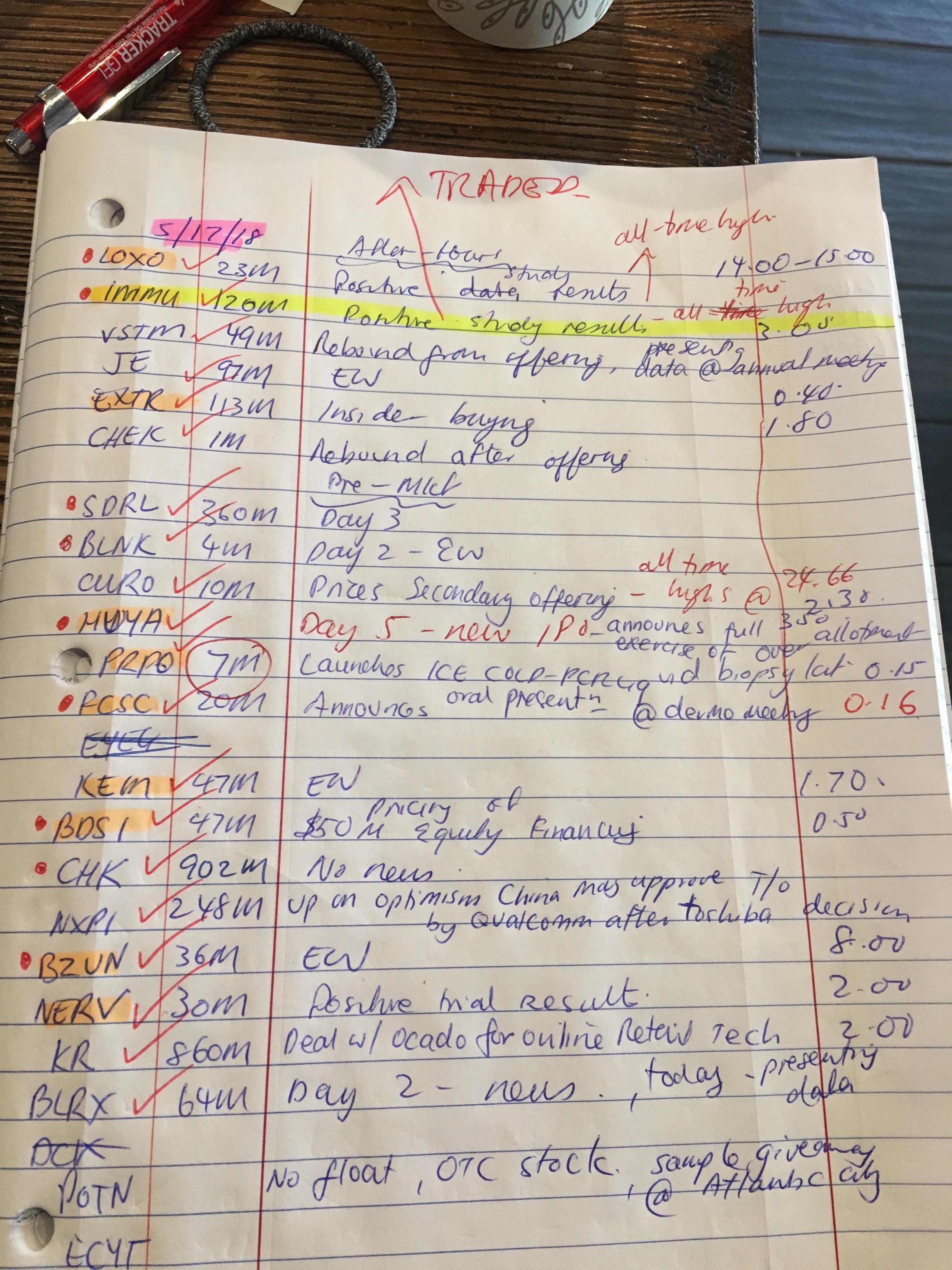

This morning I sent a watchlist of 4 stocks $IMMU, $BZUN, $FCSC and $LOXO. I traded $IMMU and made 34c/share and the other 3 made decent moves. From my full watchlist below, the ones I highlighted were the ones I was looking at pre-market which were then narrowed down to the 4 stocks. The ones with red dots means these were the ones that actually made moves at the open. I'm at my computer 1.5 hours before the open and it takes me about an hour to do my morning watchlist. At the end of the day I go through every stock on the list and especially the ones with red dots. People also underestimate pre-mkt action. It might not tell you exactly what it's going to do at the open but it gives you a rough idea which direction it will go. Anyway just being super prepared in the morning and going through the charts at the end of the day has helped me improve my accuracy. I think I'm at point where I know what to do but will I be prepared to capture the move? This has also helped me with fomo. I realize I only fomo'd traded before because I didn't know what patterns to trade but when you know exactly what to trade you can easily spot a bad setup and avoid it altogether so it decreases fomo and random trading. Anyway hope this helps some of you who are wondering how to improve your routine/process.

I like dip buying I'm hopeless at buying breakouts. I trade the first 30 minutes of the day and try to buy the first or second dip on the 1 minute chart.

Thanks for Sharing this. How do you identify the candle for dip buying? You are looking one day before and then decide or how?

@Henry263 I look at multiple time frames like 1, 5, 30 days and 1 year. But I focus more on intraday pre-mkt support and resistance after I've aligned it with other time frames. If you look at my last trade post on $IMMU, it was at all-times so I had no daily chart to align it with so I use the pre-mkt chart to find support and resistance and bought the first dip and 2nd break at the open.

@Henry263 Sorry I meant the stock was at all-time highs so there was no support and resistance to look at on the daily.

Join now or log in to leave a comment