Hello, every one I wanted to do a quick lesson on the ABCD pattern and $HEAR. I don't know if I am allowed to post this here, but here I go I have been tracking the ABCD pattern for a while now and have been seeing major improvements in my trading profits. I was like many people that trade many kinds of patterns and win some and lose some but overall not going anywhere and slowly losing more and more money. I would like to give thanks to Tim Sykes for all of the great vids on stocks and no BS advice. Thanks to Tim Bohan for the very educational Steady Trade Podcast (https://www.steadytrade.com/). Thanks, Stephen Johnson for you Youtube channel it crazy and educational with you and Tim Bohan on the podcast I have learned a lot.

It was Stephen Johnson that shown me the power of creating an excel sheet to track trades, I have now been able to turn my account from 890.00 to over 2k in one month by only trading my one pattern. I am willing to sell the excel sheet for 50.00 USD to only one that wanted it. send me a PM and I will send the payment link after I have received payment I will send an email with the excel.

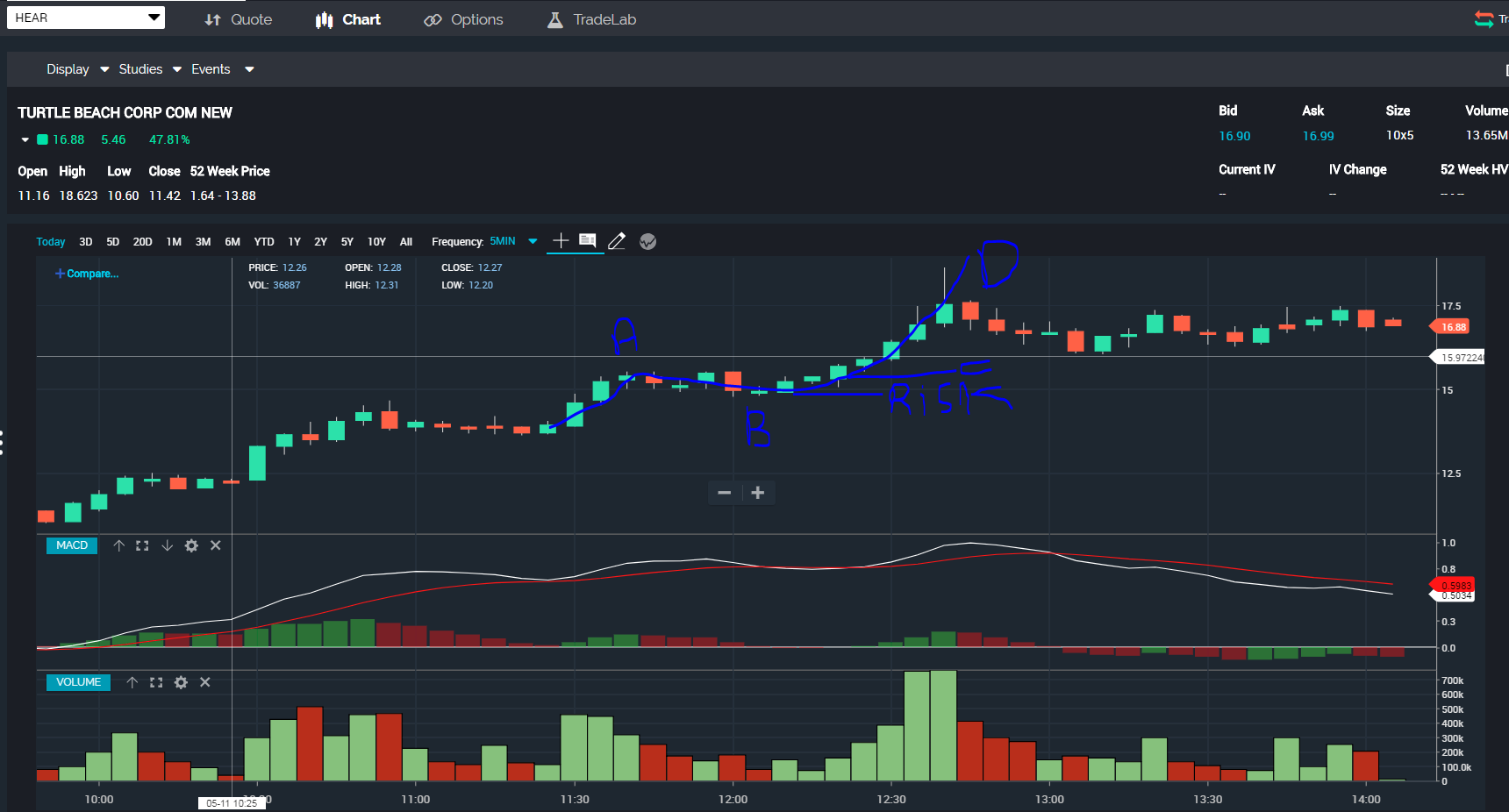

Now its time for the ABCD lesson on $HEAR.

I bought this stock yesterday and took a loss of $198.00 I did not see it this morning I was in a trade while this one formed. the first ABCD pattern formed at 8:31 AM Colorado time. the buy level for my self would be at 12.29 and risk off 12.06. in the chart below you can see there was a move upward and then a downturn, it slowly crawled it way back up before the breakout.

The second ABCD pattern formed at 10:24 AM Colorado time. this was the biggest move of the day, buy level would be 15.40. Risking off 15.02, the high was 18.63. For new traders like me, I placed a hard stop on the risk level, and a use a stop order to enter the trade. I like to use a trailing stop once I am in the trade and it is moving in my direction, (sometimes this gets me out too soon) but if done right I am almost always taking profits. As the trade gets closer to my profit target I will shorten the trailing stop % ie., I start off with a 5%-10% trailing stop if I am looking for a gain of 10% on the chart based on volume, float and so on I will start to reduce the trailing stop from 10% to 7%, then 5%, then 4% and so on until I am out. This strategy can leave a lot on the table but it also protects my loss.

Join now or log in to leave a comment