Webinar found here

Mark Crook's video lesson on MYSZ here

Syke's watchlist here

Main Ones

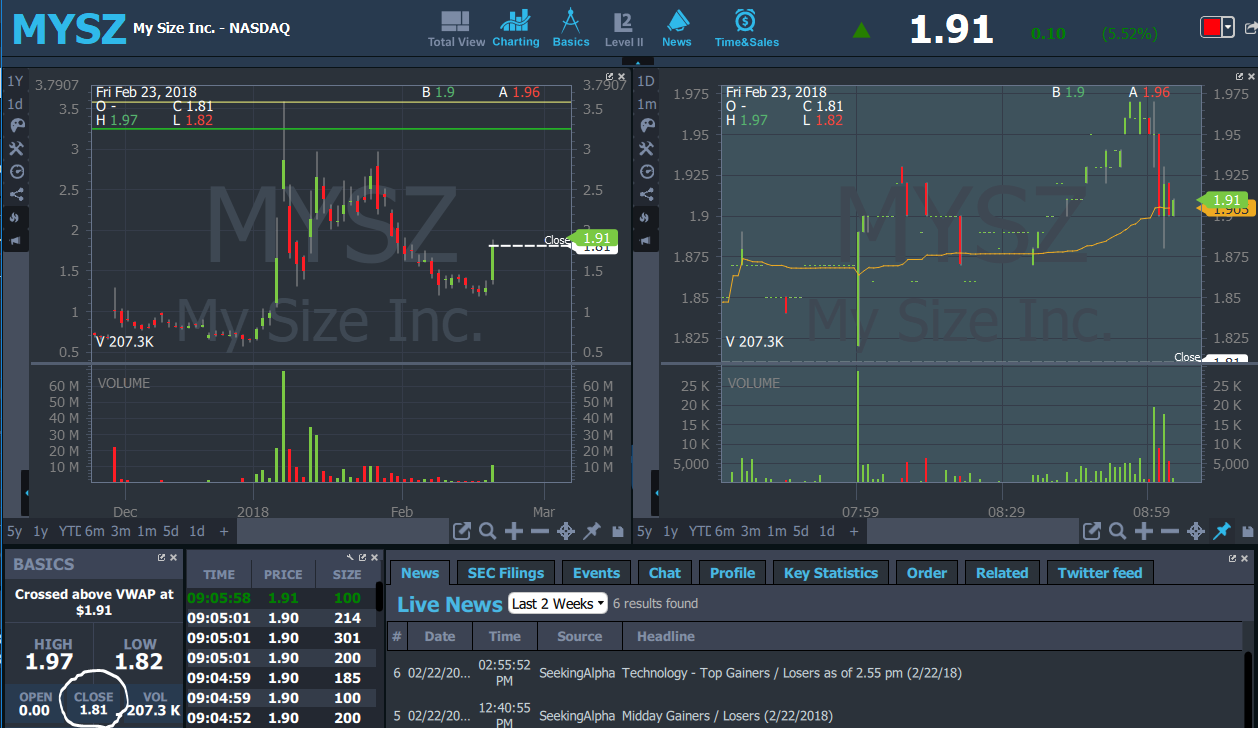

MYSZ - gaping up nicely. If it dips back down towards 1.81 I may consider dip buying it and using that as risk. (1)

POTN - gaping up ever so slightly but on very little volume. Nothing too exciting so far. Looking for dip buys but very speculative. (2)

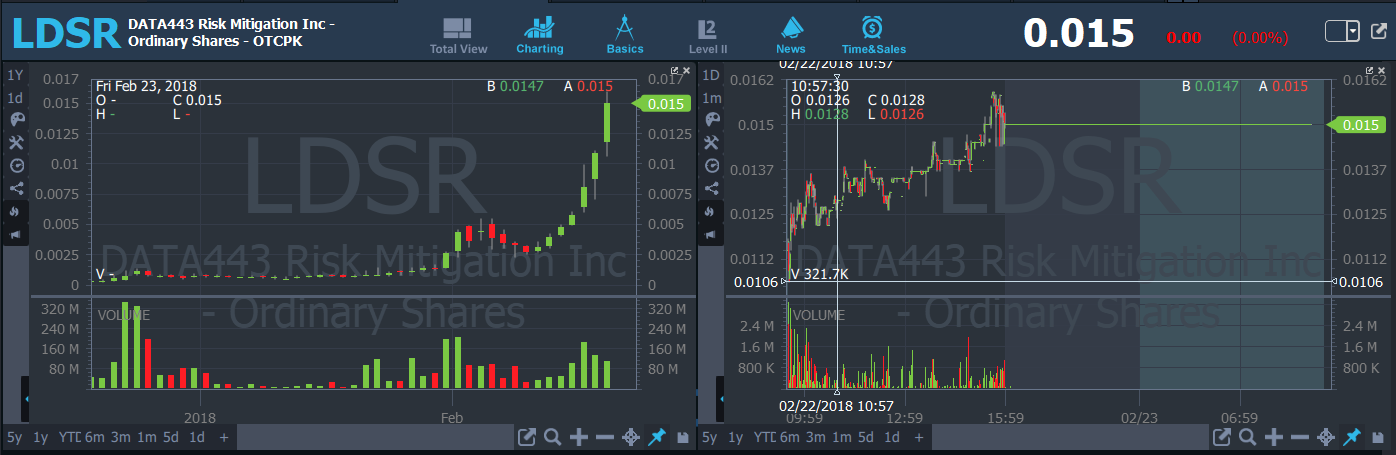

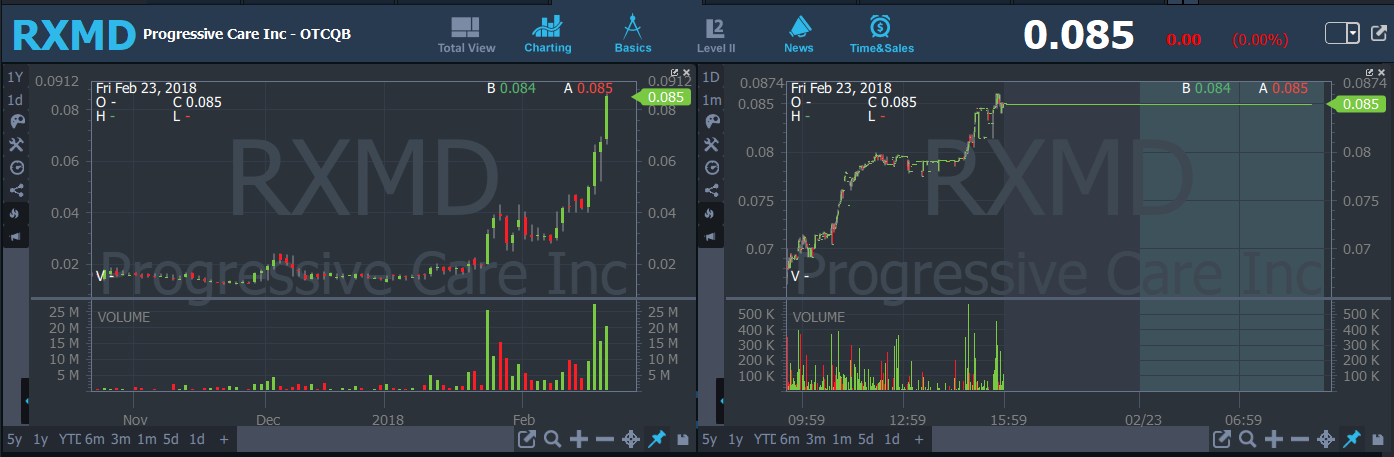

LDSR & RXMD - pump charts that I'm not looking to play just yet. Instead I want more volume coming in and for them to run much higher. (3-4)

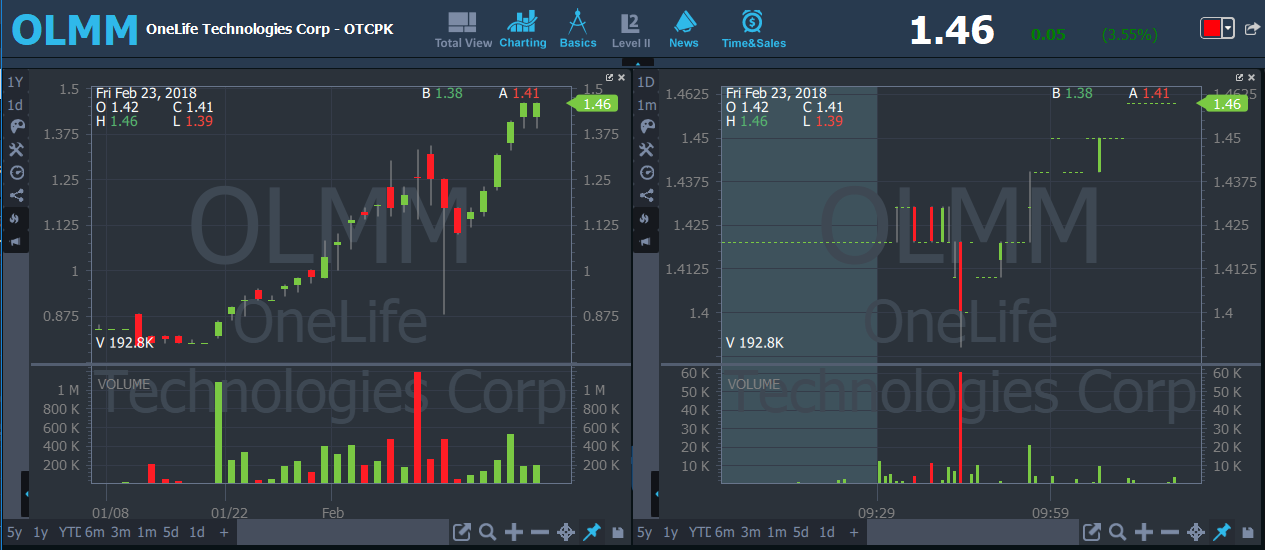

OLMM

10:21PM - pump looking chart. No play now but keeping an eye on it. Ideally it keeps on running more and more next week. (5)

MYSZ

2:06PM - had a nice morning spike as expected and I am glad that I learned from this patter yesterday and into this morning. I definitely see and understand why it spiked. Next time I will be ready to execute. Then later in the day I noticed that this was reversing and took a short position on paper @ 2.06 with only 450 shares risking the 2.10 that looked like key resistance. It did drop down to the 1.80s and I didn't take profits and then it bounced up to the 2ish but I still thought that this had more downside. It did reject nicely off of 2 resistance so I am now moving my risk down to that level. Looking to cover into a break below the 1.86ish level. Definitely not holding over the weekend because the CEO will be on FOX and what happens is unpredictable. Low odds play there. (6-8)

3:08PM - breaking down pretty well and has finally gone red and that is were I covered all 450 @ 1.78 for a $111.92 paper gain. I doubt this bounces much and probably fades lower but I got my solid win and wanted to get out and not get too greedy. Currently trying to come back green but struggling. (9)

Hey are you a trading challenge student?? Hmu victormanuelcervantes1@gmail.com

@RookieTrader1 I sent you a message on profit.ly

Join now or log in to leave a comment