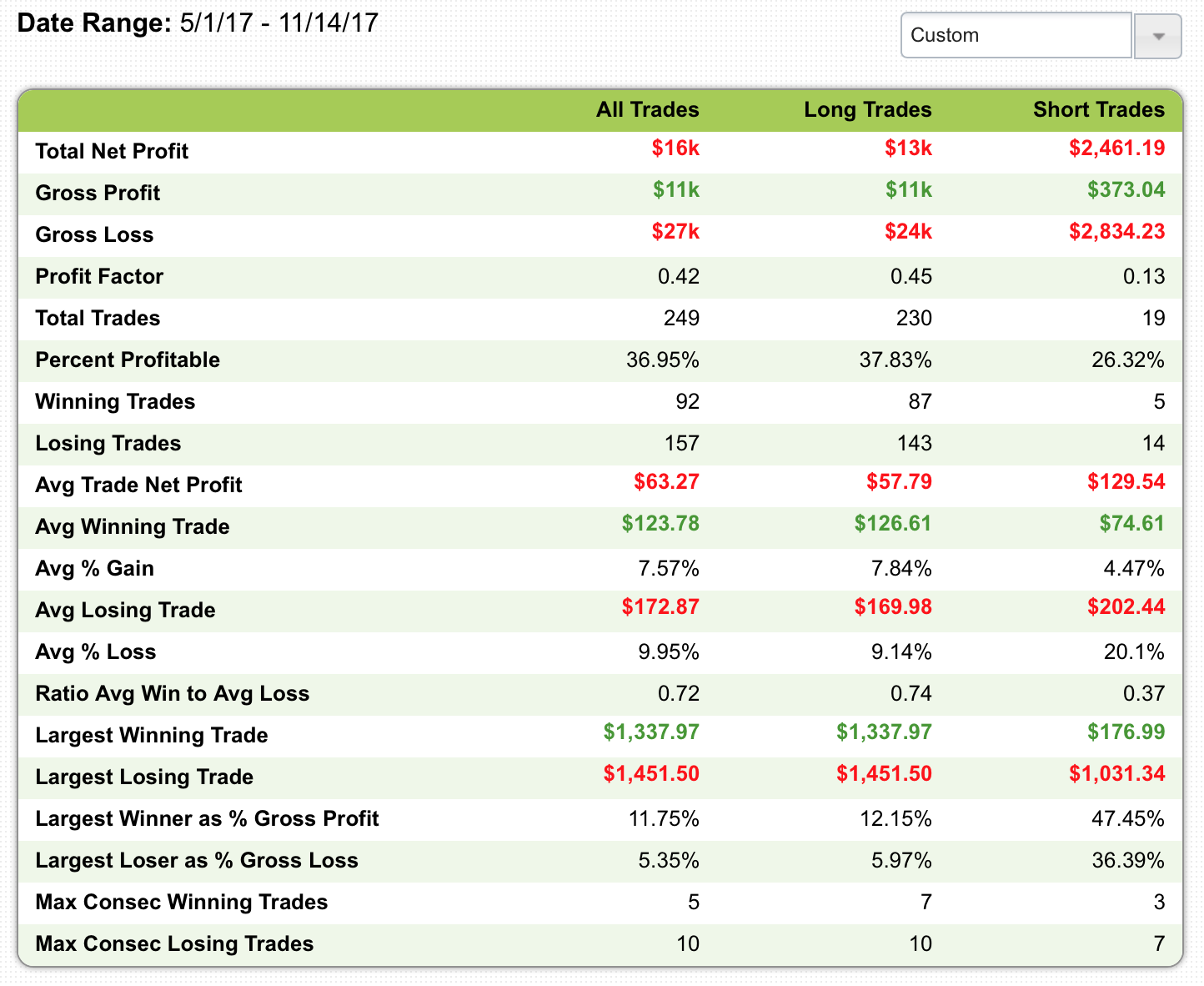

Here are my stats from the start up to November 14th. You can see I was only winning about 37% of the time and my average loss was larger than my average win.

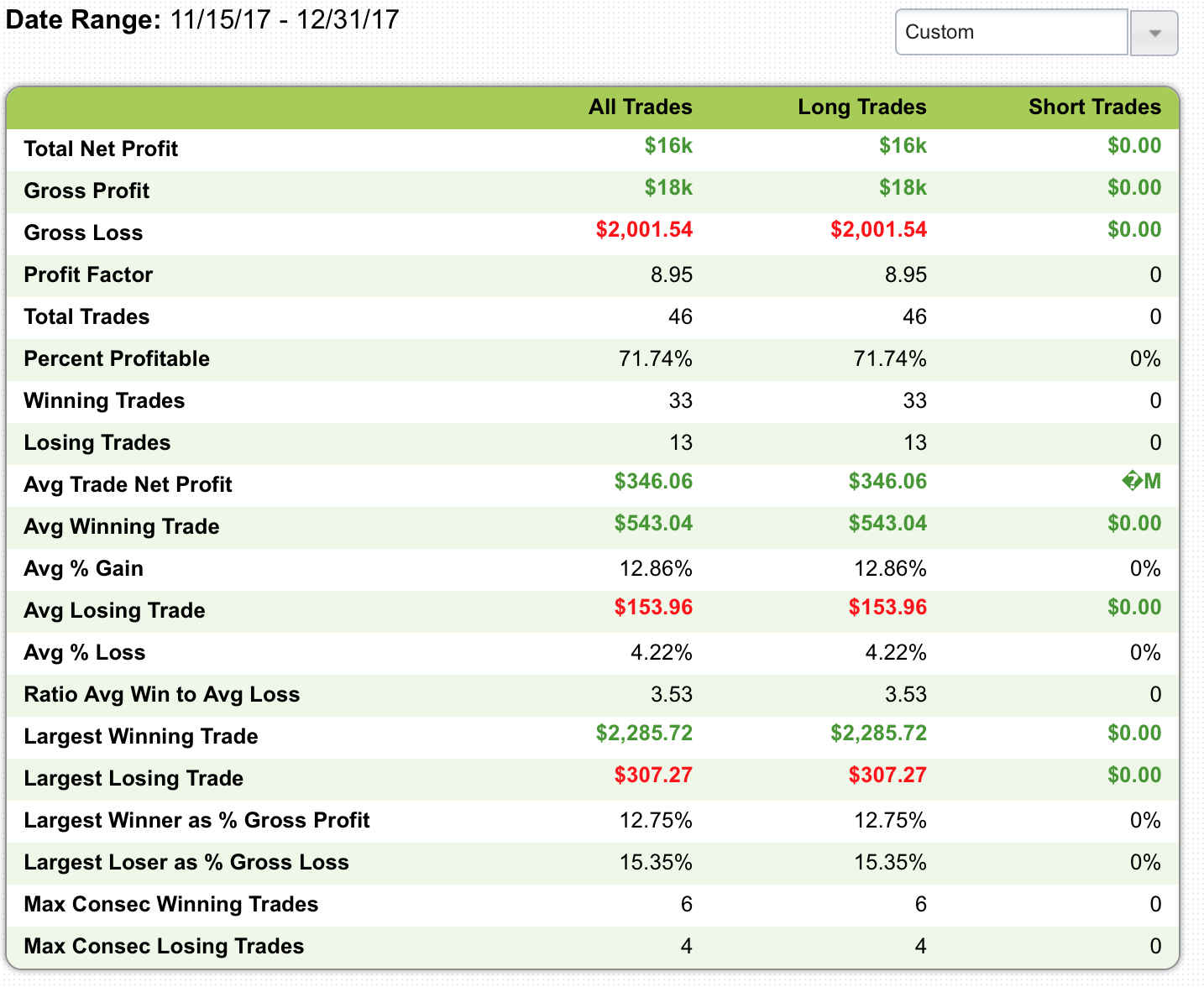

And here are my stats since my turnaround. Quite a difference. Now I'm winning 70%+ and my average win is 3.5 times larger than my average loss. This shows me that I am there. I have it figured out and can and will be consistently profitable.

This post went into more stats than I originally intended, but that is more for my own benefit. It helps me document my progress and keeps me pushing. When the turnaround first happened, I didn't ease up on studying, thinking I knew everything now. Instead it pushed me harder to study even more and be even more meticulous and careful with my trades. I am still working on a blog post detailing more of what went into this turnaround and should be done with that soon, but here are a few things that helped me.

One big thing was something Tim said at the Trader and Investor's Summit in Orlando. He said "It gets easier." And this is something I would tell myself over and over as the time wore on and my losses grew bigger. "It gets easier." Everyday I learned more, and got more intuitively familiar with chart patterns and movements as I watched the market and Tim's DVDs, video lessons and webinars. I noticed the old webinars have very low number of views. Everyone with access needs to watch those. So much good information as questions are answered about all kinds of different topics.

Another thing that directly lead to me turning profitable was hearing Tim Gritanni talk about his own turnaround in one of his speeches at a Vegas conference. He also mentioned it in some interviews he did with Sykes. And then in one of his webinars (definitely, absolutely you must watch all of Tim Gritanni's webinars) he was asked what were his steps to learning to trade. And his response is golden. He comes up with it on the fly and while it almost sounds like he is responding in a joking fashion, he actually gives incredible advice, which mirrors what he said previously about how he became a profitable trader.

Tim Gritanni's steps to learning to trade:

Fail.

Fail some more.

Learn from mistakes.

Focus on what I'm good at.

Narrow my focus to just what I'm good at.

Only trade that.

Ignore all the chatroom hype.

Ignore all the crap people are trading that I shouldn't care about because it's not what I'm good at.

Be consistent.

Be consistent.

Be consistent.

Grow account.

Slowly branch out.

This is exactly the path I took as well. When I heard this I was trying to find exactly what setup it was that I was good at. I thought I was good with morning panic dip buys but my stats showed otherwise. I had perfected my entry, but had problems taking profits and problems cutting losses when bounces failed. So even though I had a high winning percentage, I was still down overall $ wise with this setup. But my stats showed I am profitable with multi day and multi month breakouts. So that became my focus. That became my entire focus. It is the only thing I look for in trades for now. I'm now on the second to last step, which is growing my account. I will start to branch out after I'm over PDT, which should be any day now, but will stick with what is working when going full size.

I also have some advice on growing a bankroll optimally while minimizing risk given you have an edge at any given game or activity such as trading. I have many years of past experience with advantage gambling. I believe this is what helped me grow my account so quickly once I found my edge and it is what will push me to amazing new heights this coming year in 2018. But I will save that discussion for a later time.

Cheers everyone, Happy New Year!

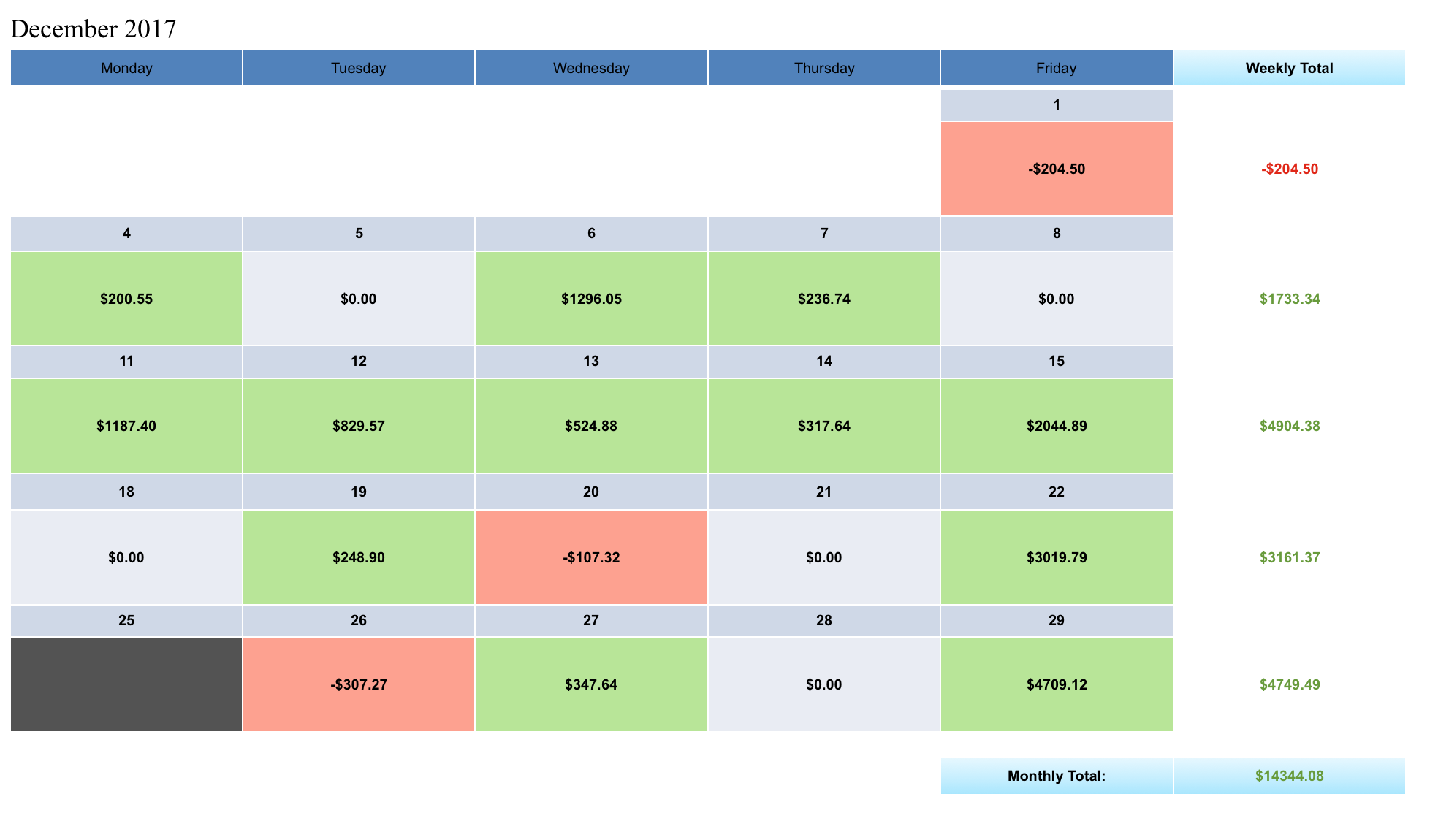

(I'll leave you with one last chart as a little inspiration. My first green month.)

This is amazing. I totally agree that focusing on one pattern is the KEY to success alongside cutting losses in time. Hope 2018 will be a gamechange for you!

incredible turnaround@

Insane. Good luck man!

Occasionally, gambling can be a very risky activity, so you must assess the risks before you start. You need to make sure that you have enough capital set aside from your trading account to cover your losses in the casino or sportsbook and there you can visit https://www.nerdmaldito.com/2022/03/os-proximos-jogos-de-rv-em-2022.html site for the Next VR Games in 2022. A good rule of thumb is that you should not risk more than 2% of any trading account on the gambling floor.

Join now or log in to leave a comment