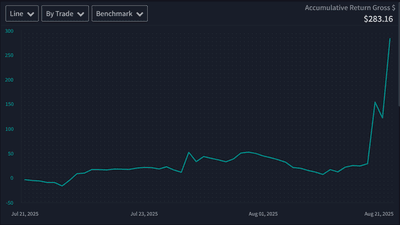

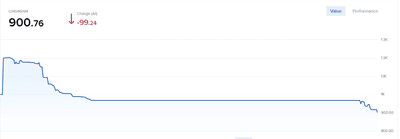

New traders think trading is about: - Finding something to trade - Being “in the action” - Taking shots - Hoping it works - Feeling productive because they’re doing something But real traders know: - Most tickers are garbage - Most price action is noise - Most “setups” are illusions - Most entries are emotional - Most trades should never be taken I feel like I'm closer to the second part than I've ever been.

Join now or log in to leave a comment