$CNAT

Support - has virtually zero long term and mid term support/resistance however, short term it has quite a bit of support around the 4.35-4.40 range. Same goes for resistance around 5.20 with 1 fake outs + the morning spike. If it were to fall it could fall to low-3s as a high and mid-2s as a low. If it spikes up it should be quickly and not hold however if it rises slowly expect something around 5.6-5.9.

Catalyst / Pattern - CNAT did have news of a collaboration which seems to have risen it from the slump it was in however, I do not see any discernible pattern besides a slight staircase mid-day. Depending on how important and valuable this news will be or has been in the past for other companies will determine where the stock goes from here.

Enter/Exit - The stock is trading 75k-150k every minute across the board, I would suggest under 5,000 Shares to exit quit quickly if things turn for the worst, max of 10,000 if you're feeling it

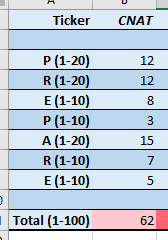

Summary - At this stage I would not suggest playing this stock until it develops further and a clearer/more certain path appears. CNAT scored a 62 on Tim's PREPARE scale, not even meeting the 71+ requirement I set. The score I gave this stock does reflect what my current knowledge of the market and contract winners is at.

This is my first public diagnosis of a stock, tell me if I'm wrong in some areas or what you think the stock will do vs. what I said it would.

Very good analysis and information. May i ask why did you put 5 for the market environment?

@khalomani For things I don't know much about or don't have much to standon for an argument I tried to take a neutral stance. I know very little about the current market environment or how to rate it so I tried to give it a neutral rating

Thanks for clarifying. Good luck

Good analysis and insight.. Thanks

Join now or log in to leave a comment