Exiting is probably the hardest part about trading. Being patient and letting winners run can have an emotional toll on a person who watches every tick.

When I see a profit, I like to take it. More often than not, I leave a tremendous amount of money on the table because I took profit too soon.

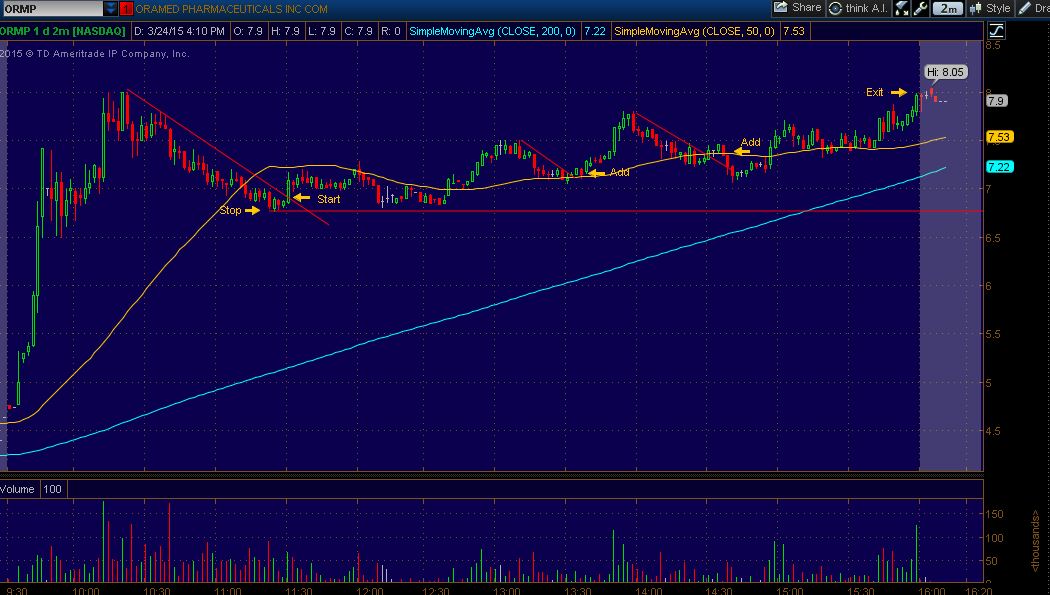

If you want a big winner, you have to let your money WORK for you. That's letting the chart do its thing and obeying your stops. When you have a winning trade and you ADDED at a higher low...move your stop to breakeven so it becomes a can't lose trade. Then leave it alone until the trend changes. If the stock hits your stop, its probably a good indication that the trend has changed or it wasn't going to be a big winner anyway.

Another way to get a big win is to take half off when you have a profit. Then move your stop to breakeven and let the stock work for you.

Breaking even is not losing. It's winning.

Cutting losses quick because you obeyed your initial stop is winning.

Averaging down on a losing trade is losing.

Here is a recap of the two stocks on yesterdays watchlist.

$RADA

$CNDO

Looks like both worked out nicely. $RADA was a small gain, and $CNDO had the AM washout and a red to green move for a continuation higher. PERFECT.

Here are 2 more examples of the ABCD with specific entry, stop, and exit:

This pattern works for pretty much all stocks over $1. Not so sure about OTCBB and pinks... Looks to be too whippy and illiquid for this chart to form in those exchanges.

Well, I think i've proven my point here. The pattern works really well. Good luck if you decide to trade this strategy.

Jollar

this is gold, thank you very much friend. this information is highly valuable. I'm going to suscribe to get uptades of your posts.

I don't average down and I don't average up. Its bad business.

Averaging up isn't bad. It can be dangerous if you dont obey your stops. The greatest trader ever "averaged up" https://goo.gl/yKPXGY

thank you also.

Join now or log in to leave a comment