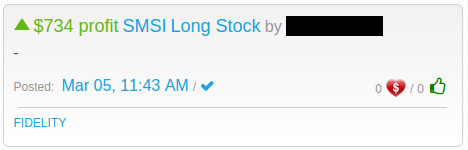

Dude, I just made $700 while sitting in that meeting!

I smiled as I looked up from my laptop. My colleague was ecstatic. He bought 3,000 shares of $SMSI at 1.50, and sold at 1.75 within the hour, locking in over 15% in gains. “Nice trade!”, I said. “Earnings season is alive and well!”

I had introduced my strategy to him, and had been sharing my watchlist every day for a few weeks now. We were both making a respectable corporate salary, and were looking for new ways to invest our disposable income. My research was paying off.

Three years earlier…

When I need quick money, I buy small cap stocks.

I was reading Rich Dad Poor Dad during a break at work, and I couldn’t get Robert Kiyosaki’s idea for quick money out of my head. The idea churned in my mind as he talked about buying the stock of small companies, and selling into the mania that typically followed an initial public offering.

The office was getting stuffy, so I decided to go for lunch and do some research on small cap stocks. I knew absolutely nothing about the stock market, but Robert made it sound easy. Simply buy low priced stocks that react to a solid catalyst (an IPO in his case).

It wasn’t long before the internet directed me to the blog of Timothy Sykes. He appeared to be the champion of the penny stock niche, so I signed up for his 7 free lessons to learn more.

I spent countless hours over the next two years going through Tim’s educational material trying to find a way to apply his experience and expertise to my lifestyle goals. I wanted to find a reliable system to make some extra cash, grow my net worth over time, and eventually leave my day job.

Present day

A system built for reliability, profitability, and convenience.

Over the last year I’ve been refining my personal trading strategy, and as you will read later in this series, a great deal of trial and error was required to make it to where I am today. I’ve simplified my system down to 6 basic steps, and the purpose of this series is to share with you a convenient solution that works. These steps are the same points I relayed to my colleague, and act as the fundamental structure of my overall strategy.

Hi Chris Could you please share your watch list for us too?Thanks in advance.

Sweet! I'm sure we could all use a little help, especially us newbies! I got into finance and eventually found Tim Sykes after reading Rich Dad, Poor Dad too, btw. :)

Good article. I'm enjoying reading your blog - thanks for sharing!

Hey @Bethany, I'll be putting my watches out on twitter when it starts to get busy again. I'm @2alive4925

Join now or log in to leave a comment