Welp, not the way I wanted to start off the month of March. Fridays are special indeed and although there have been plenty of solid short opportunities on Fridays, it it certainly one of the most dangerous days of the week.

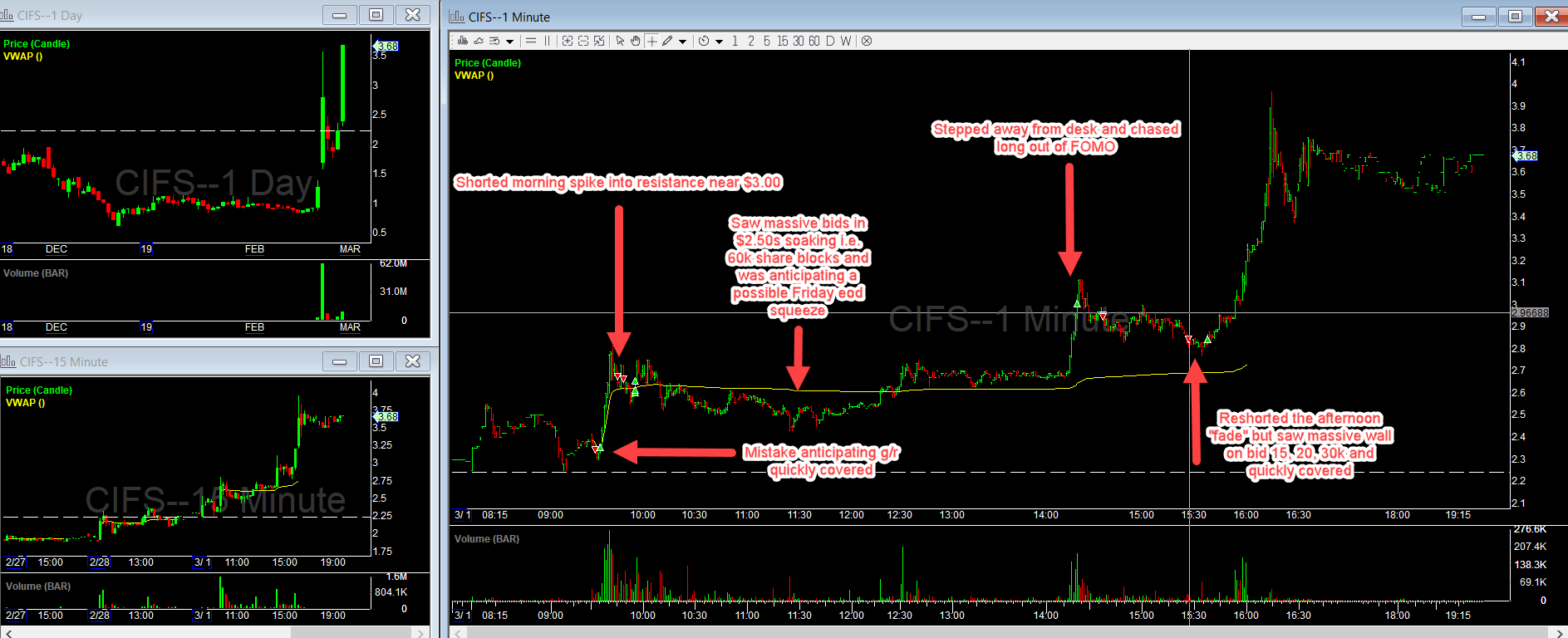

Knowing this, I knew I had to play this safely. The ticker has been "stair-stepping" for several days despite fading volume and actually had a solid base in the 1.90 range for a few days. I pondered the possibility of a long for a Friday squeeze if it could get volume in the morning. However, when the market opened, it started to fade near g/r and the volume was very light.

I took a starter short anticipating g/r snap which was mistake #1. I should have waited for the snap. When I saw some bids stack, I quickly cut for about a $20 loss. No biggee. It didn't do what I wanted so I got out. Had I had some foresight, I should have recognized this failure to go g/r and taken a long. I'm still working on the ability to flip but this will require more experience.

I got distracted by $BPTH since it was on my watch list after the a/h PR from yesterday. I had little expectations on this ramping the way it did and was a little frustrated I played another sub-par ticker in $CIFS and missed $BPTH. I let some emotion get to me and I wanted to "get even" with $CIFS for "making me" miss $BPTH.

I actually had a decent short near the hod on the morning spike in the 2.70s which was what my original plan was. The first big volume green day closed at 2.80s so my short seemed ideal and I had .10 risk. So I was happy that it seemed to finally be playing out. But the ticker failed to have any hard cracks so I covered again. I didn't necessarily have to since a slow fade to the $2.50s would have been profitable, but again, it didn't do what I wanted so I cut the trade for a small profit and b/e at this point.

The stock consolidated in the 2.50s for most of the afternoon. This is where it got interesting. I saw several large bids on Level 2 such as 60k, 40k, etc. All of these got eaten but the 2.50s held. For 1 1/2 hours it consolidated on low volume in the 2.70s after reclaiming VWAP. Then "pop". A quick squeeze to $3.00 area.

I actually had to step away from my desk about 2 minutes prior to the pop and when I came back, I was fucking pissed. The squeeze I was waiting all day for just happened and I missed it.

Mistake #2- Trading out of FOMO I ended up going long a small position near 3.00 since I had seen so damn many short squeezes over the last year and missed every fuckin one of them because I was always afraid to chase. And after the pullback to the 2.80s I realized why I shouldn't be chasing this shit. I cut this long for a loss as well.

Now we're at power hour. The clue should have been in the words "power" and "hour". I'm the FNG (fuckin new guy), but even I know better than to take a speculative short on a Friday...in FUCKING POWER HOUR!!!!!

So it looked like the key 2.80 area was going to crack as a 15k bidder got taken and low and behold, several 15, 14 and 12k bids popped up as soon as I took the short to prop it up. Now I knew for sure that was going on was a deliberate short squeeze on a low float stock by some big wallets.

But having no testicles and already being wrong on this ticker several times throughout the day, I threw in the towel and chalked it up to an educational experience and knew that it could have been a several grand day loss had I not followed Rule #1

I hope this helps anyone who wants to recognize what a short trap is and some other key tips I think I need to remember myself

#1-Don't anticipate g/r or r/g snaps...wait for them to happen

#2-Don't be afraid to flip the trade as long as you already know the key support/resistance and risk/reward levels ahead of time. I knew 2.80 was key level where it closed on first big green day and this was about .50 of upside potential. Now adjust risk to g/r again.

#3- When the trade doesn't do EXACTLY what you want...GTFO

#4- Study Level 2 Take note of large size on the bid or the ask

#5- Never trade out of revenge or FOMO. We all know NOT to do it. But we all do it. Stop doing it

#6 - Don't gamble. Everyone wants a big score. Being long a short squeeze could be fun (I didn't say IS fun cuz I've never been long on one lmao). But it's not the way to build long term wealth

#7- Always always always always always CUT YOUR LOSSES QUICKLY. When in doubt, get the fuck out! My $220 loss could have been several grand. Don't be stubborn. Trade scared. One trade will never make you rich, but it sure as hell can wipe you out (and then some).

Great post! Thanks for writing this.

You bet! It helps me to learn from my own mistakes as well

Excellent discipline to follow the #1 rule

Rob, this is super helpful. I'm focusing on a few of these lessons right now, so thank you for sharing your experience as a reflection piece. Mostly, I appreciate your candidness: I'm the FNG (fuckin new guy), but even I know better than to take a speculative short on a Friday...in FUCKING POWER HOUR!!!!! I support your awareness and discipline. Can't wait for it to prove big for you soon!

Join now or log in to leave a comment