1.10.

| ISM Manufacturing PMI (Sep) | 61.1 | 59.6 | 59.9 |

5.10.

| Exports | 213.70B | 212.70B |

| Imports | 287.00B | 283.00B |

| Trade Balance (Aug) | -73.30B | -70.50B | -70.30B |

| ISM Non-Manufacturing PMI (Sep) | 61.9 | 60.0 | 61.7 |

6.10

| ADP Nonfarm Employment Change (Sep) | 568K | 428K | 340K |

7.10.

| Initial Jobless Claims | 326K | 348K | 364K |

8.10.

| Nonfarm Payrolls (Sep) | 194K | 500K | 366K |

| Private Nonfarm Payrolls (Sep) | 317K | 455K | 332K |

| Unemployment Rate (Sep) | 4.8% | 5.1% | 5.2% |

12.10.

| JOLTs Job Openings (Aug) | 10.439M | 10.925M | 11.098M |

13.10.

| CPI (MoM) (Sep) | 0.4% | 0.3% | 0.3% |

14.10.

| Initial Jobless Claims | 293K | 319K | 329K |

| PPI (MoM) (Sep) | 0.5% | 0.6% | 0.7% |

15.10.

| Core Retail Sales (MoM) (Sep) | 0.8% | 0.5% | 2.0% |

| Retail Sales (MoM) (Sep) | 0.7% | -0.2% | 0.9% |

September retail sales +0.7% vs. -0.2% est. & +0.9% in prior month (rev up from +0.7%); sales ex-autos +0.8% vs. +0.5% est. & +2% in prior month (rev up from +1.8%)

18.10.

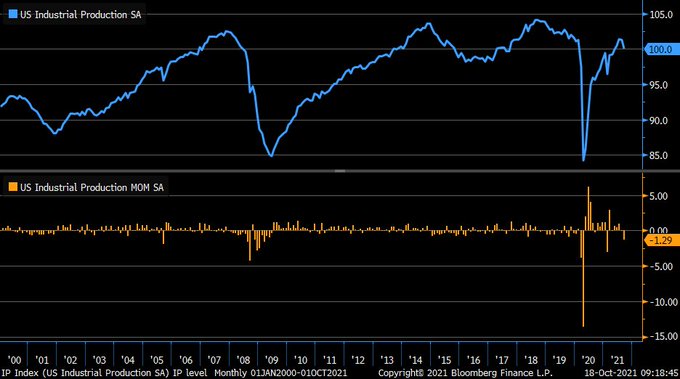

| Industrial Production (MoM) (Sep) | -1.3% | 0.2% | -0.1% |

| NAHB Housing Market Index (Oct) | 80 | 76 | 76 |

19.10.

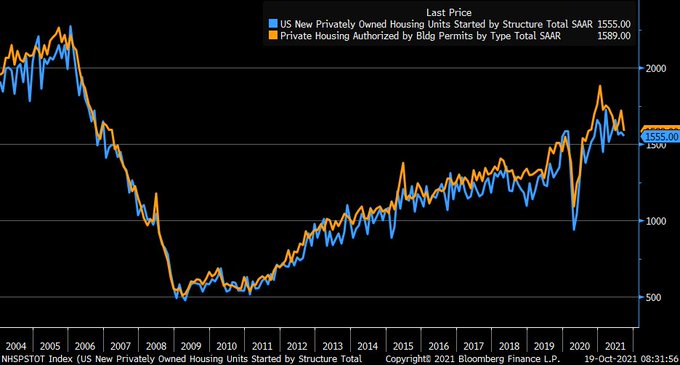

| Building Permits (Sep) | 1.589M | 1.680M | 1.721M |

| Housing Starts (Sep) | 1.555M | 1.620M | 1.580 |

September housing starts weaker at -1.6% vs. -0.2% est. & +1.2% in prior month (rev down from +3.9%); building permits -7.7% vs. -2.4% est. & +5.6% in prior month (rev down from +6%)

| Initial Jobless Claims | 290K | 300K | 296K |

| Philadelphia Fed Manufacturing Index (Oct) | 23.8 | 25.0 | 30.7 |

| Existing Home Sales (Sep) | 6.29M | 6.09M | 5.88M |

22.10.

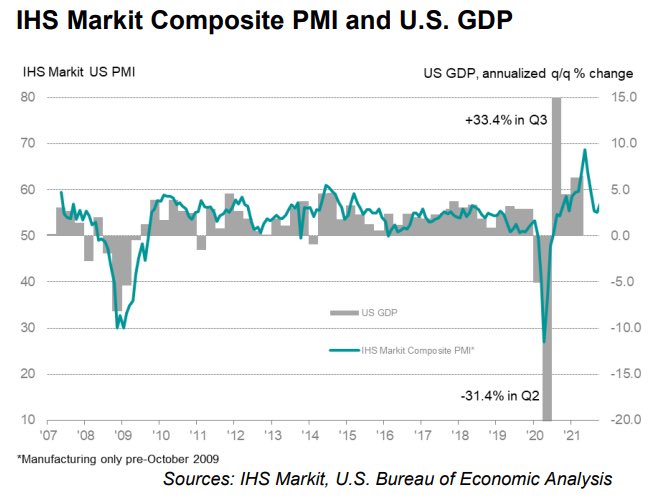

| Manufacturing PMI (Oct) | 59.2 | 60.3 | 60.7 |

| Services PMI (Oct) | 58.2 | 55.1 | 54.9 |

October @IHSMarkitPMI mixed: Mfg dropped to 59.2 vs. 60.5 est & 60.7 prior, but Services rose to 58.2 vs. 55.2 est & 54.9 prior…lift from latter brought composite measure up to 57.3 vs. 55 prior; despite ongoing supply pressure, employment grew at fastest pace since June

| CB Consumer Confidence (Oct) | 113.8 | 108.3 | 109.8 |

Oct @Conferenceboard Consumer Confidence up to 113.8 vs. 108.3 est. & 109.8 in prior month (rev up from 109.3); Present Situation up to 147.4 vs. 144.3 prior; Expectations up to 91.3 vs. 86.7 prior…spread between those components up slightly m/m but still negative (2nd chart)

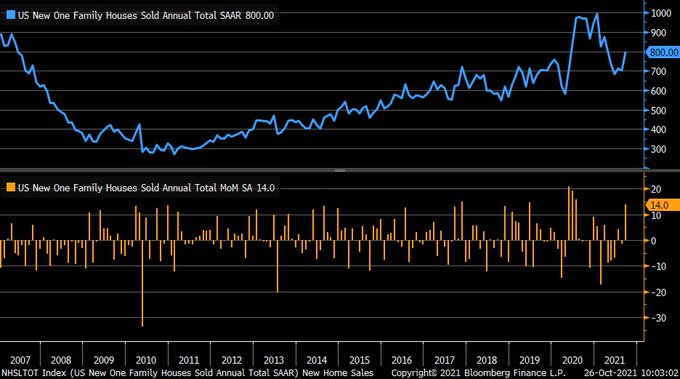

| New Home Sales (Sep) | 800K | 760K | 702K |

Quite the pop in September new home sales, +14% (largest gain since July 2020) vs. +2.5% est. & -1.4% in prior month (rev down from +1.5%); median new home price +18.7% y/y; months’ supply down to 5.7 vs. 6.5 prior

28.10.

| GDP (QoQ) (Q3) | 2.0% | 2.7% | 6.7% |

| Initial Jobless Claims | 281K | 290K | 291K |

29.10.

| Core PCE Price Index (YoY) (Sep) | 3.6% | 3.7% | 3.6% |

| PCE Price index (YoY) (Sep) | 4.4 | 4.2 |

| Personal Spending (MoM) (Sep) | 0.6% | 0.5% | 1.0% |

PELOSI SAYS HOUSE WILL POSTPONE VOTE ON INFRASTRUCTURE BILL

"Evergrande makes coupon payment before Friday deadline - sources"

BILL ACKMAN SAYS WE THINK THE FED SHOULD TAPER IMMEDIATELY AND BEGIN RAISING RATES AS SOON AS POSSIBLE ACKMAN SAYS HE GAVE A PRESENTATION TO FEDERAL RESERVE BANK OF NEW YORK LAST WEEK TO SHARE VIEWS ON INFLATION AND FED POLICY

YELLEN SAYS U.S. DEBT CEILING MUST BE RAISED, BELIEVES IT IS A BIPARTISAN RESPONSIBILITY TO DO IT YELLEN SAYS THERE IS A WAY FOR DEMOCRATS TO DO IT ON THEIR OWN YELLEN SAYS WILL SPEAK WITH U.S. SENATE AND HOUSE LEADERS TO RAISE U.S. DEBT LIMIT BY DEC. 3 DEADLINE

Join now or log in to leave a comment