February 2021 was my first month of trading with real money. Before that, I had been studying for 7 months every single day, watching video lessons and all the DVDs. At end of December 2020, I started to paper trade and made quite a bit of paper profits until the end of January 2021. So during that month of paper trading I finally got it into the game because before I was only watching videos not the markets. I finally started to put all the knowledge that I had into the practice, but I still knew that paper trading is not the same as real trading. Therefore, at the of January, I opened an Etrade account and put in $1,500. I only traded once in January, so I don't count it here in the February recap.

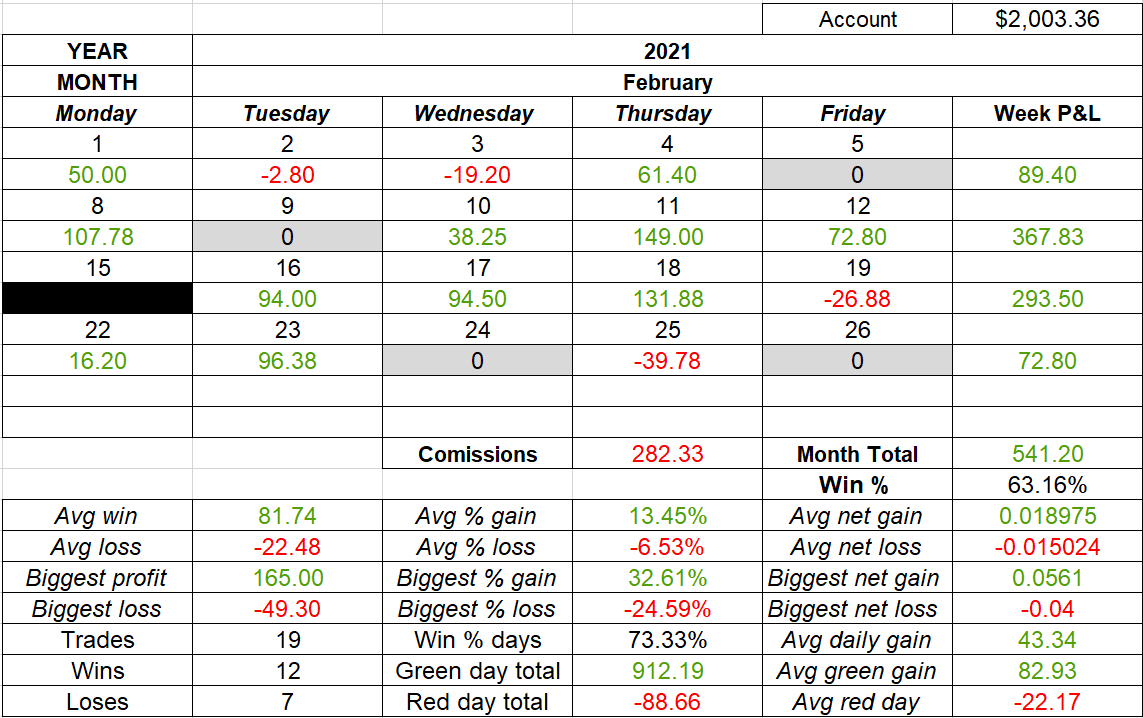

So in the February 2021 I made $541 with a 63% win rate. The average win is $66.35, and the average loss is $36.45. The average % gain is 13.36%, and the average % loss is 6.53% (just because of one stupid big % loss on a very small position, so without it, it would have been 3%). Biggest win is $145.2 on IMTL FGD overnight hold, and the biggest loss is $66.61 on BLSP FGD when I got scared and sold into the close, and it gapped up and morning spiked the next day. Overall I grew my account by 37%. During my trading I always tried to stick with the patterns that I know well and feel more comfortable with. My three favorite patterns are Morning panic dip buys, First green days, and Breakouts. So far I can say that morning panics dip buys is my most favorite, and I really feel that I understand the important aspects of it very well. My second favorite pattern is buying FGDs into the close for a gap up the next day. I've had my biggest $ and % gain on it, but lately they're not working well, so I will adapt to the market if needed. And finally breakouts are my least favorite because it's still a pattern that I'm trying to improve on and get more comfortable with it. However, right now I don't have a lot of trades to really be sure what's working for me and what's not, so I'm not assuming that these patterns will always be in this order, only time will show me what I'm good and bad at. Overall, everything is far beyond any of my expectations. I remember watching Tim Sykes's videos where he was talking about his students and how they were making money, and I never thought that I would actually be able to do the same thing. I was a complete newbie, I knew ZERO about the stock market, but now I'm here finishing my first month up $500. I can't thank Tim Sykes enough for everything!

During this month I learned many important lessons, and here are some:

1. The #1 rule is always cutting losses quickly but also intelligently. I'm very happy and proud that so far I've followed this rule every single time. I've never had trades when the stock broke my risk and I was still holding and hoping. I always follow my plan, so I'm trying to not get out at random price fluctuations, I wait patiently and when I see the actual weakness, I get out. This rule is so powerful, and that's why all my losses are very small in size and % vise (except of that one tiny trade), and my wins are way bigger in size and % vise. I will continue following this rule, as it is the most important aspect in my risk management.

2. ALWAYS have a clear defined risk and ALWAYS follow it so that you don't get out just due to random price fluctuations. My loss on BLSP is a great example, when I bought near the close for o/n, and I didn't have a risk which should have been the intraday support, and when the stock started to drop into the close, I sold while it held that support perfectly. So if I had my risk, I would have held and had a very nice profit the next day.

3. NEVER try to predict, react instead. Don't try to predict the breakout or the bounce as you are never hundred percent sure that you will be right. However, if you always react to the price action, you odds are getting way better and even though you might not have as big of a profit if you predicted, in the long run you will be better off. A great example is my loss on SIRC when I bought at $0.99 anticipating the breakout at $1. When I got in, it started to consolidate and then it pulled back to $0.95 and I sold. After that it came back, broke $1 and spiked quickly to $1.15. Then it held $1 support and got the high of $1.73. So instead of having a potential 20-50% (because I'd not hold to the high), I sold for a small loss.

4. ALWAYS lock in profits when the stock reaches your goals. Don't get greedy and think that the stock can go higher. As soon as the stock did what you wanted, you should either sell immediately or wait for the first sign of weakness and sell. You can never go broke by taking safe profits. Another example is my trade on BRLL. Even though it was a win, it was a bad trade. It was a panic dip buy. So, I waited patiently though the morning panic and had a great execution near the bottom at $0.299. It immediately started to bounce to the $0.32s and then for a minute it was at $0.33s and even hit $0.34. That was a perfect time to sell, but instead I got greedy and wanted more, I assumed that it could go near the r/g level at $0.38, However, $0.34 turned out to be the top, and it started to drop, but I was sticking to my risk at $0.29 and wanted see if it can spike back, but the problem was that I should have realized that the bounce was done, so I didn't need to stick to my risk when it was dropping, I should have exited as high as possible. It was gradually down trending, and I finally got frustrated and exited at $0.305. As a result, I turned a 10% gain into a 2% gain.

(Note: all my stats are based on my nominal PnL, not including commissions)

Now, it's time to focus on the next month and go into it with the right mindset and perspective. Always remember it's a marathon not a sprint! Good luck everybody!

Amazing job

Join now or log in to leave a comment