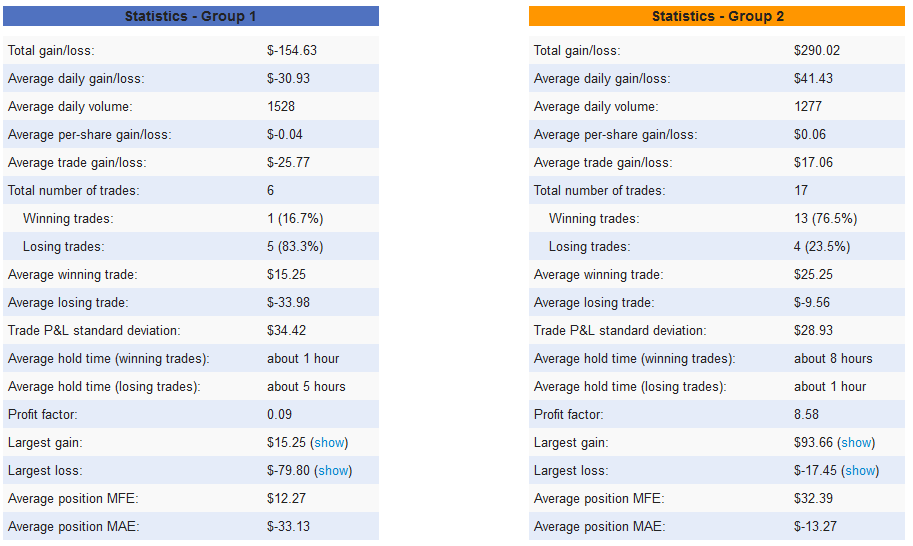

Buy Before or After the Breakout? I hate buying after the breakout. So much money lost between a dip (or consolidation) ant the actual breakout. Why would I not want that extra profit? Or, at least that is what I thought until I reviewed my trades this weekend. I've been focused on breakouts over the month of June. I've entered some pre-breakout, and post-breakout. For this month, I have 23 trades that I've tagged as pre/post breakout, and you can see the results in the attached image. The results are as clear as day, don't anticipate breakouts. (pre-breakout entries on the left, post-breakout entries on the right.) One of the most interesting stats is the average winning trade for each strategy. I thought there was a significant amount of profit lost between the dip and the breakout so, I didn't want to wait until after the breakout had happened. However, as you can see below, my average winning trade was $15 for pre-breakout, and $25.25 for post breakout entries. So, over the course of several trades, I'm not losing any profit by waiting for the breakout. What I am getting by waiting, is the opportunity to enter trades that are working right now, because my attention isn't on a trade that may or may not work out. I'm also winning a larger percentage of these trades, which means I can get more profit out of my account (I have a cash account, so when I enter a trade, I can't use those funds for that trade until 2 business days after I close the trade). Hopefully if you are struggling with the same mindset, this will help. Even if you don't take my word for it, start tracking your pre and post breakout entries and see if it's the same for you.

Join now or log in to leave a comment