If you're like me, you have a account under 5k. This is the range I feel is probably the hardest to have and still be profitable due to commissions.

Getting the right # of shares is CRUCIAL to having a chance at profiting w/small accounts.

Tim Sykes' average % gain is currently only 6.85% per profit.ly stats, while Tim G's is only 5.71%

It's important you have the right $ amount put into each trade to get you around a 1% gain to breakeven. Small gains are going to happen, no one aims for just 5%, but its important fees don't kill your account when that occurs.

It's also difficult to find the happy medium between having positions large enough to beat fees, and having position sizes too large that will make your potential losses too great.

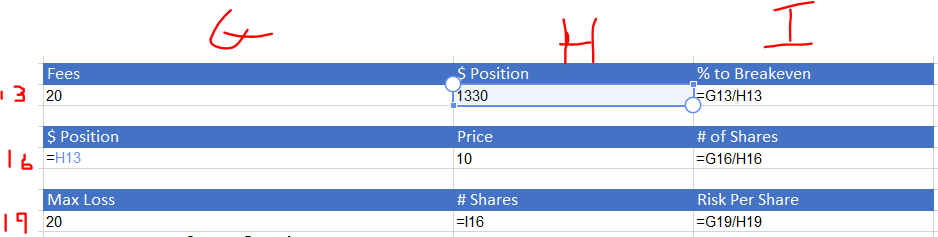

Below is an insert from my spreadsheet that I've built to auto calculate it for me (being quick counts!)

1st Row: Enter the fees your charged roundtrip, enter whatever $ pos you want as long as its around 1%, but I enter 1330 to return 1%.

2nd Row: Enter the price of the stock under 'price', this will give you the # of shares to buy to b/e with the % given in "% to breakeven" cell.

3rd Row: Type the most $ your willing to lose (NOT including fees) under "max loss", the "# shares" cell auto pulls the number given in the 2nd row's "# of shares" cell.

Finally, "risk per share" will tell you the most risk you can take PER SHARE, and not lose over the amount your willing to lose under "max loss", and still breakeven with a 1% gain.

This way you know how many shares of any price stock to buy and not have fees kill you, and know if, for example support is 15 cents away, but your max risk is only 10, that this trade would give you losses greater than your willing to take.

If you like what you see, check out Tim G's DVD where he explains concepts like this in detail at http://profit.ly/store

Keep in mind, this is in Excel so it's important to insert the correct formulas and reference the right cells. Don't just copy the formulas in the picture exactly if your stuff is in the A B and C columns

I think for small accounts, you have to size half or all of your account and only enter the best trade setups.

Join now or log in to leave a comment