Well, that didnt go as planned.

My first day of trading after a little time off didn't go that well but I did follow my rules so I cant be too hard on myself. I did get absolutely demolished though.

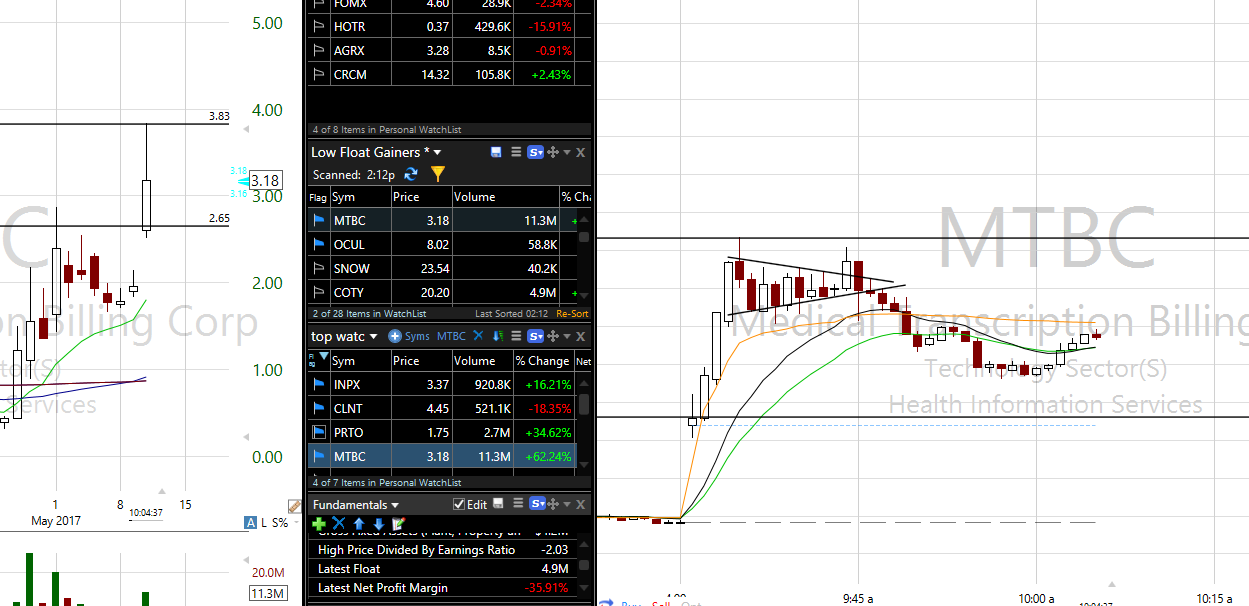

First trade was on $MTBC, after missing the crazy morning spike I wanted to get in on the bull flag which formed.

I got in on the break of 3.70 looking for a move up to the 4 dollars but the stock instantly turned around and bit me in the ass. I played $MTBC because it was a low float stock with news and a previous runner.

The next trade came on $INPX which was bouncing off the 50 moving average.

Got in on those two u shape breakouts, the first faked me out and then the second really dropped the hammer.

A bad day for me overall the small account is currently at 669USD so I will be scaling my positions back a bit more, I am in no rush and I'm looking forward to the next couple of days.

In the future I will stear clear of buying flags, I just don't like them as they don't offer me an exact entry point and I've seen them dump too many times. I will also only play the first setup, I missed the first Ushape on INPX which would've been a nice win the higher it goes the riskier the HOD breaks become and I will only play them either on crazy momo stocks or after they consolidate for longer.

See you all tommorow.

I respectfully disagree, a flag isn't an indicator it is a simple intraday chart pattern although I don't usually play it and the moving averages mostly don't work but some serve as areas of support and resistance since 90% of people are using them, the 200ma on the daily for example really serves as a SR area a lot of the times. P.S. This aren't indicators these are my lines so people can see what I was seeing not some programmed indicators.

@MaverickRTG flags are bullshit, MA are bullshit, you focus on this little shit and completely ignore the big picture with MTBC, but why listen to me, I only have 19 years experience and have only made $4.6 million, right? Learn the hard way, it's sad

I do learn from you lmao and I do look at the big picture, low float gapper on news with volume also a former runner. I dont use any of those indicators to enter trades, price action is always king, instead of raging I'm always open for some constructive criticism like where you think a good buy was, since the stock shot up without any consolidation straight out of the gate.

I think flags are legit price action patterns, but not necessarily in the current market in May, especially with these stocks.

Join now or log in to leave a comment