It has been a slow couple of weeks for me as the market correction/pullback/dip, whatever you want to call it, has made my main setup scarce. I've only entered into 9 trades so far this month. So I'm using this slower market to give me time to open a new account and consolidate some of my money and finally be free of the PDT rule.

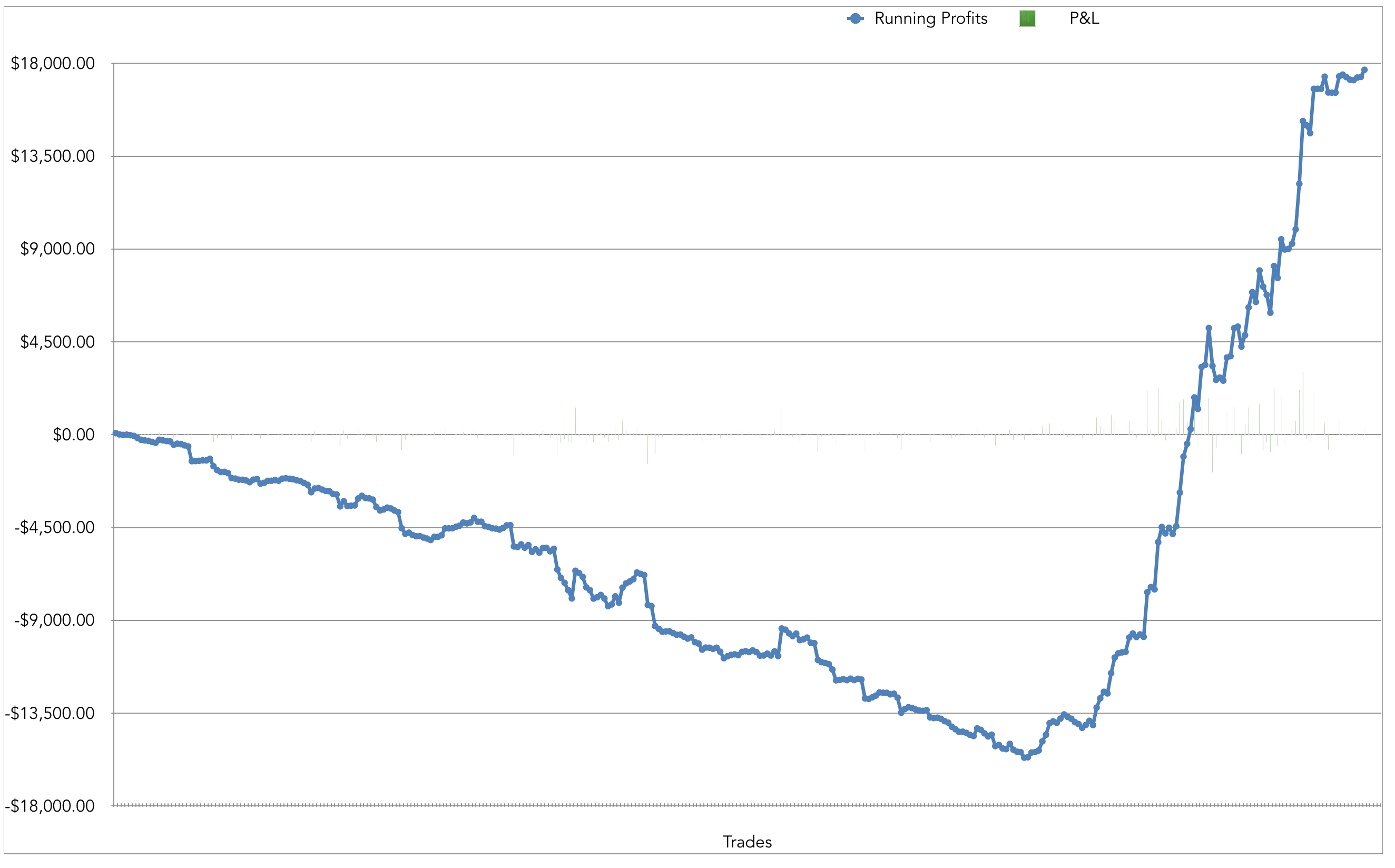

Here is my current profit chart:

I've been using E Trade and Venom/IB for my trading lately, but the size of some of my positions is causing excessive commissions through Venom. So I opened an account directly with Interactive Brokers to take advantage of their tiered pricing structure, and I will be putting enough money in it to finally get over the PDT rule. I grew my Venom account from 6k to around 24k and then seemed to hit a wall attempting to get it over PDT. It has hovered just under 25k while my E Trade account has really started growing a lot more. So I'm moving enough money into my new account to give me a good sized buffer above PDT.

This will allow me to pick up some other setups that I had previously given up on as it is difficult to hone your skills on a day trade setup when you can only do a limited number of day trades per 5 day period. I had perfected my entry on morning panic dip buys, and will start playing those again. I plan to use my ability to enter and exit trades as much as I want to help ensure I can take profits on the bounce and exit quickly when the bounces fail, possibly buying back in on the lower bounce.

I've also been working on number 5 setups out of PennyStocking Framework. Trying out setups other than breakouts has impacted my win percentage lately, but I'm trying to keep my size small on those other setups for now, to keep my overall profitability going. Since my low point I've now had 13 straight green weeks and $33.3k profits in that time.

I have started falling into a bad habit recently and need to get it back under control quickly. I haven't been cutting losses as quickly as I need to on a few trades. I've gotten lucky and have been able to wait for these stocks to come back up near my original risk levels and get out with the size of loss I originally risked when getting into those trades. But that will not always work, and I can't risk letting small losses turn into huge disasters as I keep increasing my position sizes.

So the main thing I will be working on over the next few weeks will be cutting losses quickly first and foremost. I will also work on finding some of the most import indicators to help when playing number 5 setups and getting good entries on those plays. If the overall market continues bouncing, I will also start playing morning panic dip buys again as soon as my money is available in my new account. And of course, keep studying non-stop. I still have so much to learn.

Cheers!

@papajohn haha remember days like this?

@HolyDonuts vividly. That time period is the main thing that’s been on my mind during my recent run because of the way that one ended.

@papajohn really stoked for you mate. Congrats

@HolyDonuts thanks!

Join now or log in to leave a comment