I will use this platform to take notes on my thoughts of the day. That being said:

Interesting first day just observing how things work. I found it to be a lot less stressful than I thought it would be.

What struck me the most was the information the admins in the chat came up with. I was impressed with how ahead of the curve they are as they were pulling news of random tickers while trading. Where do they get all this information form? Using the Trading Checklist, I was able to find $OTLK by myself the day before and I was pleased to know that it was one of the tickers the chat was trading, however, the other 8+ ticker I had using FINVIZ did not show up.

I then downloaded the trial version of STT and saw some of the tickers on % gainers that were also included in Tim's list and the chat. This was very cool, but as of today, I am limited in what I can do with the trial version (was not able to look at OTC plays).

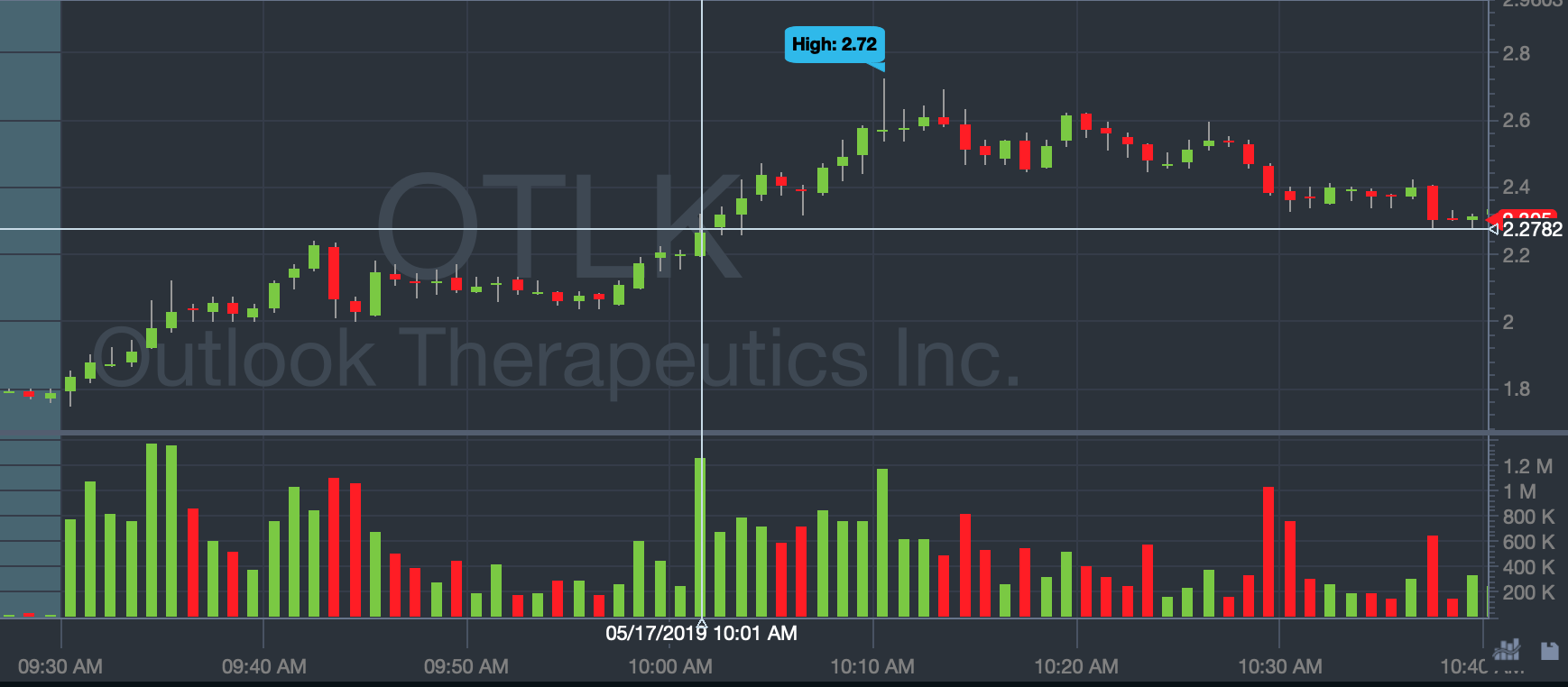

I've been watching most of the videos and throughout the play I noticed this entry point on the picture. I was not able to paper trade due to restrictions, but I wonder if it was a good entry point. The ticker had just opened, but I saw the trend making support around $2.11 and wondered if entering at $2.26 was the right move as it had broken previous resistance at $2.25. Then I would just ride the wave like 20-30 cents a share and pull out. My question is should one have an entry like that? Or is it a better habit to let the stock re-test that support in order to jump in after, possibly missing an action like the one shown?

Right or wrong it's easier said than done. Looking back, I'm not sure if I made my opinion while the play was live, or just after it had come and gone. Now I know that I have a lot to learn. The cool thing is that I am actually excited about it.

Buy into strength, sell into the spike. Don’t ever hold and hope. Cut loses quickly and study, study, study.

Join now or log in to leave a comment