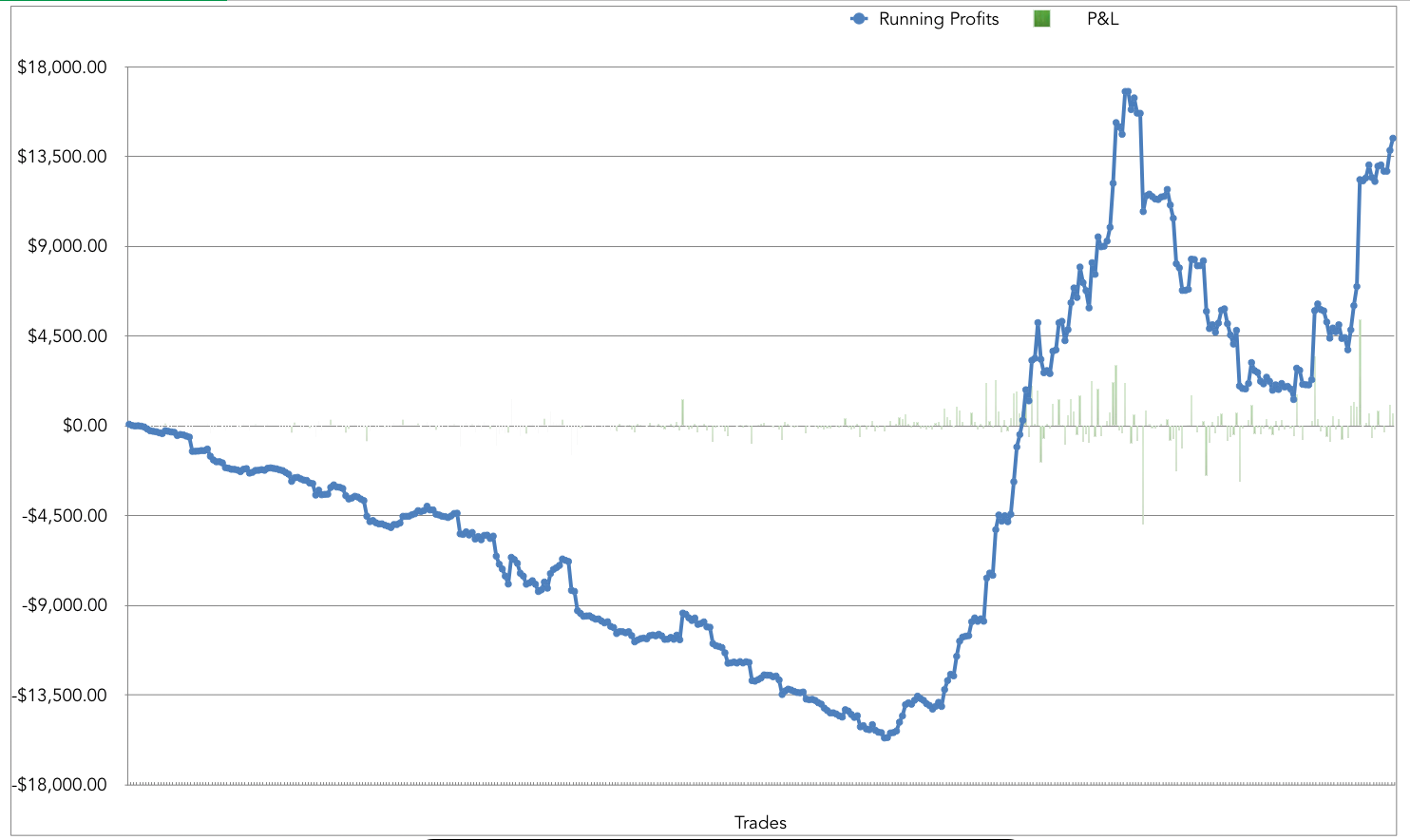

This week marks one year from when I first started trading. It's been a tough year, but I've learned so much. I'm glad to be profitable and am looking forward to really starting to accumulate some money in this coming year. For a quick recap, I lost about $16k to market tuition during my first 6 months. Then, once I got my setups and risk management down, I recouped those losses in 6 weeks, and went on to make a total of $33k in the 12 weeks after my lowest point. In February I had a bad, stubborn hold that cost me $5k and that shook my confidence and affected my trading for all of February and most of March. I ended up losing about $15k mainly due to not cutting losses on just FOUR trades! I regrouped, reread my blog post detailing my turnaround, and returned to what made me profitable in the first place. I've now nearly recouped those two months of losses in just the last two weeks. I'm about $2.3k below my all time high and ready for a breakout.

Here is my current profit chart:

A few of the biggest lessons I've learned are these. One, you have to keep your losses small. There is no reason to have huge losses, or to lose more than you expected to risk when entering your trade. It's Tim's rule number one for a very good reason. Two, you need to track your trades so that you can find your strengths. You have to narrow your focus and only play the setups that fit you the best, when you are first trying to grow your account. If you are cutting losses, and only playing your specifically tailored setups, there is no reason you shouldn't be consistently profitable. Three, if you are using the Kelly Criterion to determine position sizes, you should probably bet half-Kelly at the most. Your edge is just an estimate and anything can happen. You never know when you will get stuck in an offering or other bad news that gaps down your stock with no chance to cut losses quickly. So bet less than you think you should.

I want to highlight a trade I made last week that ended up being my biggest dollar profit and percent gain so far. The ticker is $BRKK and the setup was my bread and butter, OTC multi day breakout. My size wasn't even very big on this trade, just $3k whereas my average position size these days is around $9k. I ended up profiting about $5.4k with a 175% gain over two days. Here is the daily chart for the last year:

This was a very straightforward play, and I was lucky it ran so far. It took a lot of restraint to wait for so long before I started selling, but that's something I've been working on lately. I'm trying to refine my exit strategy in order to capture bigger pieces of the moves. Here is the intraday chart for the three days I was in the trade:

I hope this gives some encouragement to those of you still struggling with finding consistent profitability. It's a long road and takes a ton of hard work, but the pay off is more than worth it. And when you hit a home run like this, it feels pretty amazing.

Cheers!

Amazing story bro!

I am encouraged! Thank you for this post, for the reminders and for telling me that you used to use STT but that you use Equity Feed now. Thank you! I must do better on discipline and focusing on a smaller number of set-ups and STICK TO THEM without allowing FOMO to get to me! I know I NEED MUCH MORE DISCIPLINE!! I need to turn this losing ship around!!

Thank you for sharing your very honest and inspiring anniversary post!

great reminder a few big losses makes a big difference, track your trades to find your strengths, narrow your focus and play the setups that fit you best, bet conservative, refine your exit strategy to capture bigger pieces of the moves.

Join now or log in to leave a comment