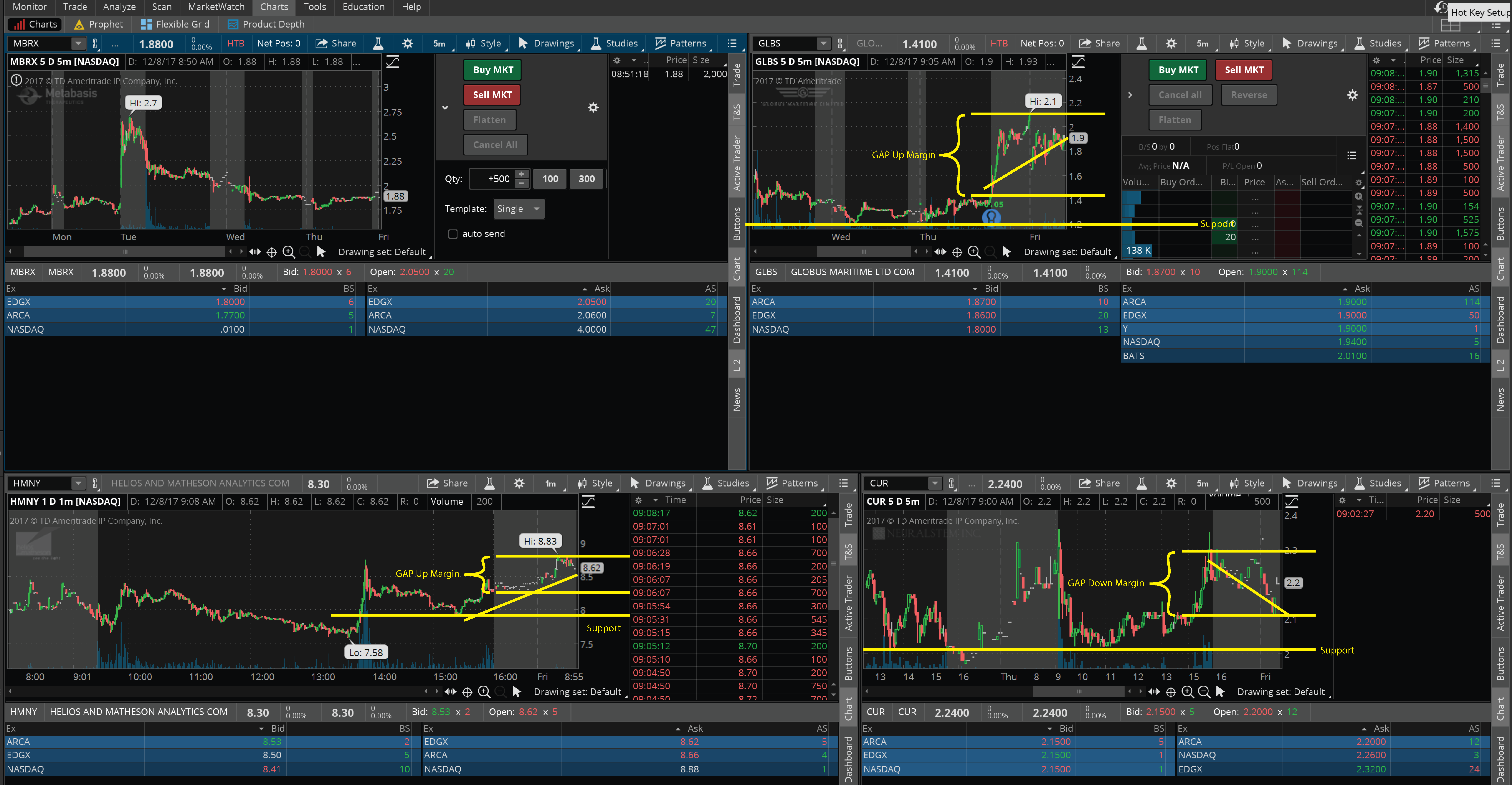

Can somebody explain to me what sort of information you're looking for when a stock gaps up or gaps down. It seems as though this is a big part of early morning plays and there is a lot of information in these that I frankly just don't know how to discern and convert into an actionable play. Like in the examples above I would assume GLBS will go into a morning panic and drop off a bit. but It's also coming off of favorable earnings, so it might spike right at the open. With CUR we are reaching support levels so does that mean this might be a good time to buy because there is a lot of reward there, or could it just be because the party is over and it's going to mellow out for a while. How do you stack the odds in your favor so you can catch the meat of the move. Just looking to capture 10% to 20%. Not looking to make 50% on a gamble. If someone could add clarity here or do like a video lesson that would be massively helpful. Thanks

Can somebody explain to me what sort of information you're looking for when a stock gaps up or gaps down. It seems as though this is a big part of early morning plays and there is a lot of information in these that I frankly just don't know how to discern and convert into an actionable play. Like in the examples above I would assume GLBS will go into a morning panic and drop off a bit. but It's also coming off of favorable earnings, so it might spike right at the open. With CUR we are reaching support levels so does that mean this might be a good time to buy because there is a lot of reward there, or could it just be because the party is over and it's going to mellow out for a while. How do you stack the odds in your favor so you can catch the meat of the move. Just looking to capture 10% to 20%. Not looking to make 50% on a gamble. If someone could add clarity here or do like a video lesson that would be massively helpful. Thanks

Tickers

GLBS

Thanks Technoyogi, Do you have some examples of some datapoints you've been tracking that have proved to be helpful

Join now or log in to leave a comment