2/2 Green trades to start off this journey & July the first a short on DRYS and the second a long on CLSN. I've made a quick recap on today which you can find here (or at the bottom of this post)

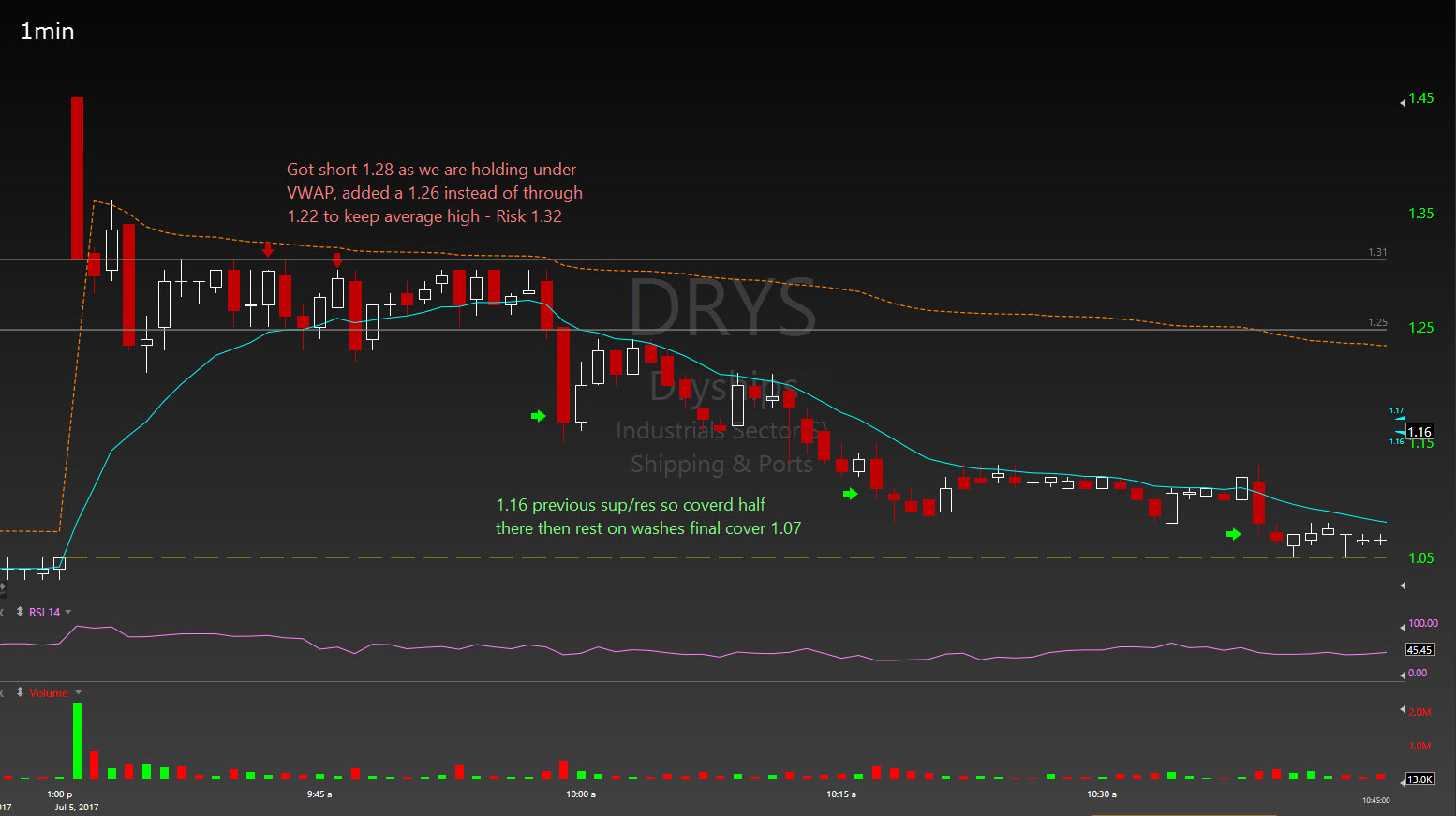

On my first trade I was looking for DRYS to hold below VWAP for a while and a short entry. I got a 1.27 average and covered on the washes down to 1.07

The second trade I caught CLSN's short squeeze as we got back over VWAP, entry 2.69, probably should have taken bigger size on this but was a bit rushed as DRYS was washing out at the time of entry. Covered my first piece on the initial move and the rest a bit early but in the end at a good price for an average of 2.85.

Really happy with these two trades, I did miss the short side on CLSN and a potential short on MSDI but happy to lock in a nice green day, +6% on the account :)

entry to follow them, or plan where they will stop out and catch the squeeze. I only really hold trades for a small ammount of tiem, if they don't work quick the setup hasn't worked for me. I tried to swing but find low volume stocks over a few days can screw you over on quick washes or spikes

Good deal! I would love to get better at playing the short squeezes on stocks that seem to be manipulated at the time. I think I have been looking at a lot of spikes the wrong way (they were actually squeezes and safer to play vs just support/resistance levels).

@wannabestocktrader The great thing about short Squeezes is that the risk is often really small as they aren't too volitile if they fake out, they just kinda trickle so you can take big size without fear of slippage, but the upside is HUGE! :D I have three main setups and the most profitable is definately looking like short squeezes

Nice trades - keep up The good work!!:)

Join now or log in to leave a comment