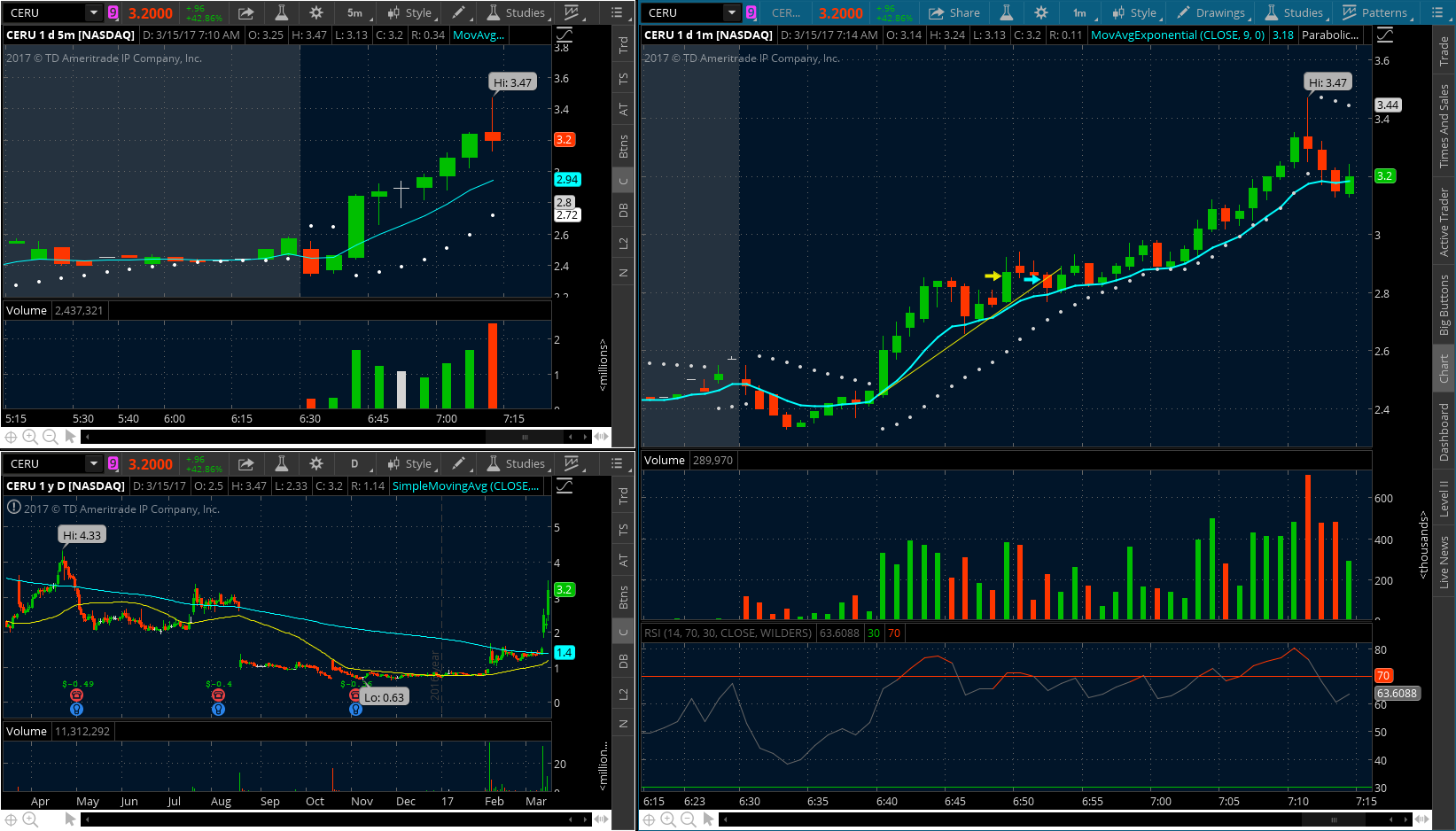

First off, hindsight is 20/20 and anybody could say $CERU was a play to hold until the low 3s, but with this current slow market and low performance on momo stocks, I kept my risk level pretty tight knowing there could be a crash right after. Perhaps my risk wasnt set properly. I was hoping anybody here could show me their proper risk level based on the entry i had (yellow arrow. exit was the blue arrow).

I set a trendline and my stop was the break of the trendline. Where should I put my stop the next time this kind of play comes around? The 9ema is always suggested, but sometimes the price is too far from the ema for me to handle (risk is too large).

I set a trendline and my stop was the break of the trendline. Where should I put my stop the next time this kind of play comes around? The 9ema is always suggested, but sometimes the price is too far from the ema for me to handle (risk is too large).

Posted Mar 15, 17 10:42 PMbykenjiii16

Tickers

$CERU

thanks for the advice. a lot goes in my head during live trades. and yeah I thought this was overextended as well, but the 9ema was hugging the chart pretty well and the market favors this pattern currently so I gotta take that into account as well

I use an 11 EMA. Its a personal preferance.

Trend lines can be helpful, but i think its more important to recognize the hi's & lo's, when you got out, the chart was still making higher highs, and higher lows, i find key support and resistance levels to be far more reliable than EMA's, you could use ema's but consider them after sup. and res.

Those higher highs and higher lows is a pretty good indicator...I probably would wait for it to prove itself in a clear downtrend...but, you are trading scared, and that's hi on Tim's 'plan' if you will. I'm still quite new, but that's what stands out to me.

Join now or log in to leave a comment