It's been a while since my last post.

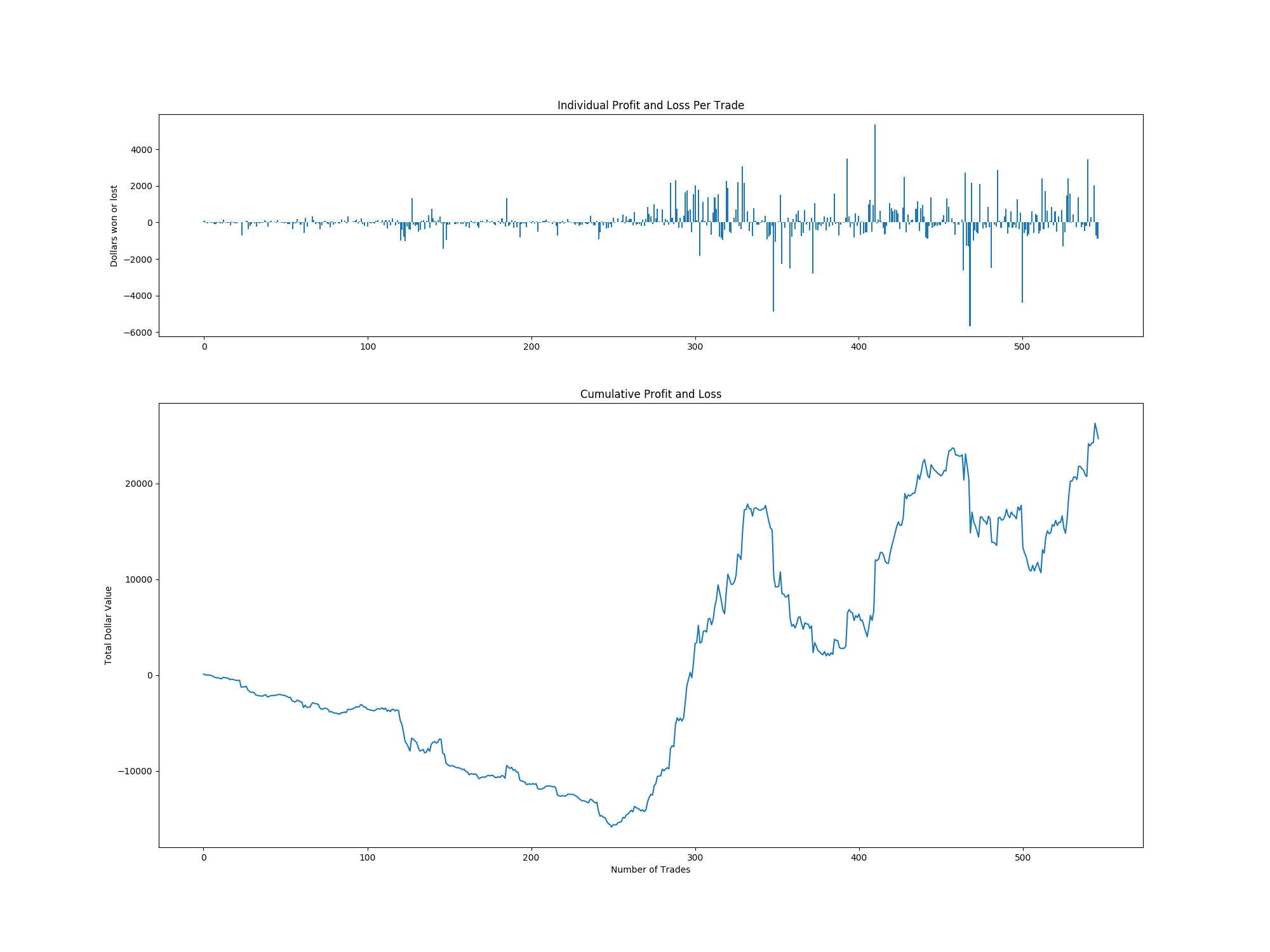

I hit an all-time high of $26k total profits on Friday before I made two bad trades on RSLS. The good thing about those losses though, is that now I know I just don't have an edge with that setup. In fact most of my profits still come from my main setup. So I'm back to focusing on that one setup and growing the account. At this point I have increased my account 500% from it's low point. I've made over $50,000 total profits playing OTC multi day breakouts. And I'm averaging $1K per day over the last three weeks. Here is my current profit chart:

I've been spending a ton of time reading books about trading. Not trading penny stocks, or even trading stocks specifically, but all kinds of trading. Commodities, options, futures, forex, equities, bonds. It turns out it is all applicable to our part of the market that we tend to focus on. At it's core, trading is the same no matter what instrument you are actually trading. I seek out all the knowledge I can find.

I wrote a software application a couple weekends ago to help me analyze my trades. I have been using a spreadsheet up until this point, but I've always wanted to write some software to replace it, expand my abilities to interpret my results, to find what works and what doesn't. Now I can calculate things like my expected value and standard deviation of each trade by setup. This gives me a clear guide to which trades I need to focus on.

The biggest bonus is that it helped me finally figure out how to cut losses. Before this, cutting losses quickly was always a 'rule'. I think in my mind, somewhere, I always have the thought that rules are meant to be broken. So I have broken this rule repeatedly, since the beginning. I always struggled with this because when counting cards at blackjack I ALWAYS played 100% correct. I always bet the right amount to bet for the situation based on the size of my bankroll combined with my edge for whatever the count happened to be. I always played perfect basic strategy, or the deviations to the strategy, based on the count. I knew that as long as I did that, then the math would work out in the long run, and I would accumulate wealth. Trading is very similar in many respects, yet I find myself breaking my rules or deviating from my trading plans.

Now that I have this software to analyze my trades, I can produce all the statistical information I have been missing to let me pin down the probabilities and values that I can use to create a 'Trading Strategy'. Now for me, I can think of this strategy as a similar thing to 'Basic Strategy' in blackjack, or GTO (game theory optimal) strategies in poker. Because of the way my mind works, I can just understand to my core that the mathematically correct strategy is the thing that will bring the money in the long run. And that shift in mindset is what I needed to be able to let go of losing trades and just take the loss. That's what this game is all about. Taking on risk for a profit.

Cheers!

@MBrandt No, sorry. That was meant for @papajohn, regarding the application he wrote.

Good job PapaJohn! I look forward to meeting you someday, maybe in Florida?

You were right! lol!

good reminder to focus on your main setup, cut losses let the math work itself out, continually seek out knowledge, identify which trades to focus on

Join now or log in to leave a comment