More than a year ago, I’ve posted a few tips to maximize the success rate in short-selling with TD Ameritrade. [ see post here How to short sell with TD Ameritrade 2015 Update: A Guide to maximize fills to your short sell order ]

Since then, I’ve discovered a few more tricks that will help you short-selling with TD Ameritrade. The most helpful one would definitely be adding a tab to show short-sell avalliability of each individual stock on Thinkorswim platform. You won’t regret it. So please read on.

First of all, why are there less stocks available for short-sell at TD Ameritrade? Upon a discussion with their trade team, they stated that one of TD Ameritrade’s mission is to protect their clients’ capital by reducing the risks of their investments. Therefore, they must keep their clients away from the investments that are marked high-risk, that includes short-selling TOC and other low-float equities.

Therefore, there’s no short-selling to stocks that are on TOC or Bulletin-board.

Second, as noted in my older post, Thinkorswim is the platform you want to place your short-sell orders on, simply because it garners all the stocks that are available for short-selling compare to their web platform and the TD Amritarde Trade Architect platform. So some stocks shown as no borrow on the web platform and no borrow on the TD Amritarde Trade Architect platform can be located on Thinkeorswim platform.

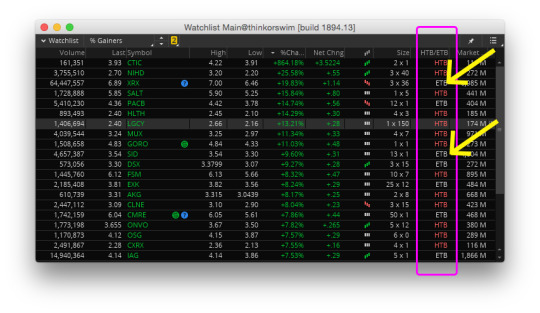

Most importantly, you can add a column on any of the watchlist gadget in Thinkorswim to show whether a stock in your watchlist is available for borrow, as ETB, aka easy to borrow. Or HTB, hard to borrow.

Now this is a big step up from checking through putting an short-sell order to see if the order goes through. And the ETB/HTB tab updates the status of short-sell availability constantly. So a lot of time you will see a stock goes from ETB to HTB as the short-sell inventory decreases through out the trading day.

Here’s how the HTB/ETB tab can be added.

Step one, make sure you have a watchlist gadget on your sidebar. If not, you may add it by clicking the plus “+” sign at the left bottom corner of your TOS, Thinkorswim, interface. See below⬇️.

Once clicked, you’ll get a panel and you can now click the watchlist tab to add that gadget. ⬇️

Once your watchlist is in place, you can now click the “setting gear” located on the top right corner of the watchlist panel to bring out the customize window ⬇️.

Click on the drop-down tab 🔽 to bring out this list. And you’ll see this ⬇️. Choose Stock Fundamentals. Then select the “HTB/ETB” from the list.

Or simply type in “HTB/ETB” in the field. Then click on the suggested item “HTB/ETB” from the list.

Once the “ETB/HTB” option is highlighted/selected. Then click the “Add Item(s)>>” button below the list panel. Then the green “OK” button to save it.

Now you have it. The column with “HTB/ETB” indicator following each stock entry in your watchlist. You have to repeat this procedure if you want to add this option to all your watchlists.

Now simply add the stock you’re looking to short to this watchlist by typing in the ticker in the bottom field of the watchlist panel. The “HTB/ETB” column will indicate, whether it’s ETB, HTB, NTB or empty.

Don’t forget that you may call customer service to find out if the HTB items can be located, ideally in the morning or at night before the trading day starts.

That’s it for now as of January 03, 2017. Happy trading, guys.

P.S.

What are the reasons that traders stick with TD Ameritrade?

For most, it charges a flat fee of $9.99 on all trades. And it sure is an advantage if you trade low-priced OTC stocks by the millions. Another one would be they offer commission-free trade for two-month if you join with account size of $3000+ See here. Thinkorswim is the best custom scanner I’ve used. It is free once y

@Graceunderprsur You're welcome!

Nice...that'll help a lot! Thanks....

Just an FYI when I followed this guide, my TOS didn't have fundamentals listed. Instead I just typed in "HT" in the search and it came up.

Thanks for letting us know

Join now or log in to leave a comment