I haven't made a real blog, well, ever, so here is my opportunity to introduce myself.

I have only gotten into the market on the latter half of last year. I'm still pretty young, but I have learned a hell of a lot just in those short months.

Here's basically happened in these few months. It's a long story:

I delved into the stock market back in May. It all started when I installed a stupid stock trading game (stock wars) on my iPhone.

This extremely trivial event led me to become interested in studying more in the stock market, as the game, with all the live feeds, numbers, news, flashing lights, hooked me into the real stock market. From then on out I did some pretty crappy research on google, looked up stuff like "how to trade stocks", found some shit I didn't like...etc.etc.

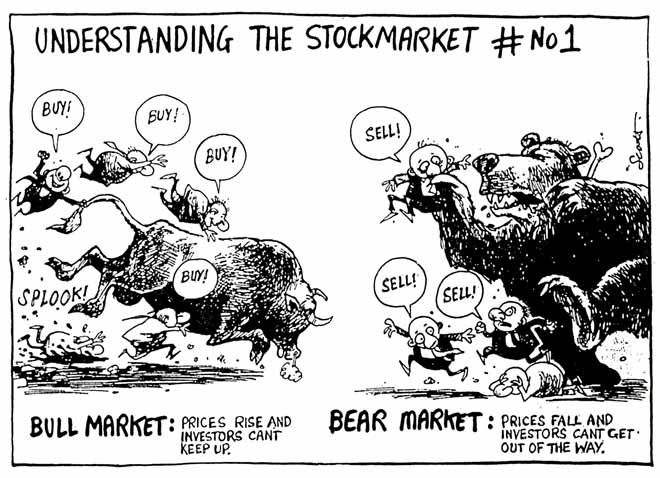

During that time I learned key vocabulary: P&D, penny stocks, options, day trading, all the fundamentals... simple shit that you absorb easily when you go into anything. But the more I learned with this vocabulary, the more interested I got.

Keep in mind I'm the kind of guy who gets interested in something and usually gets sick of it after a couple months. Not with the stock market though.

Basically, through this span of time, I learned the key basics about stocks trading, options trading, even some scrap knowledge on futures trading. During this time as well I looked into Claytrader and was almost baited into buying his DVD's and shit in the beginning when I saw him making almost instantaneous profits of $100 and $200.

I ventured on my journey scanning left and right, finding TONS of gurus for stocks and options (Claytrader, Meir Barak, Options Alpha, Real Life Trading, Superman Trading), gurus who hate other gurus (Timothy Sykes), and a few semi-shady non transparent twitter folks who post inspiring yet somewhat deceitful PnLs.

I was studying all this and making bank with my paper trading account (Marketwatch Virtual Trading) along with self-development and meditation, and to be perfectly honest, it was really fucking fun. It was probably the best summer I ever had as I felt so productive every day.

Come August / September, school started picking back up, and I drifted a little from the market. Then in September I funded an Etrade Account for $2500, traded a few times, and violated the PDT rule.

I lost trading privileges for 90 days, which was really a bummer, and promised to only come back to trading January 1st, 2016.

Well, that didn't exactly happen, and mid-December I delved back into the market. By December 25th, my PDT was already lifted, and on December 31st, $LEI, the last supernova of 2015, emerged. The rest can be seen on my profit chart.

All this said, you're probably thinking, "well shit kid, you've only made 5 real trades ever and been on the market for half a year; you probably could have just shut up and told us about how much you HAVEN'T yet learned."

So now comes the part where I tell you what I DID LEARN that has helped me.

I learned a lot of rules about trading (buy low sell high, don't buy into hype, don't short front side of move, etc.etc.), but I also learned a lot about the credibility of traders.

THERE IS A LOOOOOOOT of garbage in the trading world. Seriously, INGRAIN that statistic: 95% of traders LOSE! It's really hard to pick out the good shit, but once you do, you are on the right track to also becoming successful.

On Twitter, I found a few noteworthy gems: Nathan from IU / IL, Madaztrader, Modern Rock, AT09

Nathan gives pretty consistent live opinions about trending stocks straight on his twitter, and his service seems pretty legit (even despite some criticism)

MadazTrader is seriously the diamond the rough, providing free real time "alerts" on twitter about his honest opinions and strategies in his stocks. He also provides his full proof strategy of scalping on a Twitter FAQ he provides and has free 40+ minute videos every few days providing extremely educational and somewhat very humble advice to all kinds of traders. I love this guy.

Modern Rock is just plain funny. He also gives awesome advice, does cool shit, is a meme-ing bastard, and is laid back. He isn't too friendly to gurus though, I'll admit.

AT09 is more quiet about his trading strategies but he's also a really great inspirational source. He's young (21 yrs. old) and shows it sometimes in his tweets (overuse of LOL), successful as of now in his trading, and friendly to talk to. He also created a blog recently recapping 2015: http://www.twitlonger.com/show/n_1so4bkp

These guys I can trust. I'm hopeful for their future success, and I'm hoping to find companions / friends along the way just like them.

SYKES GROUP

Through Timothy Sykes, I also found some other traders: Tim Grittani, lx21.

These guys are also the real deal.

Grittani has an awesome blog (http://tradetheticker.blogspot.com/) and is also fully transparant, really kind to everyone, and generally just a really relatable and inspirational trader. I'm still pretty tempted to buy his DvD.

Lx21 is just plain awesomesauce. I love this guy even though he doesn't talk much on twitter, but he does also have his own service (I think) that he promotes. Loved how he also finally upgraded his minivan.

Sykes has helped, I believe his transparency and his honesty, but he promotes himself so much that it's super distracting from his actual teaching material. I do enjoy his Youtube videos though, and I might get one of his DvDs once I have the money. He has a pretty awesome mansion and car (scratch that, 2 cars), and seems to be enjoying himself. Like he says a lot though, I think does a better job of teaching than trading. I did learn from him though to trade like a castrated choir boy (which has already helped me once to avoid a large loss in ITCI).

BROKERS

I've also found out a lot about brokers, software/platforms, fees, yada yada..

ETrade - I use this currently with my small $2500 account. I kind of regret it; its not super friendly with small accounts like mine. The commissions are killer ($20 round trip) and penny stocks are hard to borrow.

Etrade Pro (platform), which I was also hoping for, is only given free to peeps who trade A LOT, or else it costs a f*ckton of money. I'm sticking with Etrade for a little longer though, and I'll probably be switching to Ameritrade or SpeedTrader.

Ameritrade - Super awesome opportunity in my eyes simply because of ToS (ThinkorSwim).

ToS (platform) is FREAKING INCREDIBLE. The real-time charts are awesome, you can customize it however you want, and for a young person like me who grew up loving customization, I can assure you that this platform, although overwhelming at first, is seriously AMAZING with the capabilities it provides for options, stocks and futures trading. My only complaint may be that the L2 is laggy, which can be fixed by buying L2 from some other platform (DasTrader)

What I really love most about ToS is that the Paper Trading feature that it provides basically provides anyone with a COMPLETELY free platform that has the functionality of one that should cost hundreds if not thousands of dollars. PLEASE DO NOT CHANGE THIS ToS!!!!!!

SpeedTrader - I do not yet meet the requirements, but I think I might really like this broker. The commission fees are good for high level trading and borrows are great (according to sources).

It also provides DasTrader (platform), which has great L2 and really nice and quick executions to trades. I'm looking forward to maybe using this as well.

RobinHood - Ohhh RobinHood. It promises COMPLETELY FREE COMMISSIONS. That should be enough for anyone to want to download this app on their apple devices. But there are a few catches.

Firstly, you still can't open a margin account, so your only option is cash account, which needs 3 days to transfer back into your account once you have traded, which seems like a huge hassle for day traders. From what I've heard, it has delayed quote data and the stop orders may not work that well. But the alluring no commissions message that it sends still may be great (probably why it's reviews are like 4.5 on the App store).

Oh yeah, and there's that. It's only an App. Seriously, and right now only U.S. citizens can get access to it (Australia is on its way). So no desktop platform and well, just a little less convenience.

I'm kind of iffy as you can tell with this brokerage, and Sykes freaking hates it, but really, this is where you have to decide for yourself if its worth it.

That's the end of my blog. It was definitely a mouthful, but hope you learned something or at least enjoyed my ramblings. Peace!

Good review, focus on transparency the most, it's tough, annoying and lots of traders are against it, but its the future, thats why you should really look up to http://tim.ly/supertrader and http://tim.ly/tritim too both of who had solid 2015 trading profits, very trade detailed publicly...lots of people can look cool and smart on twitter, transparency of ALL trades cuts through the BS

And definitely watch my http://howtomakemillions.com DVD it'll open your eyes even more

Thanks for the study drive. I will be looking at it tonight!

Hey man, I appreciate you sharing your notes. Thanks a billion.

Join now or log in to leave a comment