As I said in previous blogs and posts I was looking at trading more an more swings with large sizes lesser risk and that would let me work guaranteed money at my current job in overtime. My plan has never been to get rich trading but make more than the bank pays me for sitting in the account.

https://twitter.com/Osirustwits/status/781861399949484034

#FIRETEAMTRADING @ELGUAPO has given up alot of time to give me a crash course on options and mixing that with my trade style has been very nice so far but first I had to learn the basics my 2 books were https://www.amazon.ca/Options-Trading-Beginners-Started-Money/dp/1505641446/ref=pd_bxgy_14_2?ie=UTF8&psc=1&refRID=Q6SMACNNWCGG8XYAD5HN and https://www.amazon.ca/Trading-Options-Dummies-Joe-Duarte/dp/1118982630/ref=pd_bxgy_14_2?ie=UTF8&psc=1&refRID=ED21A43J14ZC00J4YN4N

Don't laugh seriously these books are a starting point now on to the trade

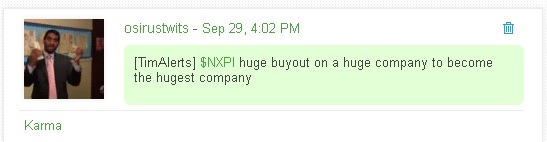

I alerted this news in chat on the $NXPI

Most won't play this or even see it but the scanner pulled the news and I bought options into close $0.50 x 5 $0.70 X 5 for about $520 for the trade is my risk was looking for just 100% on open, if less I would have dumped the trade since they expire today and have no value after 4pm.

Don't get me wrong I only truly expected 30% on every option trade just have been getting some great under price imbalances picked up from my options sweep scanner.

5 million were short this rumour was coming in with upgrades to $QUOM and $NXPI this was going to blow if my $101 high of premarket was hit at open.

I grabbed the 10 x 1.75 sold quickly $2.50 hindsight could have held but I had a trade in my other account and didn't want to loose on that once it hit. As price kept moving up I set my self a short target as $4 was too fast of a spike had to keep moving down to find a seller at $3.50 put my cover at $2.50 and on a whipsaw it filled.

First 15mins of the am options are going to go crazy good time to get out but most likely waiting 30mins you have a better sense of the market.

In my trading I have found risk is less when you short and have call options to cover for 3 reasons.

1)Buying to cover raises the price the bigger the position the more the spike

2)This sets your price to exit in stone

3)If you reuse the options at least once as protection you will make more shorting yes lessen risk

This is what the big boys do

https://twitter.com/Osirustwits/status/781888551713705988

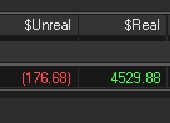

As some have no idea what I said above it makes profit

I played $NXPI as well, but I know nothing about options so most of what you said meant nothing to me haha. I got in at 95.5 average, sold some PM, sold a little more into the morning spike, and am holding a small remainder to swing to monday most likely. I also am looking to get into swing trading as my 9-5 makes it very difficult to day trade.

@Chronos247 most have no clue what i wrote or my trade style but to make it simple i added a total profit shot https://twitter.com/Osirustwits/status/781888551713705988

@osirustwits nice trade man, congrats. There is a lot of money to make with the "big ones" if you know how to trade with options,

Join now or log in to leave a comment