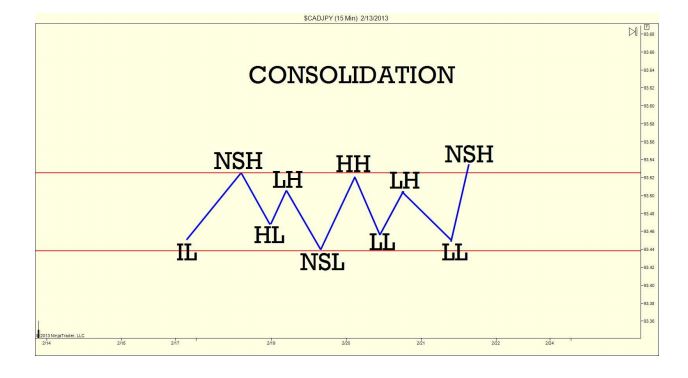

Consolidation:

When the market is in consolidation, it does not provide a clear and distinct pattern of trending in either a bearish or bullish direction. Instead price action is "choppy" with it having no clear directional movement. During consolidation periods, Trend Continuation traders should use caution when looking for trading opportunities. During these periods is where the majority of advanced patterns are formed giving counter trend traders viable opportunities.

Structure

When the market creates a new structure high or low, it is called structure. Being able to properly identify structure levels are important because they act as key decision points in allowing us to determine whether we are in a bullish trend continuation pattern, a bearish trend continuation pattern, or in consolidation.

Support and Resistance

After forming a New Structure High the market will retrace creating a higher low. When this movement occurs, that NSH's now become an area of structure called resistance. As price action pushes up from the newly created higher lows, that resistance level becomes the last stand for sellers to stop the buyers from rallying. IF the resistance level cannot be penetrated, THEN it's likely that we'll see either a period of consolidation or a reversal in trend. IF price action breaks through the resistance level it symbolizes a continuation in the current trend. Remember that previous NSH that turned into resistance after the retrace? Well, once that resistance level is broken it then becomes support. When price action retraces back down from our highs, this structure level should support the overall trend.

This content belongs to Trade Empower

great video

Great lesson. I'm new to trading and this was very helpful!! Thanks for the video lesson.

@ksab Thanks

@Rebela007 Happy to help.

Join now or log in to leave a comment