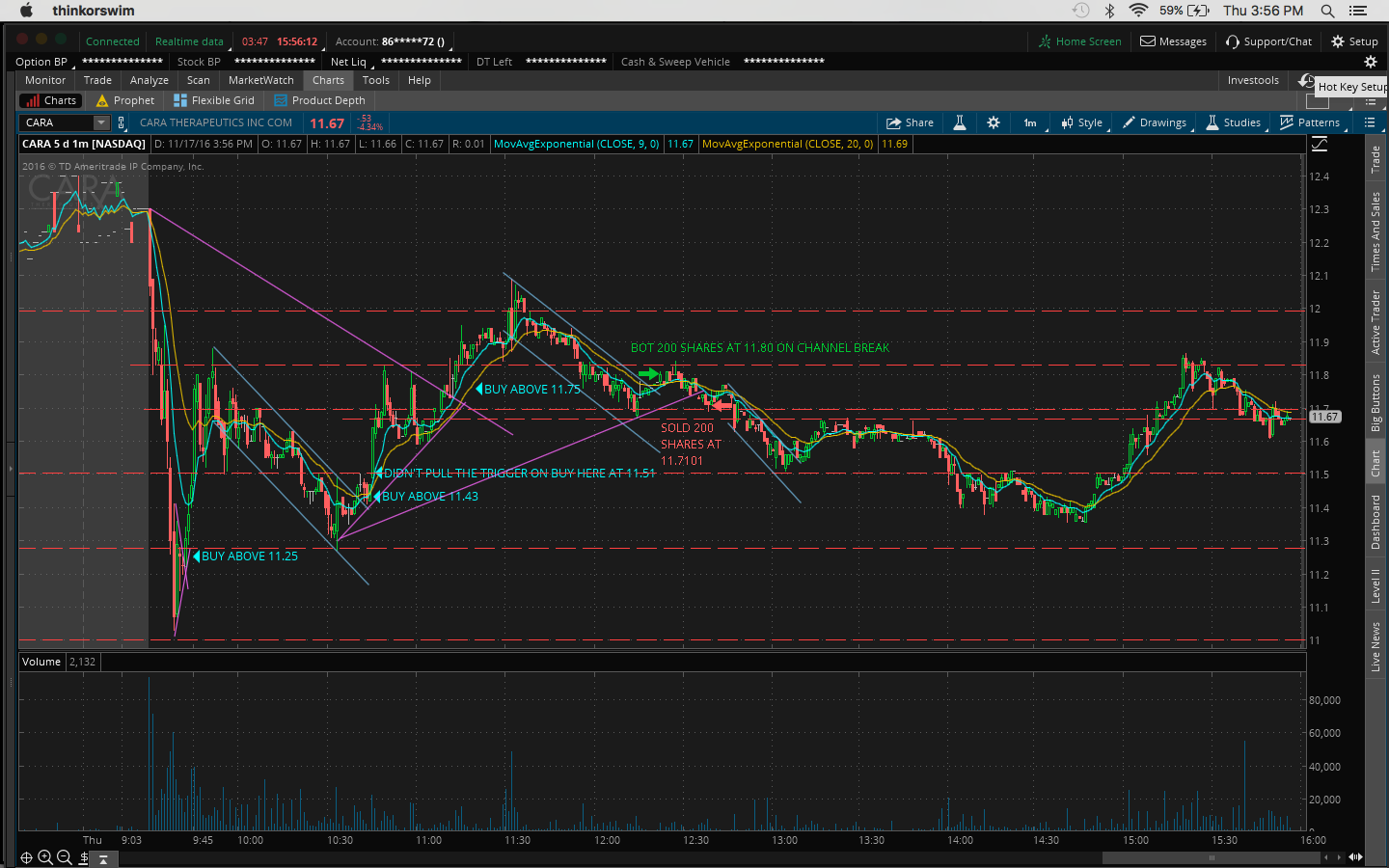

Today I bought 200 shares of $CARA after midday at 11.80 when it broke the channel. I basically caught the dead cat bounce so I shouldn't have bought it:

1. because it's the first red day.

2. when the stock is red on the day, if there are bounces it usually happens earlier in the morning before 11AM.

3. If a stock is red on the day but it's been red a few days already then it can come back which means a midday breakout will work but not on the first red day like today.

4. There was a bit of fomo going into the trade because I hesitated on a morning buy at 10:45AM at 11.51 when it broke the channel at 11.43 and resistance at 11.50 which would've been a nice 60c/share profit.

The second stock I played was $CYCC. I was really happy with this trade because I didn't let the previous loss affect me and played the price action. I saw this stock on yahoo % gainers. There wasn't any news but it's a low-float former runner with a multi-week breakout at 4.00. So when it broke 4.49 resistance, I placed an order to buy 180 shares at 4.50 and got a really good fill at 4.46. I sold a few minutes later at 4.70 as the volume was low and I just wanted to be green after the last loss. I should've kept watching this as there was another chance to buy at 3:35PM when it broke the flag at 4.65. It ran all the way to 5.40 and got up to 5.48 after hours. I wouldn't have held overnight but if I just waited till the close to sell it would've been a nice 20% win as it held the breakout level at 4.49/4.50 and never hit my stop of 4.35.

Another thing I learnt today was that you have to keep watching earnings winners even when they dip, which was the case with $ANW and $URRE because the catalyst alone is enough to push the stock.

If you trade a Pattern in your CARA trade (breakout Flag) watch for a Volume spike that the breakout confirmt. The last weeks i testet some Patterns and if there is no Volume spike on a Pattern break out they fail most of the time.

@MBP I don't watch volume closely enough so will do that thanks!

Join now or log in to leave a comment