I've been trying to trade purely off my watch list lately to practice my personal plans and see how far off or on target I am. I made a tiny gain off of ARQL today and my plan worked well but the volume wasn't big enough for anything exciting and I missed out on some better plays.

DHRM - Up .52(36.62%), Healthcare/medical equipment, 11.34m market cap, 4.74m float

http://finance.yahoo.com/news/dehaier-wins-medical-equipment-procurement-100000473.html

This company develops and sells medical equipment in China and today announced it has won a bid for medical device distribution in a new rural healthcare construction project funded by the China Development Bank Corp(CDB). The CDB currently has 1.5billion earmarked for improving rural living conditions and improving the healthcare infrastructure in 2900 counties, cities, and districts in China. So it sounds like this company has a foot in on some major funding. China always seems sketchy but I'll be watching because on top of all this information this stock has no resistance from 2.17ish to 2.54ish, a nice gap if it can get there. I will look to dip buy to lower my risk and see if it can get to this small gap fill. Low floater is prime for this kind of action and we'll see if it can get some steam. Today it did have record volume so that is certainly something to keep an eye on. It may need a consolidation day before this move can happen.

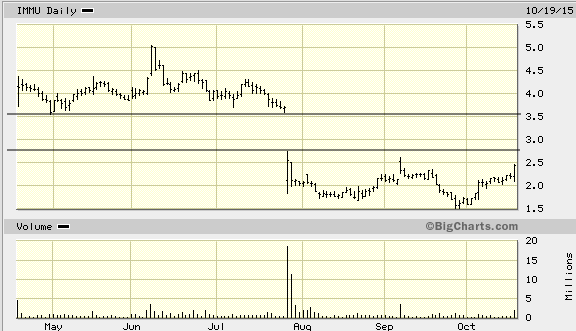

IMMU - up.24(10.91%), Biotech, 230.89m market cap, 87.9m float, shares short as of sep 30 is 15.15m(20% float)

http://finance.yahoo.com/news/immunomedics-reports-durable-responses-patients-183500746.html

News came out on this stock about their drug that targets caners and to me sounded average, nothing great but not bad either. Regardless the stock spiked today on this news and held most of its gains on above average volume. This is a much larger market cap and float than I normally look for but it also has a large short interest. The part that gets me excited the most is that this stock is approaching a large gap that it could try to fill. It has tried before and failed but it has put it solid support underneath it this time. The gap being from the mid/high twos and is on air till about 3.60. To me if the stock can get above the 2.50 to 2.60 level it has a chance to pop so I will be watching.

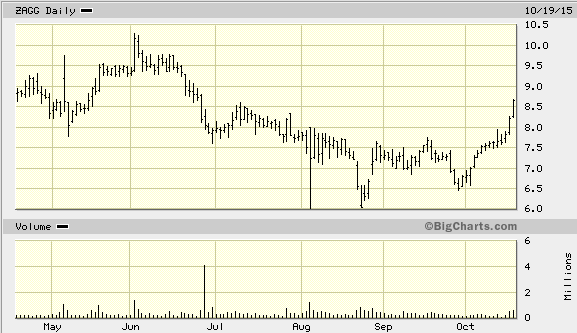

ZAGG - up .43(5.23%), Retail/Service, 255m market cap, 28.34m market cap, shares short as of sep 30 2.85m(10% of float)

This stock is up on no news but they have earnings coming up on November 3rd. They put out a keyboard for the Microsoft surface pro 4 earlier this month but I'm not sure if that would move the stock this much. I'm just going to be watching this because it closed above a key level from the past at 8.5 which looks to be pretty stout. I'm not long or short biased on this, just watching for a trend.

ERII -closed flat @2.46, Industrial goods, 128m market cap, 47.79m float, 3.52m shares short as of sep 30(11% of the float)

Big contract win that made the stock skyrocket after hours up to 5.50. Will be exciting tomorrow and I did a quick look at their last earnings report and they had revenues of just a little over 10 million dollars and I haven't dabbled too deeply into fundamental analysis but with the 75 million upfront payment they are receiving this contract sounds huge! I had to go back over two years to find a chart with relevant support/resistance levels.

I will be also keeping an eye on a few stocks from my last couple of watch lists and will narrow my options down pre-market. I'm going to just say that doing these watch list has really improved my trading, it helps me look at stocks and quickly decide what works more often than not and help me pick higher percentage plays. It has also helped me with my planning for entries and exits which is obviously crucial. I'm not saying it has made me the best trader in the world but I have noticed an improvement in my trading and I have been winning more consistently lately so I'm just putting that out there for what its worth to all of you other traders.

Good luck everyone and thanks for reading.

Too determined to fail.

You must be checking out finviz.com as well... I have DHRM on my list as well of watchlist opportunities and remember seeing ERII. Good list again. Too bad MNGA didn't pan out like we thought it might.

Yeah I absolutely love finviz, once I become more consistently profitable I plan on paying for their premium service. Yeah DHRM looks good but after looking at ERII I'm willing to bet that will be the best play tomorrow, we shall see. Thanks! Yeah that's why I'm not huge on energy plays, there are a lot more factors to look into than other sectors. I made a little on the ARQL play though.

Join now or log in to leave a comment