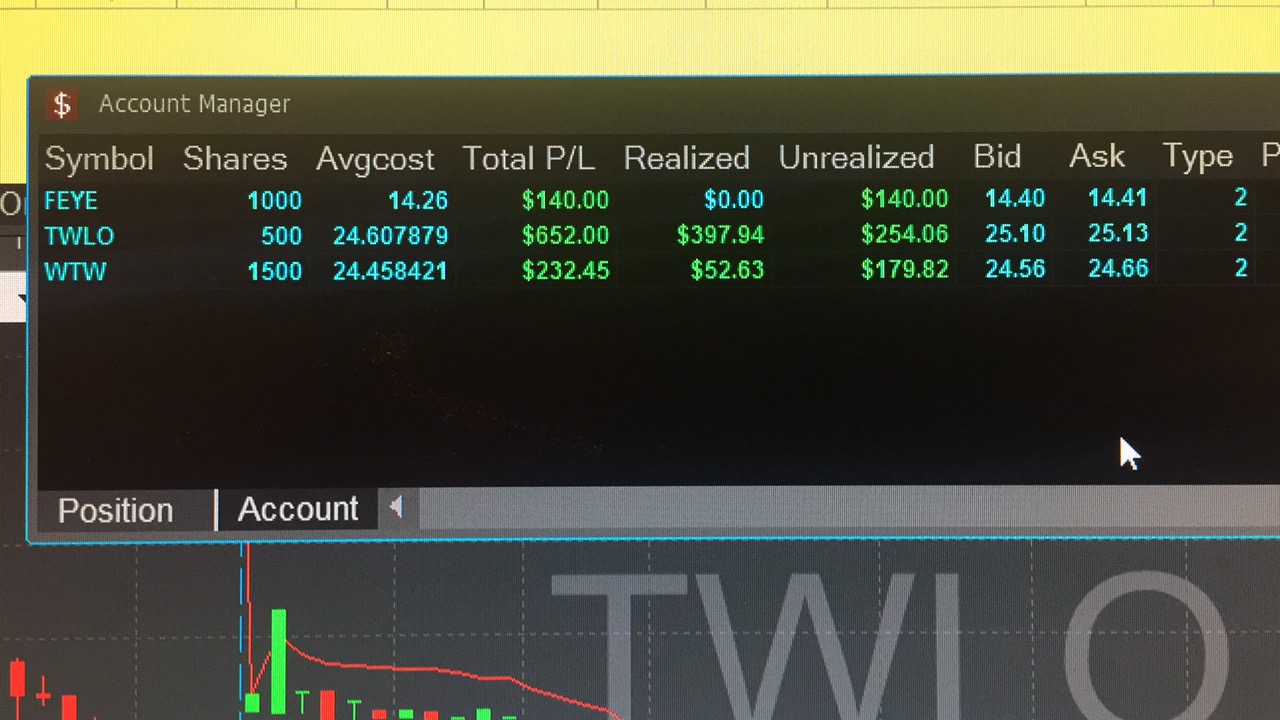

Hey guys, hope you had a nice day. yesterday I was more stable with the knowing when I am wrong cause this week I have had the right idea on 80% of the plays in general but after in the dead zone from 12-3 pm got stopped out multiple times and gave back to the markets for no reason. yesterday TWLO the money play I mean look at the chart and look at my list. I got in pretty much on the third 5 min candle the one that finished green with a big down wick and signaled further upside while volume was decent. I have a picture for you guys- I can generally post a picture every day but some days I am busy managing trades and stuff so i dont take pics. It went as high as 26.5 lol my pt was around 26$ so very proud for the call- EASY MONEY. WTW - Oprah's gem was decent in start but I am very unhappy with my bad avg at 24.45 sold into the 3rd top at just under 25$ and what timing - it was showing weakness at the top and stuffing into 25$, just as I got out with 3/4 of my position it collapsed and got stopped out on that 1/4 but its a part of the game. FEYE also not the best avg and believed in it to much it washed as I predicted to a very nice level but was busy with other two and got a shitty avg and minimized my gains, but that trade payed for commissions LOL. In general nice day, sad thing is my OCN call was FANTASTIC and it just faded all day but did not catch it cause of other ones but you cant catch them all. Its not natural and traders should never be sad because they missed out on a trade- there will be chances and opportunities all along every day and just try and pick the right ones, never be sad you missed a play because you never know what could have happened in it, maybe you could have gotten stubborn to the other side and had a big loser. Be happy for what you made and when you lose let it be a lesson THE END. Trading is a very easy job if you learn what your good at and push that to the limits of perfection. Dont try trade 24 tickers and 3 instruments with a forex trade going on also because you will overwhelm your self with it. I have traded tons of trades and made money and lost money and now do it as a profession and still I only have 4-5 stocks I watch every day in my 4 monitors, with one of the only the SP, crude, EUR/USD and gold to keep track of important stuff. The other ones are big charts with level 2's and tape and one is chat and intraday scanners. So even I am not ready for more yet and I am keeping it that way.

STOCKS

PIRS- yesterday huge day for this guy on 57mil deal rumors. Looking for failed follow through even though the markets are pointing up today. Its not looking to good in PM. Around the 3.5 level which is intraday support. I would love to see a spike into the 3.75 or 4$ levels for a stuff and fade back down to 3.20s which is the PT. If it gets going leave it alone.

TWLO - okay yesterdays moneymaker, now I am looking for 2 specific plays on this. Either a small wash and rebound for more upside. Or bigger gap up and failed follow through and its very important where this opens. The 25$ level is crucial here, if it holds it can get going if it cracks we can see test of the lows.

CNAT- Hosting a conference call at 10.30 EST and to much hype about an earnings beat and bla bla. I dont like this stuff and when to much hype comes about something it usually goes the other way. Its gaping now due to hype about 13% so at 9.16 now I am looking for a hype pump on the open to scalp maybe and later at if it reaches 10$ I will try scale in to a short with a good avg for a stuff. Now if I dont catch the bounce on the start and have some leverage and green against the stock I wont try short. If I have something to play with I will do it. So thats the plan scalp morning spike- short in to 10$ stuff.

APTO- gaping up on not much of anything. Looking for a failed spike to short into. At 1.20 now and tested 1.30 and a bit higher looking for a test of that level or just under for a short. back to the 1$ and thats the PT.

ECONOMIC CALNEDAR

- Bloomberg Consumer Comfort Index 9:45 AM ET

- Factory Orders 10:00 AM ET

- EIA Natural Gas Report 10:30 AM ET

- 3-Month Bill Announcement 11:00 AM ET

- 6-Month Bill Announcement 11:00 AM ET

- Treasury STRIPS 3:00 PM ET

- Fed Balance Sheet 4:30 PM ET

- Money Supply 4:30 PM ET

/CL disappointed in general. No momentum no buyers coming in at crucial levels and you can see what happened to it. Next stop 46$ ultra short for now. But generally I wont touch it because it has been moving very weird and new trends have been developing out of no where. I think we test 46$ today and its the next level of decent support. after that day on the daily where if it had left a wick to the down side, I lost all hope of a rebound and I wont ever get biased about a commodity like that again because the markets dont care.

Have a great day and trade safe guys.

If u don't mind can i have yr mail id or anything social?need some advice .

My Full Name is Gopal Jana. and Im a Boy.

ok ok ofcourse.... 10kiwu10@gmail.com

Thanks

Join now or log in to leave a comment