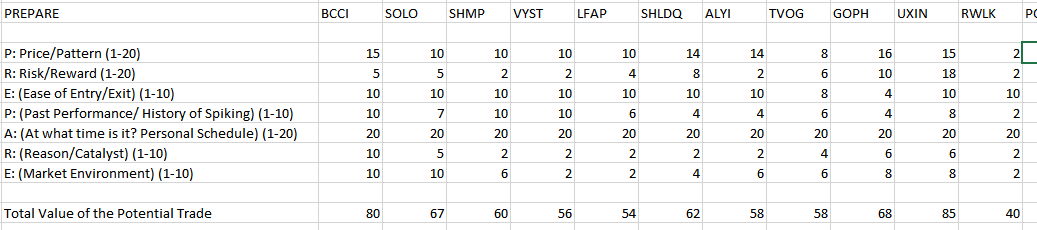

I'm getting ready to get real, so I'm giving myself one play today. Done a lot of digging and a lot of prep and I almost didn't play today because nothing was 80+ on my prepare chart. Then, BCCI dropped some news and the catalyst went to 10, making it an 80.

I was also considering buying the $SHLDQ bounce that I'm anticipating.

If $BCCI climbs and I can get in below .08, that's my play. I'm anticipating 50% gains, but I'll take 30%. I sincerely believe that it will spike like crazy today, but I'm neither greedy nor desperate, so I'll be out at the first twitch.

If $BCCI doesn't climb, I'll watch $SHLDQ for the drop. I'll buy if it gets down to .60 or so, sell for 30%. That's the plan. Here's my PREPARE.

UPDATE: I feel like such an idiot. $BCCI dropped hard and $SHLDQ climbed. Everything I thought would happen happened opposite.

So, what did I learn?

I was impatient. Instead of waiting to see something going on, I just jumped in. It looked like $BCCI was gapping up and I, like a pup running after a bird, chased it right off the cliff.

So what did I learn?

Don't hold. Don't hold. Don't fucking hold.

In at .067 and out at .052

I knew it was my one trade for the day and I wanted it to be successful so bad that I just held, held, held. What a fool I was!

What else did I learn?

Don't be attached to the outcome.

When you expect too much, your sour disappointment will turn against you when you face the truth. Build a thesis, wait for evidence, then act. REACT. Don't act. REACT.

So, yeah. Don't jump in the water until you know how deep it is.

What else did I learn?

I don't know shit about technical analysis.

God damn this hurts.

Okay. Back to the books.

hey bro wat are we learning at the thunderdome today :)

Reading "American Hedge Fund" again. Then, "Trading Foundations." If there's time, I'll start re-watching Trader Checklist. But, the woman wants to see Into the Spiderverse and I have a class at 6. So :/

Join now or log in to leave a comment