So often we see a dividing line between an "investor" and a "trader", where an investor intends on making money from a stock long-term (a few months to years), whereas a trader (or "speculator" as they are sometimes derisively referred to) intends on making profit from a stock in the short term (usually in the space of a few seconds to a few hours or a couple of days max).

The main benefit often touted for long-term investing is that it allows for much greater profits in a more stable, safer, and predictable manner, whereas the main benefit of trading is quick profits.

However, an issue that i see with investing is that you don't get to capitalize on the dips on the way up that a trader normally takes advantage of, thus you end up missing a lot of possibilities for profits.

Example of this flaw:

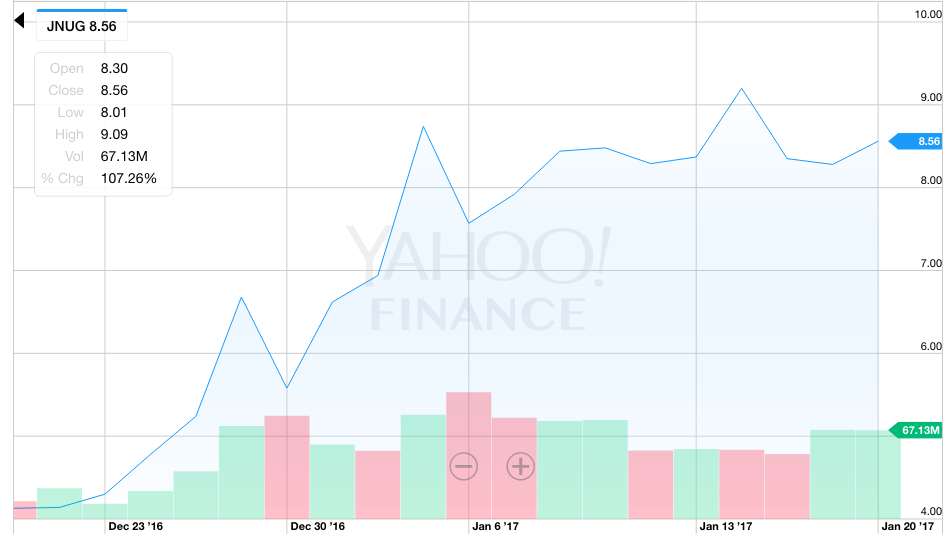

So for example, this is a recent chart for JNUG, which i have been trading in and out of very frequently the past month:

(click to enlarge)

So during this time, i was very bullish with gold and first got in JNUG at 6.37 with 305 shares.

Now, let's say today i believe that gold is starting to fizzle out so i sell my shares at 8.50, meaning that my profit (without commission) would be $649.65.

What i ended up doing in reality is buying and selling JNUG many times during this same period, after already having done my DD and concluded that gold and thus JNUG would continue to rise and ended up profiting $1,011 from JNUG thank God (unfortunately my lack of cutting losses quickly really messed me up with some of my other stocks), using many different position sizes (usually only 100 or 200 shares) and also trading several different other stocks as well.

So i looked at a stock that i concluded would be a good investment, but rather than just holding the whole time, got in and out of the stock depending on its momentum and whether it was at its highs or its lows on its way up, and found it to be way more profitable than just holding the whole time. Additionally, i was also free to make other trades as well, thus potentially raising my profit further (unfortunately i played some of those pretty bad but that's my fault).

And actually even looking at an intraday chart:

(click to enlarge)

I was very bullish on this going up because of the inauguration but unfortunately because of the PDT rule was only able to make 1 trade with this. So i bought 840 shares at 8.10 the day before at sold at 8.60 for a profit of $420, thank God.

But had i had the ability to buy and sell several times in the same day (rather than just riding it up one time), i could have done the following:

in 8.10, out 8.30, profit = $168

in 8.20, out at 8.50, profit = $252

in 8.30, out at 8.60, profit = $252

in 8.63, out at 9, profit = $310.80

(all 840 shares each time)

Total profit: $982.80, around double than what i got for trading it just one time going up.

Summary:

So hopefully this shows that a good strategy to employ is to combine both value investing as well as daytrading. So look for a stock that you see going up for the next few months and rather than just holding onto it for the whole time, simply trade it in and out, going in when the price is going up, and getting out when the price is consolidating or finding support.

What do you all think?

(and for those who say that you shouldn't invest in JNUG in the first place because of decay, etc etc etc, i know; this is just an example, but the same principles apply to AMZN or whatever stock you choose)

Yea that's why it seems beneficial to me to combine both approaches. Identify a long-term play that you see going up, but trade in and out of it on its way up

Yes , maybe the gains are smaller on long term chart but is more predictable . End result in and out higher profits

Assuming you are in the US, you should consider also consider the tax rate for these profits versus long-term investing. http://www.investopedia.com/articles/personal-finance/101515/comparing-longterm-vs-shortterm-capital-gain-tax-rates.asp

Thank you . I will take the tax variable into consideration

Join now or log in to leave a comment