This was in no way shape or form a big win as far as profits are conserned however it was probably one of my most thought out and well exectued trades I've had. Here are some of my key thought before taking the trade and my goals for exiting my trade.

"AVGR was the ticker pre-market that had the most volume and trades, it spiked at the open and pulled back until around 10:30am where it started finding support in the $1.70s and the rest of the day it stair stepped back towards it's highs.

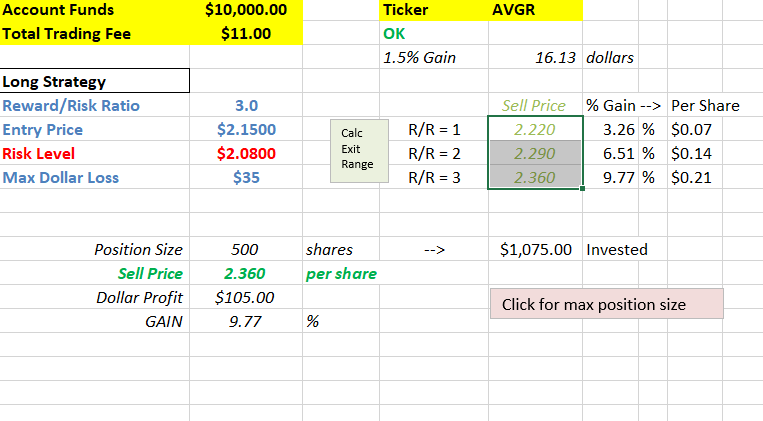

I was watching the price action for an afternoon HOD break out but my plan was to ONLY execute my order IF the volume spike at the $2.20 HOD BO was higher then all the previous spikes and after the spike I wanted to see low volume on the selling/short pressure and that is exactly what I saw at 1:38pm. I waited for a pull back to $2.10 area with a risk off $2.08. As soon as the pullback came I executed my buy and watched the price action trend up and down but still holding $2.15 where it finally pushed to the SMA50 and squeezed higher!

My Goal was to take profits at $2.36 3/1 risk reward in this case knowing that while it might push higher due to the massive amount of volume today I saw $2.50 as long term overhead resistance so I locked in profits for a nice 9.9% win.

It's nice to see a trade come together when you have a plan, stay patient and follow your plan when the opportunity shows itself.

Cheers

Very nice trade! In terms of highest volume at breakout, that negating the fact that some volume bars at the open had even higher volume, right? Usually the morning bars have tremendous volume and breakouts later in the day have high volume spike (but not quite as high as some of the mornig bars).

thank you. I will have to look back at my saved charts to take note of what the volume bars looked like in the morning in comparison to the HOD break volume bar. I mainly look to see if the volume spike is stronger as it pushes towards the HOD and at the HOD break.

Gotcha!

Join now or log in to leave a comment