Hi Everyone, hope your own trading journeys are going well!

I started trading back in November last year and have since mostly lost with 5 losing months and the other 3 being spent paper trading. I think this is a fairly common thing for new traders - get stuck in get burnt, take some time to improve away from the fire, jump back in.... get burnt again and repeat! The end of last month however I began finding a lot more success and feel I'm in a fairly similar position to Stephen Johnson who is close himself to being profitable and who's journey has been great to watch!

Today I'm starting this blog currently down something like $4,000 (I stopped posting all my trades on here after how bad it made me feel! But kept records of my own for lessons) and hope that I will be in the green by the end of the year! I'll list the lessons I've learnt so far to hopefully help anyone just starting out avoid them and will try to add a new blog each week going over the trades/lessons I've learnt.

Lessons:

1. Start REALLY small and be ready to lose it all!

The biggest mistake I made early on was putting almost my entire account set aside for trading into a trading account. I would risk around $40 on a trade and by the end of month one was down well over $1,000 which was a huge amount of money for me to lose. I expected to be able to jump in and win fairly early on and this was foolish! If I was starting again I would only invest 20% of my trading funds into an account and risk $5-$10 on each trade until I had consistant profit. Stage one of trading is SURVIVAL and if you can last the first 6 months having only lost 50% of your initial account set aside for trading you've done really well! You will have also most likely made most of that back through your main income (assuming you have one!) and the stress levels with trading and life will be much lower than mine were!

2. Track everything!

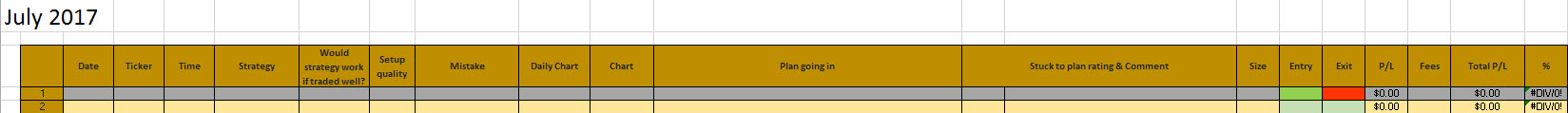

This is crucial and something and something I have been pretty good at from the start but have also improved on massively over the past few months. This is a picture of what my tracking sheet looks like and it is a huge help in finding mistakes and what you are doing well:

I also have sheets tracking any trades I missed that suit my strategies to keep data on how well my strategies perform and find any key parts of charts that may increase the likelihood of them working out.

3. Trade as little as possible!

When starting out it is super easy to get caught up in the mania and try and catch everything that is running and follow everyone's alerts.... don't! the key to survival in the early days and building an account in the future is to take as few trades as possible and make them all high quality setups. I now have a target going into every day to try and take just one trade on one great setup, lock in a nice gain and call it for the day! If you have an account of $1,500 and lock in just one $30 gain on one perfect setup per day you make 10% in a week. $150 doesn't sound like much but x10 on a $15,000 account and you're earning more than most of the people you know!

4. Patience!!!

Probably the most difficult lesson to follow as entering a trade is so easy and it's easy to fall into a FOMO trap when you see a stock starting to make a move. Remember, if we are only taking one trade we want it to be perfect and being disciplined enough to wait for that one setup and one perfect trade is what separates the winners from the losers in my opinion. I personally suck at trying to trade momentum off the open and I think there are very very few people who are, especially newbies trying to follow a chatroom hype! Wait for the easy, gimmie trades lock one in and walk away (far easier said than done!).

5. Don't follow the chatroom hype

I've been a member of 3 different chatrooms and the biggest trap you can fall into is trying to follow and alert or someone else's trade. Before entering a trade you MUST know their plan, their entry price, their size and relative size to their account and why they are in the trade if you can't answer those questions you are shooting in the dark and can be in pretty big danger. Also be aware that anyone can be in a chat room and anyone can post a trade, they could even be waiting for longs to be trapped to short or just simply a losing degenerate who posts a new trade idea every 10 minutes! Have your own strategy, understand the main strategies used in the room you are in and if they differ massively get out and find a new one.

Hopefully that is somewhat helpful to anyone just starting out or in a similar rut to the one I found myself in a few months in! Looking forward to updating this journey regularly!

good read. thanks. i think of similar things but don't track my trades well or put into words what i think very well. after 6 months of losing about 65% of my account i'm looking for that turning point with dip buying trades. again thanks for the post.

thanks for sharing....keep up the good work

@Solokat I think that tracking my trades and my favourite patterns is probably my biggest weapon right now, once I have big enough sample I'm able to really quickly see which strategies work and which ones work which i simply don't trade well haha!

Join now or log in to leave a comment