1.11.

| Manufacturing PMI (Oct) | 58.4 | 59.2 | 60.7 |

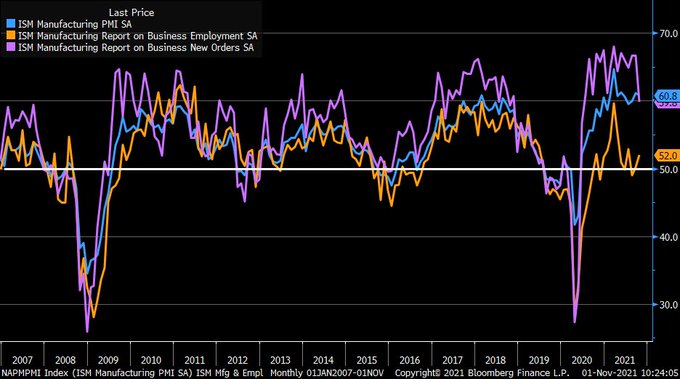

| ISM Manufacturing PMI (Oct) | 60.8 | 60.5 | 61.1 |

October ISM Manufacturing dipped to 60.8 vs. 60.5 est. & 61.1 in prior month; new orders fell sharply but still expanding; production eased a touch, inventories improved, and export orders ticked up … fortunately, employment back in expansionary territory

3.11.

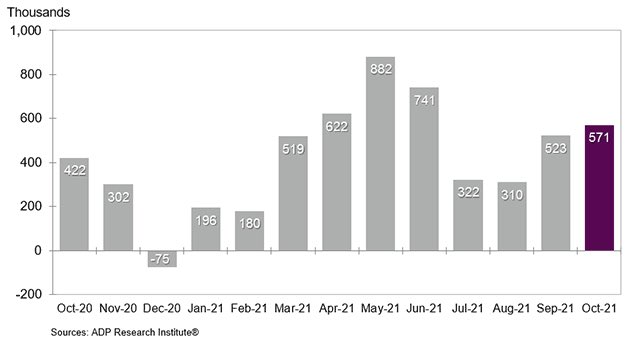

| ADP Nonfarm Employment Change (Oct) | 571K | 400K | 523K |

October @ADP payrolls 571k vs. 400k est. & 523k in prior month (rev down from 568k); small firms added 115k; midsized 114k; large 342k … some sector highlights: leisure/hospitality 185k, education/health 56k, manufacturing 53k, and other services 22k

| Markit Composite PMI (Oct) | 57.6 | 57.3 | 55.0 |

| Services PMI (Oct) | 58.7 | 58.2 | 54.9 |

| Factory Orders (MoM) (Sep) | 0.2% | 0.1% | 1.0% |

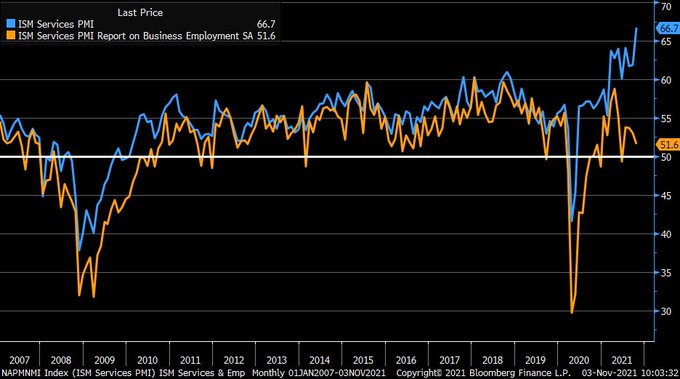

| ISM Non-Manufacturing PMI (Oct) | 66.7 | 62.0 | 61.9 |

Stronger ISM Services in Oct; headline up to 66.7 (record high) vs. 62 est & 61.9 in Sept…prices paid climbed to 82.9, new orders up to 69.7, deliveries lengthened to 75.7, and inventory sentiment dropped to 37.3…employment ticked down but remains in expansionary territory

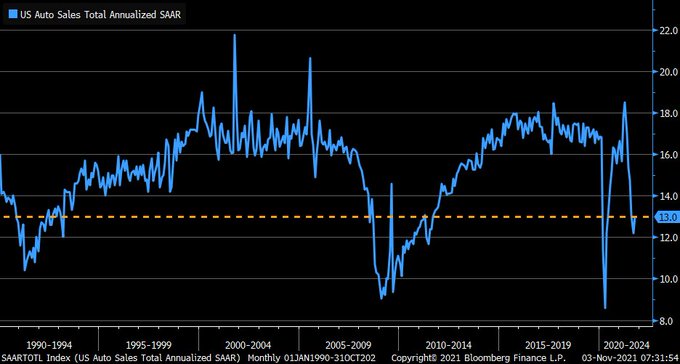

October vehicle sales ticked up to 13M annualized rate; better than 12.5M est. and an uptick from 12.2M in prior month, but still below August levels

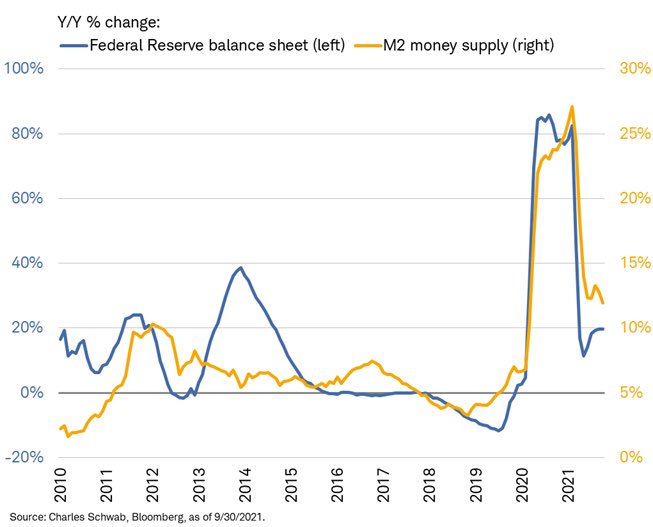

To some extent, “tapering” has already started … looking at annual changes in Fed’s balance sheet and M2 money supply, growth rates of 19.7% and 11.9%, respectively, are off peeks of 86% and 27%, respectively

4.11.

| Exports | 207.60B | 214.00B |

| Imports | 288.50B | 287.00B |

| Initial Jobless Claims | 269K | 275K | 283K |

| Nonfarm Productivity (QoQ) (Q3) | -5.0% | -3.0% | 2.4% |

| Trade Balance (Sep) | -80.90B | -80.50B | -72.80B |

Sharp increase in trade deficit in September, -$80.9 billion vs. -$80.2 billion est. & -$72.8 billion in prior month (rev from -$73.3 billion) … deficit at its widest on record

| Unit Labor Costs (QoQ) (Q3) | 8.3% | 7.0% | 1.1% |

5.11.

| Nonfarm Payrolls (Oct) | 531K | 450K | 312K |

October nonfarm payrolls stronger at +531k vs. +450k est. & +312k in prior month (nice revision to prior month, which was +194k) … now 4.2 million jobs short of pre-pandemic peak

Unemployment rate down to 4.6% vs. 4.7% est. & 4.8% in prior month

| Private Nonfarm Payrolls (Oct) | 604K | 400K | 365K |

Private (non-gov’t) payrolls +604k vs. +420k est. & +365k in prior month (rev up from +317k) … 2021 has yet to post a decline

| Unemployment Rate (Oct) | 4.6% | 4.7% | 4.8% |

9.11.

| Core PPI (MoM) (Oct) | 0.4% | 0.5% | 0.2% |

| PPI (MoM) (Oct) | 0.6% | 0.6% | 0.5% |

Oct PPI came in as expected at +0.6% m/m vs. +0.5% prior; +8.6% y/y, unchanged from prior month; core PPI unchanged at +6.8% y/y

10.11

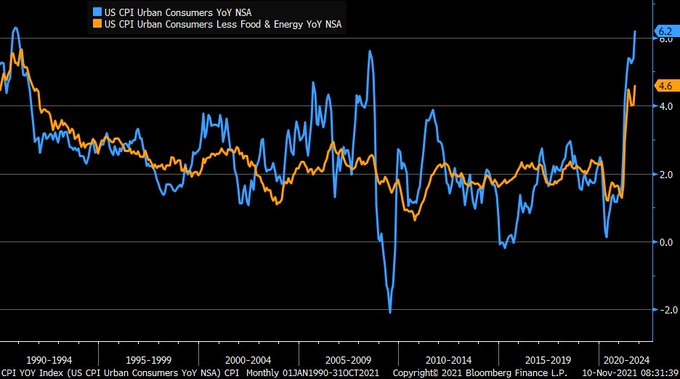

| Core CPI (MoM) (Oct) | 0.6% | 0.4% | 0.2% |

| CPI (MoM) (Oct) | 0.9% | 0.6% | 0.4% |

Much otter October CPI #inflation at +0.9% m/m vs. +0.6% est. & +0.4% in prior month; y/y at +6.2% vs. +5.9% est. & +5.4% in prior month … core CPI +4.6% y/y vs. +4.3% est. & +4% in prior month … annual growth now highest since early 1990s

| Initial Jobless Claims | 267K | 265K | 271K |

12.11.

| JOLTs Job Openings (Sep) | 10.438M | 10.300M | 10.629M |

| Michigan Consumer Expectations (Nov) | 62.8 | 70.0 | 67.9 |

| Michigan Consumer Sentiment (Nov) | 66.8 | 72.4 | 71.7 |

15.11.

| NY Empire State Manufacturing Index (Nov) | 30.90 | 21.60 | 19.80 |

16.11.

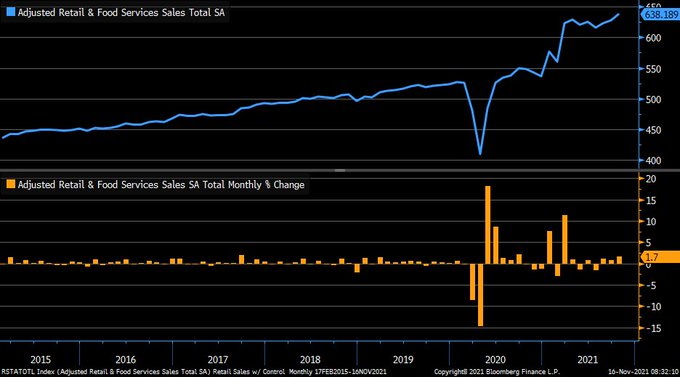

| Core Retail Sales (MoM) (Oct) | 1.7% | 1.0% | 0.7% |

| Export Price Index (MoM) (Oct) | 1.5% | 0.9% | 0.4% |

| Import Price Index (MoM) (Oct) | 1.2% | 1.0% | 0.4% |

| Retail Sales (MoM) (Oct) | 1.7% | 1.2% | 0.8% |

October retail sales stronger at +1.7% vs. +1.5% est. & +0.8% in prior month; sales ex-autos much stronger at +1.7% vs. +1% est. & +0.7% in prior month … control group +1.6% vs. +0.9% est. & +0.5% in prior month

| Capacity Utilization Rate (Oct) | 76.4% | 75.8% | 75.2% |

| Industrial Production (MoM) (Oct) | 1.6% | 0.7% | -1.3% |

| Business Inventories (MoM) (Sep) | 0.7% | 0.6% | 0.8% |

17.11.

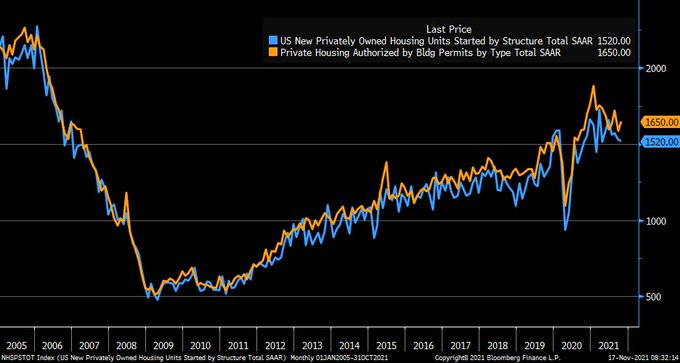

| Building Permits (Oct) | 1.650M | 1.638M | 1.586M |

| Housing Starts (Oct) | 1.520M | 1.576M | 1.530M |

Downside surprise for October housing starts, -0.7% vs. +1.5% est. & -2.7% in prior month (rev down from -1.6%); building permits stronger at +4% vs. 2.8% est. & -7.7% in prior month

18.11.

| Initial Jobless Claims | 268K | 260K | 269K |

| Philadelphia Fed Manufacturing Index (Nov) | 39.0 | 24.0 | 23.8 |

22.11.

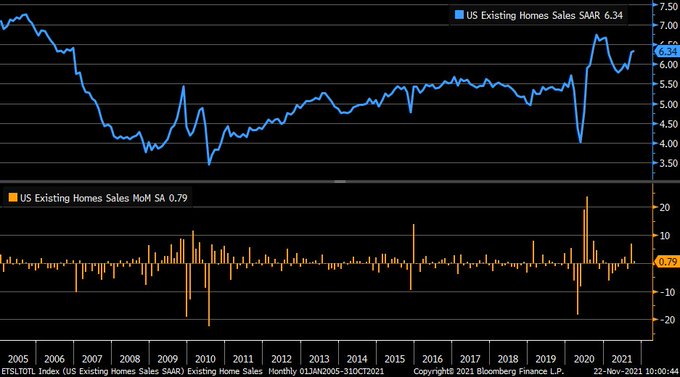

| Existing Home Sales (Oct) | 6.34M | 6.20M | 6.29M |

Upside for Oct existing home sales, +0.8% vs -1.4% est & +7% in Sept; per @nardotrealtor Lawrence Yun, inflationary pressures, such as fast-rising rents & increasing consumer prices, may have some prospective buyers seeking protection of fixed consistent mortgage payment

23.11.

| Manufacturing PMI (Nov) | 59.1 | 59.0 | 58.4 |

| Services PMI (Nov) | 57.0 | 59.0 | 58.7 |

24.11.

| Core Durable Goods Orders (MoM) (Oct) | 0.5% | 0.5% | 0.7% |

| Durable Goods Orders (MoM) (Oct) | -0.5% | 0.2% | -0.4% |

| GDP (QoQ) (Q3) | 2.1% | 2.2% | 6.7% |

| GDP Price Index (QoQ) (Q3) | 5.9% | 5.7% | 6.2% |

| Goods Trade Balance (Oct) | -82.89B | -94.90B | -97.03B |

| Initial Jobless Claims | 199K | 260K | 270K |

| New Home Sales (Oct) | 745K | 800K | 742K |

| New Home Sales (MoM) (Oct) | 0.4% | 7.1% |

| Personal Spending (MoM) (Oct) | 1.3% | 1.0% | 0.6% |

29.11.

| Pending Home Sales (MoM) (Oct) | 7.5% | 0.9% | -2.4% |

POWELL: WE EXPECT INFLATION PRESSURES TO SUBSIDE IN SECOND HALF OF 2022

*FED'S BULLARD SEES 50% CHANCE HIGH INFLATION WILL PERSIST

POWELL: STILL IS A THREE-PART TEST FOR RAISING RATES POWELL: ON TEST FOR RATE HIKES, IN COMING MEETINGS WILL SAY INFLATION CONDITIONS HAVE BEEN MET

FED'S POWELL: WAGES HAVE MOVED UP SIGNIFICANTLY POWELL: RISK OF PERSISTENT INFLATION HAS RISEN

Join now or log in to leave a comment