My third month in the challenge is at hand, and I have a confession to make. I became a bag holder twice this month. Both times were a fake out break out, and both times I stayed in much longer than I should. One was by choice, and the other was due to circumstances. Here is how it played out in both cases.

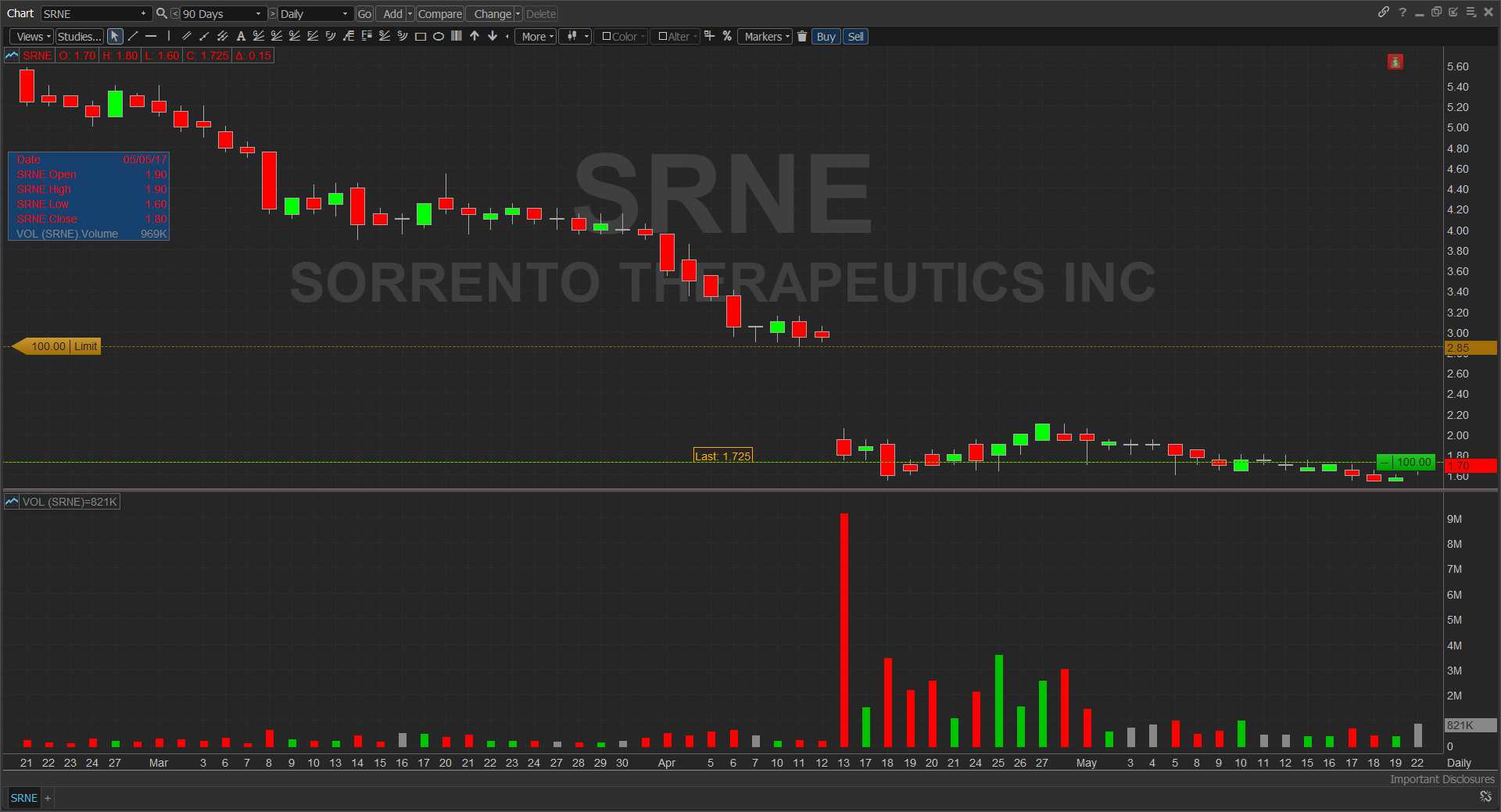

SRNE - Entered 4/28/2017 after stock broke $2 and was heading towards 2.10 for a possible gap up. This stock was trading at 0.05 increments with good volume heading into the trade. After entry the stock got stuffed below 2.10 and retreated. I held overnight looking for a morning spike that didn't happen. I held overnight, but the next morning the stock began to dip and I was not able to exit because I was away. The stock recovered above my mental stop, so I decided to hold it another day...., ok few days. The price continued to fade just below my mental stop, and I still held on. I had recovered before, it should again (right?) It dipped/recovered (but a little lower) 5 May. Historic lows set 4/18 at $1.55, so my risk was 0.25 at this point. May 17 was a bad day for all markets, and SRNE hit $1.55 that day. I wasn't surprised that it followed the market ... 3/4 stocks do. The next day I faced a tough decision...take the $100 loss, or average down and look for an earlier exit. I don't like loosing money, and the $1.55 was a solid low after the previous down day. I doubled my position...got in at $1.60...enjoyed two green days and got out 3/4 of my position at $1.75. At this point I've decreased my exposure significantly, I'm even at $1.80, have 100 shares still in play, and will exit (w/ $30 profit) if it gets stuffed at $2.10. Averaging down in this case paid off however, if 5/17 wasn't a huge red day I'd taken the loss and moved on.

VSTM - I started stalking VSTM at the end of March. It was coming off historic lows close to $1 and rose $1+ in March. It didn't accelerate higher as expected, but I was very interested in the $2.48+ level for a gap up to $4.30. There was solid vol/price action 5/10 and I expected great things the next morning. I bought strength at $2.48 and it was stuffed at 2.54...stuffed at 2.51 the next day, and 2.50 on 5/15. The 15th was the first red day after a low of 2.03 three days earlier. I figured some consolidate was good before a push into the gap. It pulled back to 2.23 the big red day 5/17, and I was faced with the same decision as with SRNE. Double down or take the loss. I made the same decision for the same reasons and got in at 2.29 ... enjoyed 2+ solid green days with a gap up this morning and exited 9/10s of my position at open (2.48/2.49.) At this point I've decreased my exposure significantly, I'm even at 2.40 with 100 shares still in play, and I'm up $100. It finished strong today at $2.50 and I expect it to begin filling that gap to $4.30 in the morning.

Unfortunately, I tied up 90% of my small account (40% SRNE, 24 days) and 50% (VSTM, 5 days), and blew my 20% (max each day) rotation out of the water. I'll be sitting on my hands for the next 3 business days while 90% of my account reconciles. As a result of being a bag holder my monthly performance took a big hit. Had I cut my losses early I could have enjoyed all the great tickers in play this month.

CUT LOSSES EARLY, and Don't be a BAG HOLDER!

Join now or log in to leave a comment