Some after hours pricing is near where market left off on Friday but some numbers are just wildly different than market close. Are these market maker numbers? Where do the oddball numbers come from?

As an example:

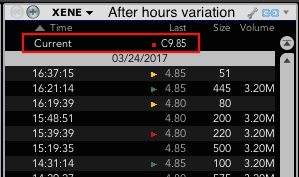

I am long on a bad sushi play with XENE that got crushed on Friday - dropped from $10 to $4.50 in one day on failed drug results. Held in consolidation with support at $4.50. I got in at $4.85. Over weekend the aftermarket price has varied wildly from 6.10 to now 9.85 - but I don't have any basis to understand what these numbers are or why they are so all-over-the place. Also if any credence can be placed in after hour numbers as I have seen them evaporate near market open.

Anyone have insights into wild after hour trading pricing?

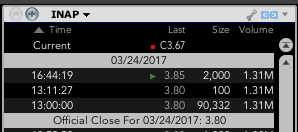

INAP after hours numbers look reasonable:

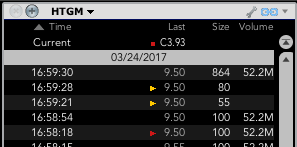

HTGM another not-even-close after hour number:

you can still trade after hours. Instead of the order type being "GTC" you would put it in at "EXT" for extended hours. Because volume drops off so significantly, the spread tends to widen. You'll notice hot stocks that are still trading a lot AH will have a tighter spread.

What you're seeing in the top picture is the last closing price which was 9.85 on 3/23

@Learnthings Thanks for your reply - I couldn't figure out what that number was! So no need to either get excited or freak out on a number that is old news. Thanks again.

Join now or log in to leave a comment